The venture capital fund Digital Currency Group (DCG), which owns Genesis (a trading platform for professional investors) and Grayscale (currency investing and cryptocurrency asset management), could become bankrupt very soon. Three Arrows Capital (3AC) founder Su Zhu believes that “Genesis creditors will push it into bankruptcy and take the remaining DCG assets in coming days.”

9) Genesis creditors will push it into bankruptcy and take remaining dcg assets in coming days either way, they are likely demanding Barry pays back his cashouts the easy way instead of waiting for a DoJ criminal case with restitution punishments

— Zhu Su 🔺 (@zhusu) January 3, 2023

This has long been rumored, as many companies have either disappeared or are on the verge of going bankrupt since the FTX collapse. However, the company has always publicly denied all information about possible bankruptcy.

The brand new newsletter with insights, market analysis and daily opportunities.

Let’s grow together!

But the threat might just become real.

What’s going on with DCG?

To begin with, investor confidence in Digital Currency Group (DCG) plummeted after The Wall Street Journal, on November 17th, reported that Genesis was trying to raise $1 billion in investments; otherwise, all withdrawals from the platform would be suspended. That was the size of the hole in the budget. Where did the $1 billion hole come from when the company only had about $175 million in funds on FTX? Genesis had previously loaned $2.4 billion to 3AC, which filed for bankruptcy in July 2022 after the Terra Luna debacle in May. 3AC provided $1.2 billion in collateral, so the total loss is about $1.1 billion. However, The Block later clarified that the amount was reduced to $500 million. Genesis said at the end of 2022, it was working to preserve client assets and increase liquidity. But it will take “weeks, not days,” to form a plan.

Then, three Gemini Earn users filed a class action arbitration request against Genesis Global Capital and Digital Currency Group in response to the suspension of Gemini Earn because of the withdrawal freeze. Gemini suspended withdrawals for Earn in November 2022 after Genesis, a major partner in the exchange, ran into liquidity trouble.

Under Gemini Earn, customers receive interest payments in exchange for providing their cryptocurrency assets. This is similar to bank deposits.

The Gemini Earn users insist that Genesis failed to return them their digital assets.

On January 2, 2023, Gemini co-founder Cameron Winklevoss accused DCG CEO Barry Silbert of “unfair disruption tactics” over plans to resume withdrawals from Genesis. According to Winklevoss, Genesis and DCG owe Gemini and its customers $900 million. He gave Silbert time until January 8 to resolve the issue.Chapter 11 bankruptcy is a bankruptcy with reorganization since the company has the right to continue operating, restructure existing debt and move forward. In response, Silbert said DCG did not borrow $1.675 billion from Genesis and the next maturity date for the loan is May 2023.

Why the Genesis fall could hit hard

A popular Twitter trader and influencer nicknamed Andrew suggests that if DCG does not pay Genesis $575 million in May 2023, the company could face Chapter 11 bankruptcy. A Genesis bankruptcy would result in the liquidation of DCG’s assets (based on the loans to be revoked), which could lead to the parent company’s bankruptcy.

DCG owns Grayscale, the world’s largest digital currency asset manager, which sponsors 16 investment products, including the Grayscale Bitcoin Trust — GBTCGBTC trades like a closed-end fund, which can often trade at a premium or discount to the value of its holdings. and the Digital Large Cap Fund. The total amount of assets under Grayscale’s management is more than $15 billion.

If Genesis fails to pay, the debts could be collected from DCG. In that case, Grayscale may be forced to sell its balance sheet to cover Genesis’ creditors.

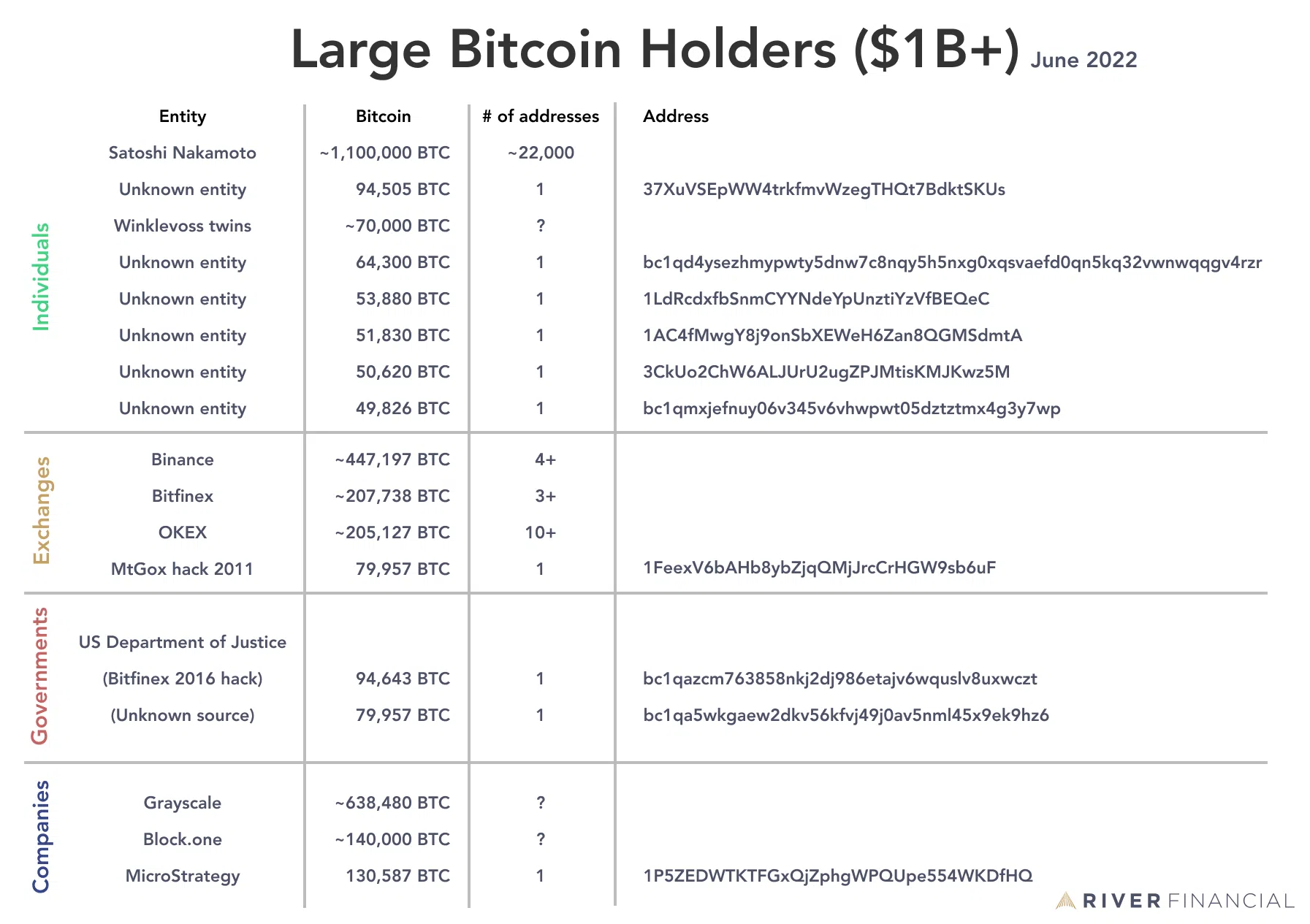

Thus, Grayscale is one of the largest active bitcoin holders in the world. Only Satoshi Nakamoto (the supposed creator or creators of Bitcoin) has more, according to River Finance.

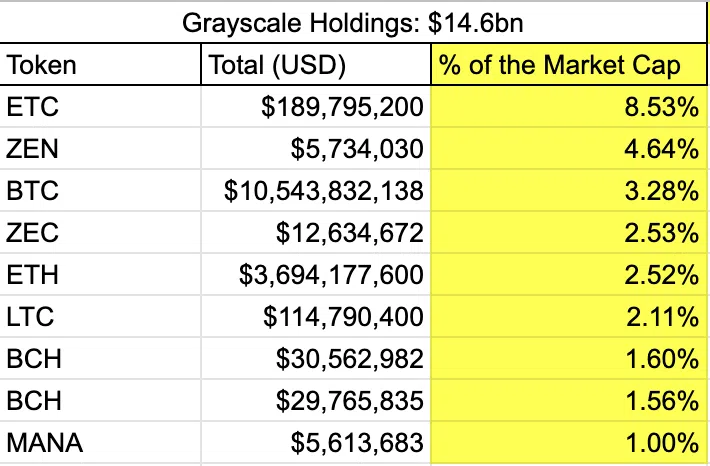

According to OKLink, Grayscale owns about 632,000 bitcoins (BTC) worth about $10.5 billion, which is about 3.28% of the market value of BTC. The current premiumGBTC and some other Grayscale products have a "premium. This is the difference between the value of the trust assets and the market price of the asset. rate is -45.17%. This is the size of the discount to the bitcoins market price.

Also, the company owns more than 3.03 million Ethereum (ETH) worth about $3.6 billion, which is about 2.54% of the market value of ETH. The current premium rate is -59.3%.

And more than 11.84 million Ethereum Classic (ETC), worth about $190 million, which is about 8.50% of the market value of ETC. The current premium rate is -76.69%.

If Grayscale closes its two main funds, there could be more than 3 million ETH and more than 630,000 BTC on the market. The appearance of such a huge amount in the free market could provoke a real collapse of cryptocurrency prices. Popular crypto influencer Karl has listed the assets that could be hit the hardest in such a case.

You have not selected any currency to display