Contents

The collapse of Terra, Three Arrows Capital, Celsius Network, and Voyager Digital were all big shocks to the crypto world. But none of these events can compare in scale to the fall of FTX. The market is going to be in turmoil for a long time to come. It continues to uncover many problems that have not been obvious from the beginning. Not only FTX and Alameda investors were affected, FTT token holders. The entire industry was affected and hundreds of crypto companies and firms were involved in one way or another.

Black 11.11.

In the end, there was no savior for FTX. On November 11, the FTX exchange, Alameda and 130 other affiliates began bankruptcy proceedings under Chapter 11 of the U.S. Bankruptcy Code. Sam Bankman-Fried retired as Chief Executive Officer.

Press Release pic.twitter.com/rgxq3QSBqm

— FTX (@FTX_Official) November 11, 2022

The brand new newsletter with insights, market analysis and daily opportunities.

Let’s grow together!

Chapter 11 bankruptcy is a bankruptcy with reorganization, because its purpose is to continue to operate, to restructure existing debt; to move forward.

Filing for Chapter 11 bankruptcy involves:

Filing a bankruptcy petition with the court, preparing a detailed plan — schedule of all your current liabilities and assets; filing a disclosure statement detailing your financial situation and operations; filing a plan of reorganization.

A plan of reorganization is a proposal for how an existing debtor plans to repay creditors.

Creditors are given priority based on the type of debt they owe. Not all creditors repay their Chapter 11 bankruptcy loans in full.

Some repay 100 percent of their debt, while others repay only a certain percentage.

Creditors are given a vote on the proposed plan to reorganize the company, and the court must approve the plan in order for it to pass.

What other problems caused the fall of FTX?

FTX does not care about the problems of Canadian teachers. Pension investments in the Sam Bankman-Fried exchange have created a hole of $95 million.

THEY EVEN RELEASED A STATEMENT TODDAY ABOUT THEIR INVESTMENT IN FTX. pic.twitter.com/F6ymqRIqA6

— GURGAVIN (@gurgavin) November 10, 2022

Three sources told Wu Blockchain that Alameda held a meeting today and all employees resigned. Some employees sent farewell messages to former partners. On November 10, SBF announced that Alameda Research is winding down trade.

Three sources told us that Alameda had held a meeting today and all employees resigned. Some employees sent farewell messages to former partners. On November 10, SBF stated that “Alameda Research is winding down trading”. @TechFlowPost

— Wu Blockchain (@WuBlockchain) November 11, 2022

A highly credible source very close to the Sam/FTX situation on what was going on internally: pic.twitter.com/iGO3sbvRr0

— Autism Capital 🧩 (@AutismCapital) November 10, 2022

Because of eight-figure funds on FTX and liquidity problems, Deepak.eth decided to sell a lot of NFT at 8,000 ETH. He once made it into the Guinness Book of World Records by buying cryptopunk5822 NFT for 8,000 ETH.

My NFT Collection is now available. It will either be sold to the highest bidder or be placed in a fractional DAO where I will be selling 80% ownership for 8k ETH to the community.

DMs open. Check them out👇 pic.twitter.com/7TZpAc7TDK

— Deepak.eth ⛓ (@dt_chain) November 11, 2022

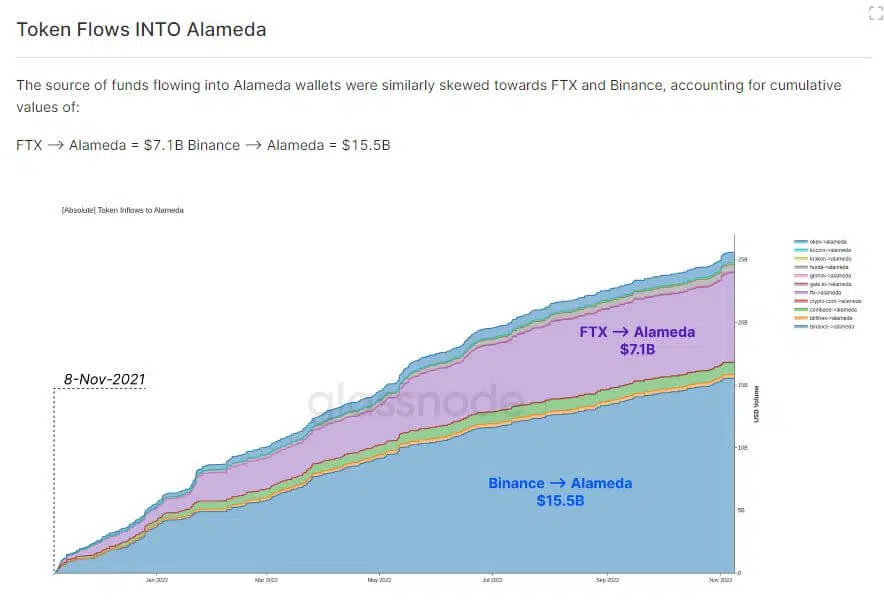

Now it is suspected that Binance is also involved. FTX and Alameda used their more fortunate competitor. According to a CryptoSlate publication, more than 90% of tokens from wallets linked to Alameda ended up on FTX last year. About 9% of all outflows from Alameda ended up on Binance. Since last November, about $25 billion of various altcoins and stablecoins have flowed into Alameda. Of the $25 billion, $7.1 billion came from FTX wallets and more than $15.5 billion came from Binance wallets.

What is FTX?

FTX is one of the largest international cryptocurrency exchanges headquartered in the Bahamas. The company has its own token called FTT.

What happened to FTX?

Last week, there was an article on CoinDesk, that Alameda, the cryptocurrency hedge fund owned by FTX founder Sam Bankman-Fried, had billions of dollars worth of its own FTT on its balance sheet and was using it as collateral in further loans. FTX investors’ funds were also allegedly used.

This could have had disastrous consequences if the price of FTT were to fall. Which, in fact, it did.

FTT had no value other than the promise of FTX to buy any tokens at $22.

Anyway, Binance CEO Changpeng Zhao, better known as CZ, announced the sale of FTT to the company for about $500 million because of “recent revelations.” Investors and traders were scared of the possible devaluation of FTT and rushed to sell off their tokens. At least $6 billion was withdrawn in just three days. This only made things worse, and Sam Bankman-Fried’s exchange ran into liquidity problems.

How can I make money on this?

It is still possible to bypass the blocking of withdrawals from FTX through non-exchangeable tokens (NFTs) for users with Bahamian KYC. Millions of dollars have already been withdrawn from the exchange. A user with Bahamian KYC creates NFTs, other users buy them for a lot of money, and then the former withdraws money from the exchange.

People now withdrawing FTX balances by buying NFTs from Bahamian accounts for six- and seven-figure amounts, buyer then gets side payment and Bahamian withdraws funds

Tens of millions of Tether taken so far pic.twitter.com/UVnz5FUBNT

— foobar (@0xfoobar) November 11, 2022