The house of cards built on lies continues to fall apart. After the collapse of the FTX exchange, other projects began to close one by one. And judging by the rumors, Genesis is next in line. The exchange began to have liquidity problems and is about to declare bankruptcy. An analyst at The Block reported that Genesis had a hole of $1 billion in its budget (later, the amount needed was reduced to $500 million). And if no one helps the company financially, its fate is inevitable.

Genesis has a $1B hole that they’re trying to raise for. Spoke to Binance and couldn’t get a deal done.

Seems suspicious considering CZ casually spent $500M on Twitter. Has to be more than a simple $1B hole.

— Steven (@Dogetoshi) November 21, 2022

Sources tell The Block crypto trading firm Genesis—which has been struggling to raise emergency capital to shore up its lending unit’s liquidity profile—has slashed its raise target from $1bn to $500 million. As Bloomberg reported, it faces potential bankruptcy w/o funding.

— Frank Chaparro (@fintechfrank) November 21, 2022

The brand new newsletter with insights, market analysis and daily opportunities.

Let’s grow together!

The company’s troubles began because of the FTX loans. Before that, it assured that everything is fine, and it is not experiencing any difficulties because of the collapse of the crypto exchange.

More DCG turndowns. Nearly every formerly high flying crypto VC is down bad. Really bad. Liquidity remains a concern for every entity.

**a name to watch that could emerge as a DCG ‘white knight’ – a16z 👀

— Andrew (@AP_ArchPublic) November 19, 2022

Binance decided not to help

Genesis allegedly asked Binance for help (like FTX in its time) but was rejected. The management of the crypto exchange also tried to negotiate for financial support with alternative investment manager Apollo Global Management.

JUST IN: #Binance turns down request to invest in Genesis.

— Watcher.Guru (@WatcherGuru) November 22, 2022

According to The Wall Street Journal, the reason for the rejection was a potential conflict of interest of Binance with the business model of a subsidiary of Digital Currency Group (DCG). DCG’s parent company is unwilling to separate from part of its venture capital portfolio or sell Grayscale Investments, which is an important source of revenue.

Against the background of Genesis’ problems and Grayscale’s refusal to disclose reserves, rumors of DCG’s own unsustainability began to circulate. Both are subsidiaries of the cryptocurrency conglomerate DCG.

UPDATE WE ARE SO SO SO FUCKED…@grayscale is refusing to show Proof of Reserves…

They hold their #BTC and #ETH on #coinbase…but won’t show blockchain data confirming ANY of their holdings.

“Teserves” are an excel spreadsheet 💀

— Crypto King (@Cryptoking) November 21, 2022

Genesis previously reported that its derivatives business has about $175 million in blocked funds in its FTX trading account. And the company wasn’t just hurt by FTX. Genesis was hit hard a little earlier after the collapse of the Three Arrows Capital (3AC) in early 2022.

But so far the company has no plans to file for bankruptcy.

Gemini is trying its best (but for how long?)

Gemini stated that it is still working on processing payouts for its Earn product, which runs on the troubled cryptocurrency broker Genesis. Last week, Gemini warned of serious delays for Earn users wanting to withdraw their money.

1/5 Update for Earn customers: we continue to work with Genesis Global Capital, LLC (Genesis) — the lending partner of Earn — and its parent company Digital Currency Group, Inc. (DCG) to find a solution for Earn users to redeem their funds.

— Gemini (@Gemini) November 22, 2022

The FTX purse is not so empty

FTX Group has $1.24 billion on its balance sheet, according to a note from Alvarez & Marsal North America LLC, a financial adviser to the commercial group. According to it, Alameda Research and related companies alone have about $401 million left on their balance sheet, Reuters writes.

More than $700 million is the outstanding debt of other companies to FTX Group. The balance is spread across the vaults of various divisions, including FTX Japan and FTX Ventures.

Apparently, FTX Group’s financial reserves as of November 20 are much higher than previously thought.

However, the bankrupt crypto exchange owes more than 50 major creditors $3.1 billion.

Genesis Timeline

November 8: “No material net credit exposure”

November 9: We lost $7M

November 10: Okay, we have $175M locked in FTX

November 16: Sorry, no withdrawals or new loans

November 17: Okay, we need $1BN

November 21: We’ll go bankrupt without the money

👍

— Cred (@CryptoCred) November 21, 2022

How can I make money on this?

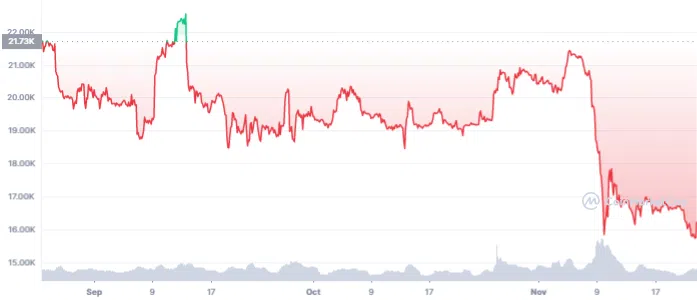

This news caused another drop in investor sentiment, causing bitcoin to hit a new two-year low of around $15,400. Things are even worse with Solana tokens.

JP Morgan has some reassurance: all the recent crashes in the crypto ecosystem have been among centralized players, not decentralized protocols. And thanks to the fall of FTX, cryptocurrency regulation will be accelerated. By the way, there are a few more positive things about this sad event.