Contents

The FTX situation is still unresolved, and the industry is already guessing which crypto exchange will fall next. However, despite the plenty of platforms, most users’ eyes are fixed on Crypto.com, which, in their opinion, may also face a serious liquidity crisis shortly. And here’s why.

Crypto.com native token falling

We’re talking about the multi-network token CRO, which, according to CoinMarketCap, fell in value by 35.6% over the past week. The reason is the same — the collapse of FTX and investors’ fear that the situation will spread further and affect other exchanges. And here Crypto.com is not an exception, but rather one of the first candidates for the fallout. The company may also run into liquidity shortages and we already know what happens after that.

CRO is a native coin of the decentralized blockchain Cronos, with the Crypto.com exchange being open source. According to a representative of the platform, the token’s decline is primarily due to “several market factors.” The company understands that due to the bear market and now the collapse of FTX, the value of cryptocurrencies will continue to fluctuate, so they are probably ready for anything.

Additionally, the company added that the value of CRO will not affect Crypto.com’s liquidity or future earnings. The platform ends its second consecutive year with more than $1B in revenue and more than 70M consumers worldwide. That sounds encouraging, but we’ve heard similar things from other infamous exchanges before.

The brand new newsletter with insights, market analysis and daily opportunities.

Let’s grow together!

Despite the week-long decline, CRO is up 5.44% in the last 24 hours and at the time of writing is trading at $0.07355 per coin. The market capitalization of the token is $1.86B.

Accidental transaction

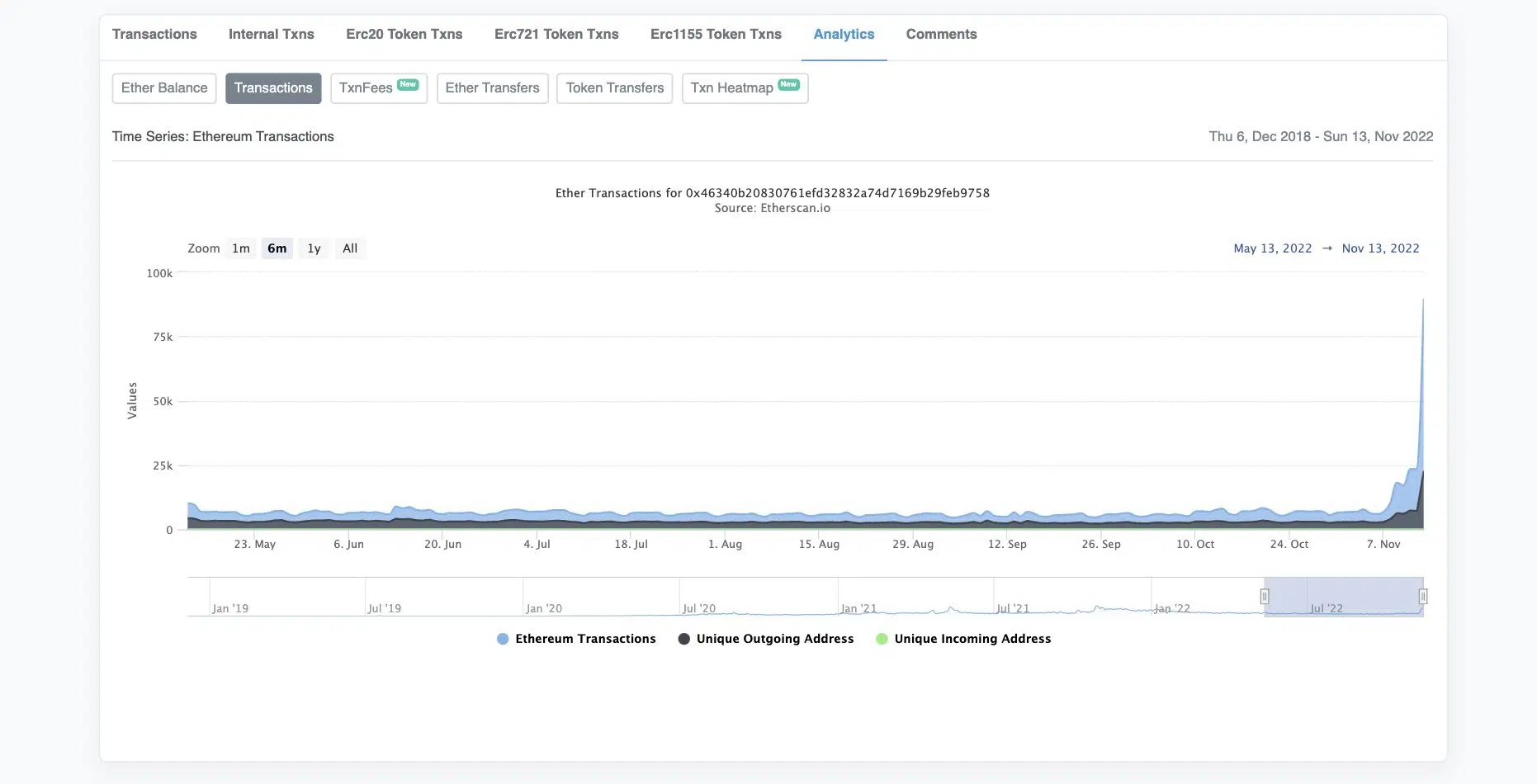

On October 21, Crypto.com accidentally transferred 320K ETH (~$403M) to Gate.io’s wallet. The incident happened almost a month ago but got publicity only recently because users’ concerns peaked only in mid-November when in ten hours they withdrew over $53M from Crypto.com.

Company representatives said that the transfer was supposed to be made to a new cold storage address, but the cryptocurrency was sent to the address of an external white-listed exchange at Gate.io.

The situation had no connection with the collapse of FTX, but exchange users thought otherwise, and began actively protecting their assets just in case. Later it became known that Gate.io returned all funds to Crypto.com cold storage, and representatives of the crypto exchange said that they would strengthen security to prevent this from happening again.

However, despite the positive outcome, users did not believe the transfer was accidental. Many think that the exchange tried to close the hole in the balance sheet of the friendly platform Gate.io. Meanwhile, Twitter has already started discussing that Crypto.com is threatened by the so-called bank panic when all clients start to panic about the financial stability of the bank and urgently try to withdraw their funds. One of them was famous crypto-influencer Ben Armstrong (aka Bitboy Crypto).

I just withdrew all my funds off https://t.co/hKkLMzo7Sl. I don’t necessarily think anything is wrong with @cryptocom… but if you haven’t learned the importance of self-custody by now then there may be no hope for you.

Not your keys, not your crypto

— Ben Armstrong (@Bitboy_Crypto) November 13, 2022

On November 14, analysts at The Chainsaw detected 90K unique transactions, indicating that users were trying to withdraw their funds from the exchange.

If Crypto.com is found to have hidden assets, its fate may repeat the fate of the FTX exchange.

The falling volume of trading

In addition, it has become known that platform users have become afraid to buy and sell their savings through the exchange. The reason is that, according to Nomics, Crypto.com’s daily trading volume fell from $4B in 2021 to $284M in October 2022. Add to that the increase in withdrawals from the platform, and you do get not exactly favorable statistics. Customers simply see and fear instability.

Crypto.com has also been blamed for some not-so-good deals. Here are some of them:

- The company signed a 20-year contract to rename the former Staples Center, the home franchise of the NBA’s Los Angeles Lakers. The deal is worth $700M.

- The company spent millions on advertising during the Super Bowl. Seems like a pretty normal investment, but not once was the word “cryptocurrency” said in the commercial. It sounds ridiculous. Especially considering that some commercials were sold for $7M for a 30-second running time.

- The company made actor Matt Damon the face of its brand. A contract with a star of that caliber probably cost the stock market a pretty penny.

Such deals are not welcomed by investors and are considered “cursed” because companies that spend hundreds of millions of dollars on such things can end up going under and filing for bankruptcy in the future. So, for investors, it’s a direct risk of losing their money. And who needs it?

What does the company say?

Even though FTX has already started bankruptcy proceedings and Binance CEO Changpeng Zhao said that other crypto exchanges will crash soon, Crypto.com is confident that they are not affected and everything is fine. The exchange’s CEO Kris Marszalek stated this officially.

According to him, the company is not experiencing any liquidity problems and has sufficient reserves to meet its obligations to investors.

He also noted that the crypto exchange keeps about 20% of its reserves in the Shiba Inu meme coin, and withdrawals are made as usual. In addition, the head of the crypto exchange spoke in favor of transparency of the market and its global regulation, which will allow making such FTX cases as little as possible.

Thanks for having me @andrewrsorkin — looking forward to more conversations on what @cryptocom is doing to increase transparency, compliance and security across the industry https://t.co/V5MAYJmQTd

— Kris | Crypto.com (@kris) November 15, 2022

How can I make money on this?

We mentioned above that the CRO native coin started to grow actively during the last 24 hours. LunarCrush trader also noted that the coin is growing despite fears of a fatal decline due to FTX.

🧐 Kucoin Token $KCS and Crypto(.)com $CRO social engagements surge amid FTX contagion fears.

#NotYourKeysNotYourCoins pic.twitter.com/QNd4Glqi0P— LunarCrush (@LunarCrush) November 14, 2022

However, given that many users are now wary of Crypto.com, it is probably right to do the same and follow the news about the exchange. There is a chance that the company is really doing well and will not go the way of FTX and other platforms. However, we’ve heard more than once that the industry product keeps afloat and is doing well, and after a while the firm’s bosses have already filed for bankruptcy and later disappeared, leaving customers with almost nothing. Stay alert, guys!