In this overview article, we reconstruct the chronology of events of the sudden and unexpected crash of the second biggest crypto exchange FTX, as well as its unexpected bailout from Binance. Also, we try to understand what it was all about.

Drama in Seven Acts

Let’s try to reconstruct the entire timeline of events in order to understand what happened.

- Yesterday began a personal conflict between the founders of FTX and Binance. In response, began a massive sale of FTT tokens by Binance (one of the major investors of FTX).

- A few hours after it, FTX limited (or froze in some pairs) withdrawals for users of the exchange. Later FTX completely stopped processing withdrawals to Ethereum, Solana and Tron networks, including all known stablecoins, which operate on these networks.

- FTX (Alameda) allegedly started massive sales of BIT tokens to obtain urgent liquidity, although according to the contract, the sale of these tokens was frozen for a three-year period until 2024. This caused serious problems for BitDAO/Bybit, causing BIT to fall by almost 20% and panic already on the neighboring exchange.

- This led to Bybit being dragged into the conflict, although FTX/Alameda later denied their involvement in this massive attack on BIT token.

- The liquidity problems on FTX are becoming obvious to everyone, the exchange is blocking its users from the withdrawal of assets with no operating capital.

- Against this disastrous background, the founder of Binance makes an offer to buy FTX to save the situation. FTX happily agrees to this help (though it takes time to find out the details of this deal). The market crash stops on this positive news.

- Such rapid and significant events led to a shock in the crypto market:

- Bitcoin hit $16k at the peak of its fall, now its rate has stabilized at $17k (down 15% in 24 hours).

- $FTT is down 70% in 24 hours, Binance also banned shorting $FTT on its exchange.

- All related FTX projects suffered, for example, Aptos was down 30%, and Solana dropped 20%.

- FTX CEO Sam Bankman-Fried’s fortune dropped $14.6 billion to $991 million in the last 24 hours.

What was that all about?

Analysts have yet to digest and understand what it was and who was to blame. Certainly, this is another market shock not inferior to the scale of the Terra/Luna/Celsius crash, the only important difference being in this case, that Binance is ready to buy out all troubled assets to save the situation. But how was this crisis possible?

The brand new newsletter with insights, market analysis and daily opportunities.

Let’s grow together!

There is a lot to cover and will take some time. This is a highly dynamic situation, and we are assessing the situation in real time. Binance has the discretion to pull out from the deal at any time. We expect FTT to be highly volatile in the coming days as things develop.

— CZ 🔶 BNB (@cz_binance) November 8, 2022

CZ of Binance seems to be the only winner in this battle (though time will tell, this war is not over). Right now he is dominating and giving out advice on his Twitter about how not to get into a similar difficult situation to FTX.

He made two very important tweets, which can be called the main conclusions of what happened. Let’s look at them further.

No borrowed money (1/2)

CZ writes:

Two big lessons:

1: Never use a token you created as collateral.

2: Don’t borrow if you run a crypto business. Don’t use capital “efficiently”. Have a large reserve.

Binance has never used BNB for collateral, and we have never taken on debt.

This wish seems like the quintessence of everything that happened to the crypto market in the current year, which started the long crypto winter. It looks like what financiers call “collateral damage” happened under attack with FTX (earlier exactly what happened with Terra/Luna/Celsius and started the crypto winter era). Greed for cheap and big money led to the creation of clever borrowing schemes that held onto the hope of stability and predictability in the market. Any unexpected stress test (for FTX, such as the Binance attack) instantly made the borrowing scheme inoperable.

The era of trust is coming to an end (2/2)

And the next important tweet from CZ, which makes a logical conclusion from the first one:

All crypto exchanges should do merkle-tree proof-of-reserves.

Banks run on fractional reserves. Crypto exchanges should not.

Binance will start to do proof-of-reserves soon. Full transparency.

The abundance of risky schemes in crypto leads to the permanent danger of the collapse of entire floors of the crypto industry, so the era of trust seems to be ending. CZ is calling for regulation and transparency for everyone in crypto to make situations like FTX or Terra/Luna impossible (or unlikely).

Following Binance, exchanges OKX, Huobi, KuCoin and Gate also announced that they will start publishing transparency reports on their reserves.

If unfortunately FTX becomes another LUNA,nobody in the industry can benefit from the accident including Binance. Both customers and regulators will lose some confidence about the whole industry .I hope CZ can think about stop to sell FTT and make a new deal with SBF.

— Star (@star_okx) November 8, 2022

A very interesting thread that summarizes CZ’s claims, drawing a new crypto reality, is given by Circle CEO — we recommend reading it to anyone interested in this topic.

How can I make money on this?

So, the FTX story showed that crypto winter continues. The FTX situation showed once again that the crypto industry is on the precipice (not only for financial services but also for example mining). It is hard to say what will happen in the future, but now the most urgent task for an investor is to save his money. A huge number of tokens have collapsed in value on the background of these events, there are no safe islands in crypto. Even assets parked in safe stablecoins can be frozen for withdrawal, as the current situation with FTX has shown.

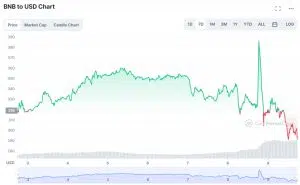

And if the thought of trying to short the crypto market is born, you have to remember that shorting is a complicated procedure, which carries a lot of dangers. The only thing that looks interesting against the background of all that happened is the BNB token from Binance, as Binance probably turned out to be the only winner in this difficult market situation.

Greed Fear Crypto Index shows extreme fear in the market, and the most sensible thing to do in such a nervous environment is to take a break and temporarily quit the game.

The brand new newsletter with insights, market analysis and daily opportunities.

Let’s grow together!