Digital Currency Group (DCG), the venture capital fund that owns Genesis Trading and asset manager Grayscale, could be the next big bankruptcy. DCG owes Genesis’ credit division $575 million, which will mature in May 2023. And DCG’s total debt to Genesis is about $1.6 billion. If the liquidation of Genesis occurs, that entire amount could be recovered from DCG.

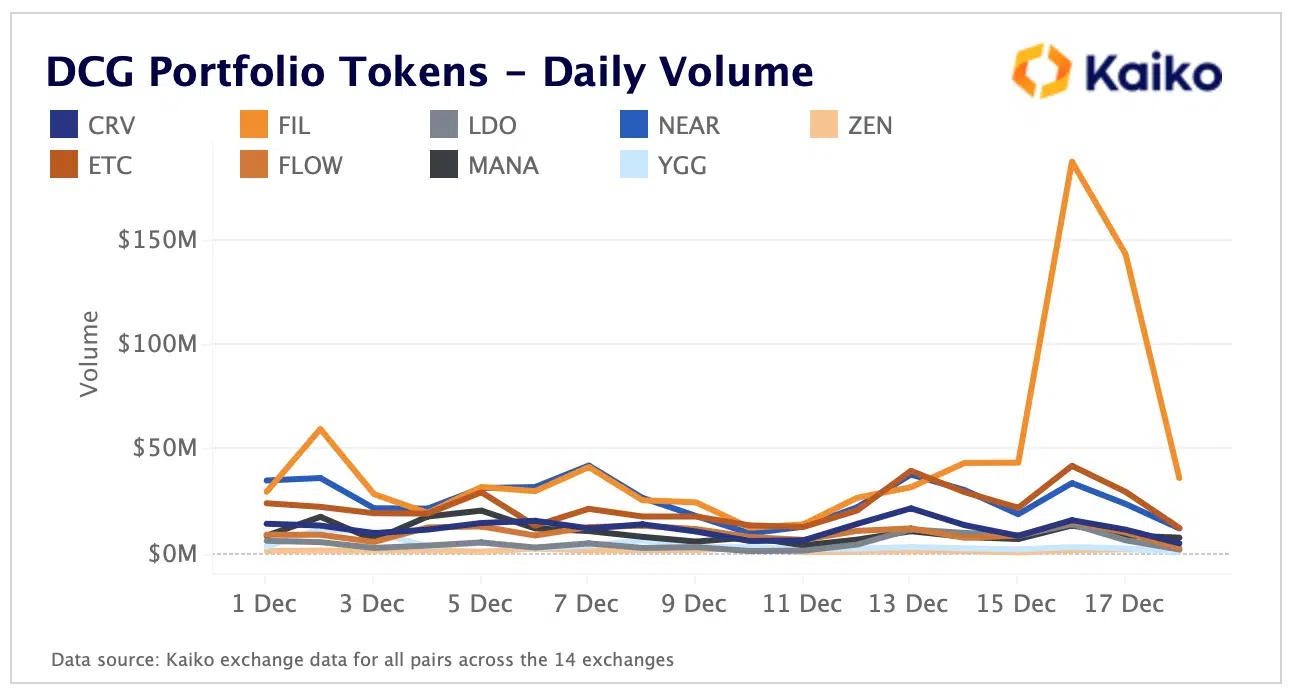

“A DCG bankruptcy would have knock-on effects for the crypto industry as a whole, but none more so than those tokens in its investment portfolio,’’ Kaiko analysts expressed.

Meanwhile, some believe that DCG is actively selling off its holdings in an attempt to restore liquidity. Such thoughts are suggested by the double-digit volume of token sales.

However, if you look at the volumes of some of the tokens in the DCG portfolio, you can see that most of their volumes do not look unusual. Most likely, it was a sell-off in the lower capitalization token market. That said, Filecoin (FIL) stood out sharply against them, as its daily volume increased more than 10-fold, and it fell 28% in the last week.

The brand new newsletter with insights, market analysis and daily opportunities.

Let’s grow together!

In November, The Block wrote that Genesis had a $1 billion hole in its budget (the necessary amount was later reduced to $500 million). And in the absence of financial aid, the collapse would be inevitable.

Why did the token sale raise concerns?

If DCG is really dumping assets, it could mean two things;

- they are trying to pay off a $1.5 billion loan to Genesis. The loan can be revoked in the event of bankruptcy;

- they are going to Chapter 11 of the U.S. Bankruptcy Code. And to do that, they first exhaust all liquid assets.

In the latest episode of Unchained, “The Chopping Block,” Hasib Qureshi discussed the possible consequences of Genesis going out of business. The 10-year bond could have been structured as a callback if the company went into liquidation, he said.

If true, Genesis could treat the promissory note as a “current asset” (less than one-year-old) even though it was structured as a ten-year promissory note. This would have been a significant part of any current assets that Genesis showed to creditors. This, in turn, would greatly reduce DCG’s ability to limit liability from Genesis’ bankruptcy. And it would also reduce the urgency for Genesis to file bankruptcy because they “have assets.”

Also, it would reduce the urgency for Genesis creditors to force Genesis into bankruptcy through a notice of default.

The leverage would go to Genesis’ creditors, as it would be legally easier to drag DCG into bankruptcy because of a current asset than because of a ten-year promissory note.

All of this will increase the likelihood that DCG will have to conduct a recap against Genesis’s bankruptcy. DCG’s chances in bankruptcy court are drastically reduced if the promissory note is in fact payable.

The prolonged silence may be a sign that Genesis’ creditors are giving DCG time to deal with the situation.

According to Founder & CEO of Messari Ryan Selkis, that decision depends on where GBTC stock is currently being held.

“If spoken for at Genesis already, not great. If at DCG, there’s a path forward. Tricky, but doable,” he tweeted.

Selkis concluded that analysis of the DCG-Genesis situation now depends on two significant known unknowns: is DCG’s “10-year” promissory note revocable, and where is GBTC?

How bad things are? Spring will tell. But as early as December 17, Dutch cryptocurrency exchange Bitvavo requested a refund of 280 million euros from DCG and its subsidiaries.

Also, according to the Financial Times, DCG is trying to raise capital to save Genesis. A recent report revealed that this is being done “in part” to prevent the immediate repayment of the loan to Todd Boley’s investment house.

Boley led the debt raising for DCG through his investment company, Eldridge Industries, in November 2021. The same goes for a $600 million loan from a group of investors, including Eldridge. DCG was founded in 2015 by billionaire investor Barry Silbert. He told investors that Eldridge’s $350 million loan remains outstanding after Genesis went out of business last month.

What’s up with GBTC?

Grayscale Investments said it would explore new options to return some of the Grayscale Bitcoin Trust’s capital to shareholders if it fails to convert the world’s largest bitcoin fund into an exchange-traded fund (ETF). Those options could include a tender offer to buy up to 20 percent of the trust’s outstanding stock worth $10.7 billion, Grayscale Executive Director Michael Sonnenschein said in a letter to investors seen by The Wall Street Journal.

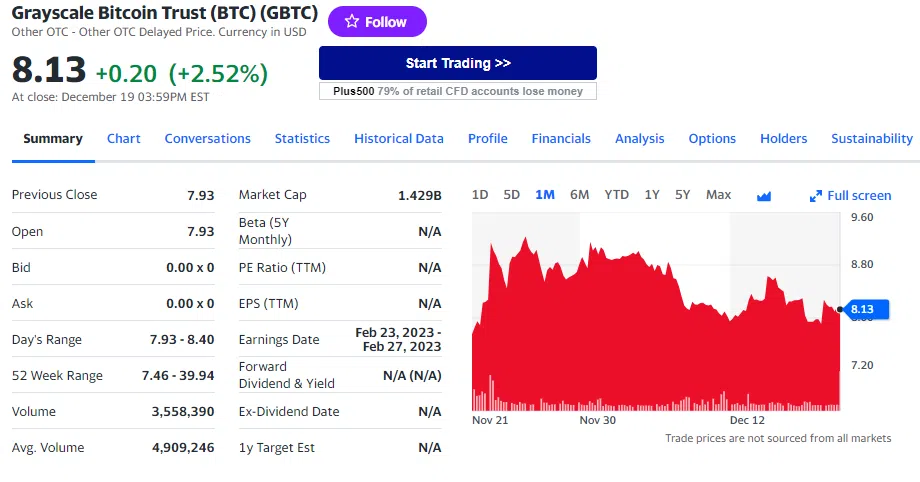

Grayscale Bitcoin Trust (GBTC) trades like a closed-end fund, which can often trade at a premium or discount to the value of its holdings. According to YCharts, on December 19, GBTC traded at a 46% discount to the price of bitcoins. GBTCs can be created but not redeemed. That is, investors can only sell their assets on the open market at a discount. The trust charges a 2% annual fee.

Grayscale claimed that converting GBTC into an ETF would help bring its share price in line with its underlying value. Market participants will be able to create and redeem GBTC shares to ensure that they reflect the underlying value of the bitcoins they own.

At the same time, on December 13, GBTC shares reached a record high level of discount to BTC, for the first time exceeding 50%. This happened after the U.S. Securities and Exchange Commission named the reasons for refusing to accept the application to convert the largest Bitcoin fund into an exchange-traded fund.

Grayscale Investments is exploring options to return some capital to its flagship Grayscale Bitcoin (GBTC) product, according to a letter to investors.

The price of GBTC has been rising over the past five days. The stock was trading at $8.13 at the close of December 19.

How can I make money on this?

The crypto market is starting to falter again. And it is becoming increasingly unpredictable and unstable. The situation with Binance also adds fuel to the fire. Will the world’s largest crypto exchange be able to overcome the mass outflow of funds? And now DCG adds to the thrill for investors.

Several DCG-related assets, such as Filecoin, Near, Ethereum Classic, Litecoin, Bitcoin Cash, etc., lost value after a potential sell-off.

Coinglass data showed that $237.86 million was liquidated from the industry on December 17 alone.

The Bitcoin price fell to a new bear market low of $15,487 in December, after rumors intensified that Genesis and DCG, which also owns Grayscale with its GBTC of 635,000 BTC, would go bankrupt.

The brand new newsletter with insights, market analysis and daily opportunities.

Let’s grow together!

With all this uncertainty, it is unrealistic to make any predictions about digital assets. All that remains is to closely monitor further developments around DCG and its subsidiaries, as well as Binance.