Contents

The current crypto winter has significant differences from the previous one. First, the institutional acceptance of cryptocurrencies is firmly entrenched. Many investors take a long-term view and recognize the cyclical nature of these markets. They use these conditions to prepare for the future, says Coinbase 2023 Crypto Market Outlook.

But there is no guarantee that digital assets have not faced failure. The total market capitalization of cryptocurrencies is currently about $835 billion, down 62% from $2.2 trillion at the end of 2021. By comparison, the Nasdaq is down 30% since the end of 2021, and the S&P 500 is down 18%.

“From a Sharpe ratio perspective, however, crypto’s risk-adjusted return actually performed in line with US and global stock indices through 2022 and did much better than US bonds. Prior to the fallout in November, an equally-weighted basket of BTC and ETH offered a negative Sharpe ratio of 1.08 compared to an average negative return of 0.90 for US stocks. This is a significant deviation from the trend observed in the last crypto winter, when digital assets underperformed nearly all traditional risk assets for the duration of 2019 and into early 2020,” the report says.

Currently, there is approximately $145 billion in stablecoins in circulation, which is about 17-18% of the total cryptocurrency market capitalization.

The brand new newsletter with insights, market analysis and daily opportunities.

Let’s grow together!

This is more than five times the 3.4% of stablecoins at the beginning of 2021, with a similar amount of market capitalization. Bitcoin, ether, and stablecoin together make up nearly 78% of the digital asset class at the time of publication. Stablecoins backed by fiat account for 91.7%.

And transactions involving only the four largest stablecoins by market value (USDT, USDC, BUSD, and DAI) represent 76% of all trading volumes on centralized exchanges, according to CryptoCompare.

Analysts believe that the evolution of the cryptocurrency ecosystem poses topics such as tokenization, allowed DeFi, and Web3. Meanwhile, Bitcoin’s main investment thesis remains unchanged, while Ethereum appears to be ahead of its Layer-1 competitors in terms of network activity.

Other blockchains continue to evolve, and altcoins compete for market supremacy. The Coinbase survey mentioned most of the well-known projects, including Solana (SOL). But for some reason, there was no mention of Cardano (ADA).

What to expect in 2023?

Bankruptcies and the unfortunate events of 2022 have led to a crisis of confidence that could prolong the down cycle for at least a few more months. Liquidity constraints could also disrupt the market in

in the short term, as many institutional structures reckon with assets locked up in the FTX bankruptcy process.

Therefore, against this background, experts expect three key themes to prevail in 2023:

- A flight to quality among institutional investors.

- Constructive disruption will, ultimately, lead to new opportunities.

- Fundamental reforms will open up in the next cycle.

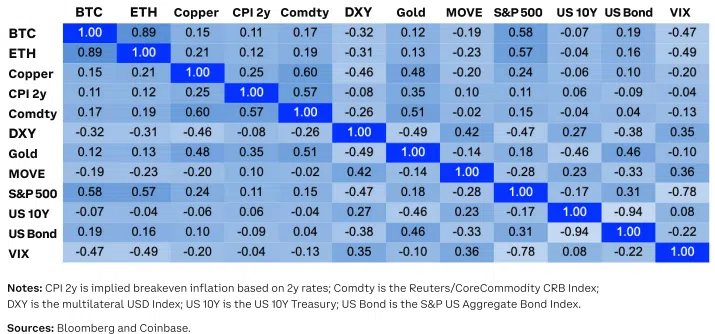

Digital assets exhibit a low correlation with other traditional financial assets, including commodities and bonds.

Table: Correlation matrix of individual variables based on one-year history (November 30, 2021, to December 1, 2022) of daily returns.

Even more Bitcoin and Ethereum

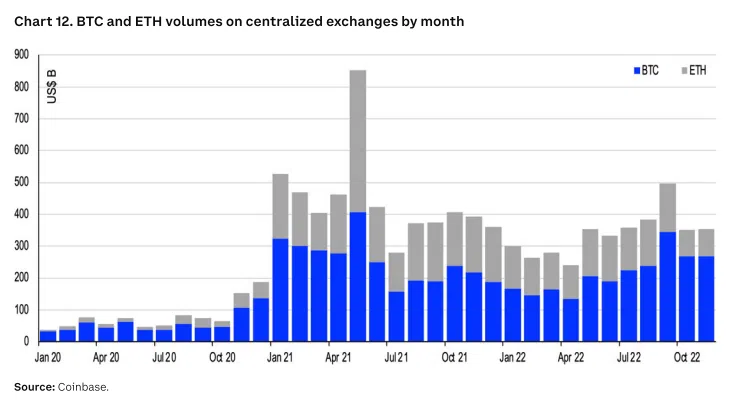

Analysts expect the choice of digital assets to shift toward higher quality names, such as Bitcoin and Ethereum, based on factors such as sustainable tokenomics, the maturity of their respective ecosystems, and the relative liquidity of the market.

However, Bitcoin miners are not having the best of times right now. And the situation is unlikely to improve in the near future. The latest Glassnode data (November 18, 2022) shows that Bitcoin miners are selling ~135% of the coins mined in a day, which means that miners are liquidating all of their recently mined coins, as well as some of their BTC reserves.

Higher input costs and lower production costs, combined with higher energy prices, have led to an extremely stressful economic environment for miners.

Stress signals in the industry include Compute North’s bankruptcy filing and a potential bankruptcy filing by Core Scientific. Iris Energy was forced to pull the plug on much of its equipment after the default in November.

Individual unprofitable miners will eventually be forced to shut down or be absorbed by larger companies.

Analysts expect 2023 to see more consolidation in the Bitcoin mining industry.

Also, Bitcoin has proven to be resilient, and it is not dependent on any centralized structure, either pumping or dumping.

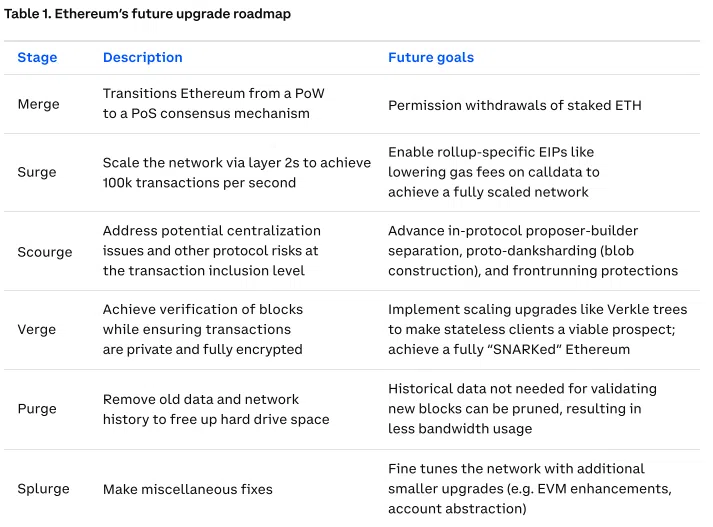

The Ethereum’s Merge in September 2022 was a critical turning point for the network, as it moved from Proof-of-Work (PoW) to Proof-of-Stake (PoS). The scale of this achievement is enormous. But more importantly, from an investment perspective, it bolstered the market’s confidence in future platform upgrades.

The rise of self-custody and DeFi

Many industry participants believe that disruptions in the crypto space in 2022 were concentrated among CeFi (centralized finance) or CeDeFi (a combination of CeFi and DeFi) organizations such as Celsius, Three Arrows Capital (3AC), and FTX.

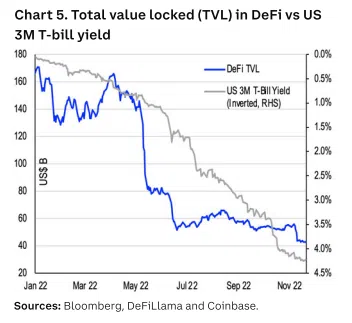

Overall activity in DeFi has dropped from a peak of $180B in total value recorded in December 2021 to $42B at the end of November 2022.

In the future, there could be a large number of decentralized apps (dApps) adapting their platforms for DeFi’s permitted activity as regulated institutional organizations seek greater participation in this sector.

More demand is expected for authorized or “enhanced” DeFi, which combines institutional-level compliance standards with transparency.

Permitted DeFi is likely to target different use scenarios and address a variety of problems (e.g., secured lending) compared to DeFi without authorization. In the short term, this may mean that markets can price permitted liquidity pools (which comply with anti-money laundering or AML/KYC regulations).

Over time, users and regulators may find ways to consolidate liquidity pools used by non-institutional participants. With Web3 primitives, such as decentralized identification, it may be possible to use the best of both worlds.

The movement toward self-custody and Decentralized Financial Protocols (DeFi) (Decentralized Exchanges or DEX) is likely to accelerate.

Physically-backed tokens

The concept of tokenization of real assets is not new, but it has gained significant traction in recent months. It applies to financial service providers as well. For some institutions, tokenization is a less risky way to deal with cryptocurrencies compared to investing directly in tokens. The current level of support for tokenization is much higher than it was in the previous crypto winter of 2018-19. Instead, banks are now using tokenized versions of financial instruments in several institutional use cases DeFi, often via public blockchains.

As for the NFTs, they are not having the best of times. But the technology has a promising future (if there are new uses for them).

Future engagement may be driven by new forms of utility beyond art/collections, including digital identity, ticketing, membership/subscription, RWA tokenization, and supply chain logistics.

In 2023, the debate around compulsory token-level royalties may also intensify, as it’s a hot topic for the creator community. If royalties are increasingly ignored by market participants, it could jeopardize technology adoption on a broader scale.

Credits, and the miraculously surviving Compound and Aave

In 2022, many loans were withdrawn from the system. Some of the historically largest lenders of digital assets went bankrupt or ceased operations after the fall of Celsius, 3AC, and FTX.

In 2023, lenders are likely to do more due diligence and stress-test potential risks in preparation for less turbulent markets in the future. And it will take several months for institutional lenders to regain their previous level of activity.

Notably, DeFi’s lending protocols, such as Compound and Aave, have remained fully operational.

How can I make money on this?

According to the Coinbase outlook, Bitcoin remains one of the main reserve currencies of the crypto economy. Moreover, from a macroeconomic perspective, the value proposition for bitcoin has only intensified this year.

Much of the future adoption of the Bitcoin network, especially in developing countries, may be due to the utility of this asset as a medium of exchange. Crucial will be the growth and development of a more scalable second-tier infrastructure (like The Lightning Network).

As we head into 2023, it is worth keeping an eye out for Bitcoin-related events that could have an impact on the market. One of them is the upcoming payout of Bitcoin and other funds from the rehabilitation plan of the bankrupt Bitcoin exchange Mt. Gox. More than 11 years have passed since the initial security vulnerability. Mt. Gox is preparing for the potential distribution of funds to its creditors in 2023. The latest notice, dated October 2022, states that the revised deadline for registering refunds is Jan. 10, 2023, after which payments should begin.

The brand new newsletter with insights, market analysis and daily opportunities.

Let’s grow together!

The betting odds are low on the Ethereum network, in part because bettors can’t withdraw their ETH before the Shanghai hard fork. The latter could change a lot of things. Scheduled date: March 2023.