The significant movements of Bitcoin and Ethereum always intrigue the community, as such actions typically have an underlying purpose.

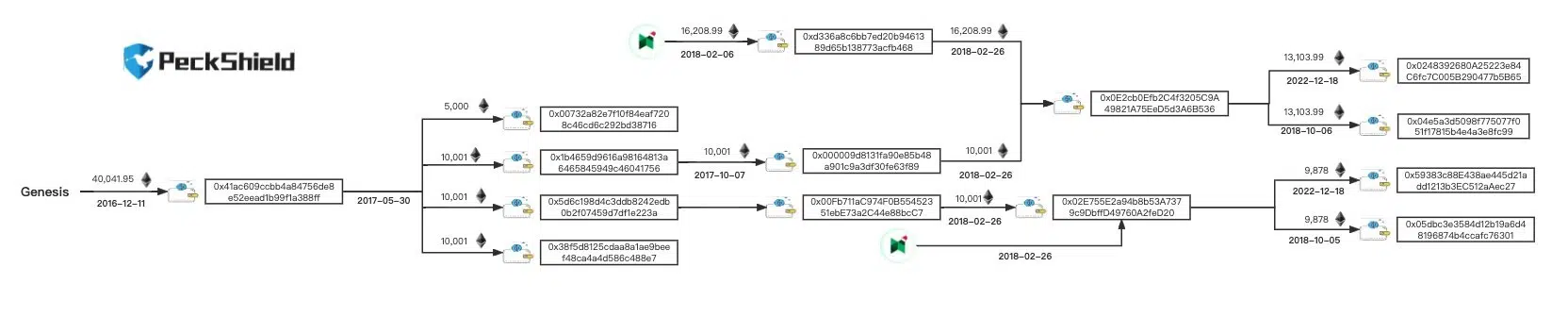

On December 18, the Ethereum bulls (A bullish investor, also known as a “bull,” believes that the price will rise.), who had been dormant for four years, woke up. Two addresses transferred a total of 22,982 ETH. These tokens came from the Genesis and Poloniex trading platforms, and the addresses themselves had been inactive since 2018. This was reported by the blockchain security company PeckShield.

The bulls transferred 13,103.99 ETH and 9,878 ETH, respectively.

It’s interesting that similar activity of these addresses was during the fall in the price of Ether. In 2018, the price of ETH ranged from about $190 to $230. On the transfer day, the asset was worth about $1,200.

The brand new newsletter with insights, market analysis and daily opportunities.

Let’s grow together!

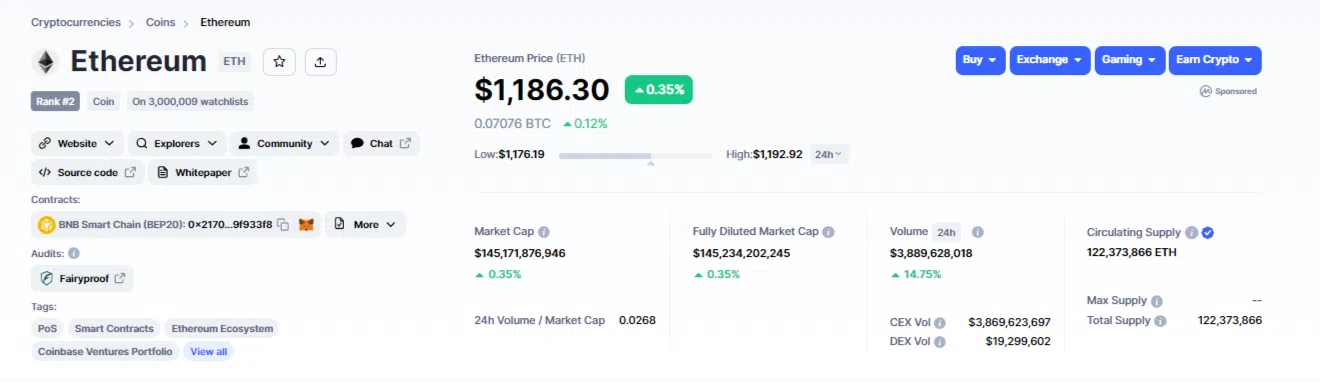

As of December 19, the ETH price is going up (although you can’t call it an upsurge because last year, the token was four times more expensive).

Trading volume in 24 hours was $3,888,923,299. In the CoinMarketCap ranking, Ether ranks 2nd with a real market capitalization of $145,234,202,245. There are 122,373,866 coins in circulation.

Ethereum is the second most expensive and popular cryptocurrency. The project was founded in 2015 by Vitalik Buterin and Charles Hoskinson.

This year, Ethereum completed The Merge update and switched to the Proof-of-Stake (PoS) consensus mechanism, after which mining was no longer necessary. The network’s energy consumption has been reduced by 99.9%, and its carbon footprint is now 0.1 million tons of CO2 per year.

The Shanghai could explode

There’s a big update planned for the Ethereum network in 2023 called The Shanghai. The Merge has effectively replaced mining with stacking, with “stacking” ETH (stETH) tied to the Ethereum Beacon chain. The latter is what the upcoming update is aimed at.

This will make previously staked tokens sent to the Ethereum 2.0 contract prior to the Merge available for withdrawal.

There will also be significant changes to the EVM functionality of the Ethereum blockchain. For example, with the Shanghai update, a reduction in gas fees for Ethereum-based Layer-2 solutions should be implemented.

According to a discussion at the 151st Ethereum Core developer meeting on December 8, the next Ethereum hard-fork (aka Shanghai) will occur tentatively in March 2023.

Given that the Shanghai update “releases” staked ETH, there is a risk that validators will sell their stETH massively as soon as the update is implemented. Which means there will be a large number of offers to sell. And that will likely lead to a sharp drop in prices.

Nevertheless, the ETH protocol has set a payout limit of 43,200 stashed ETH per day out of more than 10 million, which should help avoid affecting the cryptocurrency’s price.

How can I make money on this?

Given that such significant updates will be made to the Ethereum network, and the fact that analysts have predicted that the crypto winter is almost over, we can expect ETH to feel more confident in 2023.

However, as the practice has shown, after the last major and long-awaited Ethereum update, the network’s native token has not increased in value but only decreased. It may well be that the situation will repeat itself after the next upgrade. But the crypto market is so unpredictable that nothing can be foreseen, much less guaranteed.

Analysts believe that if ETH fails to rise above the $1,250 mark, it could continue to move downward.

At this reading, it could push ETH to $1,312.

The brand new newsletter with insights, market analysis and daily opportunities.

Let’s grow together!

Once that happens, Ethereum’s price will target $1,350. This will be a confirmation of the altcoin’s uptrend.

If a drop below $1,200 occurs, the price could even fall to $1,165. Any new losses could take the price to $1,075 support.

Suppose there is a broad cryptocurrency market recovery in 2023. In that case, there is a good chance that Ethereum could claim to be the cryptocurrency with the largest market capitalization (currently, the total value of all BTC tokens in circulation at the current price is about 2.2 times greater than the total value of all ETH tokens).

According to DigitalCoinPrice’s forecast, the price of Ethereum could reach $17,161.39 at the end of the decade. The forecast is based on an estimate of historical data.

CoinPriceForecast’s ETH price forecast suggests the coin could trade at $2,340 by the end of 2030. By the end of 2034, the site believes the ether could trade at $2,961, slightly lower than the projected price of $3,033 in 2033.

PricePrediction believes the average price of ETH could be $1,974.33 in 2023 and $4,048.58 in 2025, based on technical analysis using artificial intelligence. In 2030, the estimated price could jump to $26,727.08.

CaptainAltCoin is also bullish: ETH could reach $26,814.19 by 2030.