Morgan Stanley, one of the world’s largest investment banks, began buying shares of Grayscale Bitcoin Trust (GBTC), a large digital currency investment fund. The news of this caused Bitcoin to rise. We gathered all the information on this topic and explained why it is important.

What happened

Liquidity inflows are vital for the crypto market, especially during this difficult time of the prolonged crypto winter. So far, the crypto market is a relatively small sector of the global economy that is isolated from the really big money (from bank-level investors and hedge funds). That’s why it’s extremely important that really big players enter the crypto market and set an example for the rest of those investing in Bitcoin.

One of the world’s largest investment banks, with $6.5 trillion under management, announced the purchase of shares in the Grayscale Bitcoin Trust (GBTC), which backs its shares with real Bitcoins. According to representatives of this bank, shares of GBTC were added to the portfolio as a diversifier (in other words, to reduce the risk of the conventional portfolio). According to a Morgan Stanley representative, at least 1% of their portfolio should be allocated to BTC.

The brand new newsletter with insights, market analysis and daily opportunities.

Let’s grow together!

This landmark purchase has already strengthened the price of Bitcoin, which crossed the $17,000 mark on this news. Nevertheless, do not get too euphoric; it’s more of a symbolic purchase for the market at $3.6 million.

However, judging by the stated plans, we can talk about the accumulation of Bitcoin by this bank for about $300 million. Morgan Stanley previously experimented with buying Bitcoin via GBTC shares and decided to continue to increase its position even against the background of the crypto winter and falling market.

“The Morgan Stanley Europe Opportunity Fund revealed in a filing it bought $3.6 million worth of GBTC, that being the Grayscale Bitcoin Trust that holds actual spot bitcoin.”

Last week news from Blackrock, this week from Morgan Stanley#Bitcoinhttps://t.co/Yv1WBHJ3Fn

— Alessandro Ottaviani (@AlexOttaBTC) January 9, 2023

It is also worth noting that this symbolic gesture was preceded by other equally important events that happened in late 2022. The Bank for International Settlements gave commercial banks the green light to hold 1–2% of their capital in crypto. The Federal Reserve Banks have also made it clear that commercial banks can provide crypto-related services.

Taken together, this shows the outlook for crypto to attract more large capital from institutional investors in 2023.

The worlds’ largest fund w/$15 trillion… Now Morgan Stanley w/$6.5 trillion assets under management announced they bought $3.6 million in #BTC . Expect to hear more institutions announcing they too have been buying #Bitcoin over the past few months. Kudos to #Huobi news. pic.twitter.com/povZb8DvAt

— Jeff B (@jeff_bxxxxr) January 9, 2023

Why is this important to Grayscale?

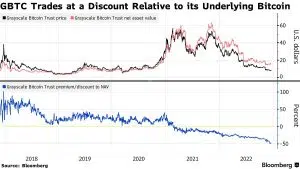

Amidst FTX’s collapse, fears of a domino effect in the form of declines by many other industry players, including major cryptocurrency funds, are growing. We have previously written in detail about Grayscale’s share price discount problem (or read more in this article about “slam dunk” arbitrage), which could potentially lead to the collapse of GBTC. In addition, Grayscale’s problems are further amplified by those of its owner, the Digital Currency Group (DCG).

Grayscale is the largest cryptocurrency fund operator. It is not a public company, and only a few thousand large investors hold stakes in its funds, including the mentioned Morgan Stanley.

If Grayscale closes the fund, more than 3 million ETH and more than 630,000 BTC will enter the market. With the current low liquidity and negative expectations, the appearance of such a huge amount in the free sale could provoke an incredible collapse of the crypto market.

However, despite the existing problems, GBTC has existed for almost ten years. The fund has already gone through several crises, bringing the operator billions of dollars in revenue. In this context, Morgan Stanley’s deal is very important, as it adds stability and faith to the fund.

Former Morgan Stanley CEO: I still own #bitcoin 🙌 pic.twitter.com/oGepARln1K

— Bitcoin Magazine (@BitcoinMagazine) October 17, 2022

Brief summary

To summarize, Morgan Stanley’s investment, although not large in amount, is psychologically important for everyone: it strengthens Grayscale’s reputation, which is immediately reflected in the Bitcoin price, and it also sends a clear signal to other major players that it is possible to invest in crypto even against the background of crypto winter and negative sentiment.

Such calming deals are sorely lacking in the current market, the crypto industry has gone through too much bleeding in recent months, and it urgently needs a demonstration of positivity from the big players.

If grayscale goes down others go down then the banks go down. So the banks are coming in to rescue grayscale. Morgan Stanley etc.

— Endshare (@end_share) January 10, 2023