Shards of collapsed Alameda and FTX continue to fly in all directions, hitting the entire crypto market and even pensions. Research firm Kaiko decided to dig deeper and examine the impact of the Alameda and FTX crash on stablecoins.

Alameda and FTX, run by Sam Bankman-Fried, had millions in stablecoins. In this table, Dune Analytics tracked Alameda, FTX, and their Ethereum wallets.

As of November 14, Alameda had over $46 million worth of stablecoins remaining, with TrueUSD (the 6th largest stablecoin by market capitalization) being the largest stablecoin, followed by $11.7 million USDC and $11 million USDT. USDC stock has dropped five times in a few days.

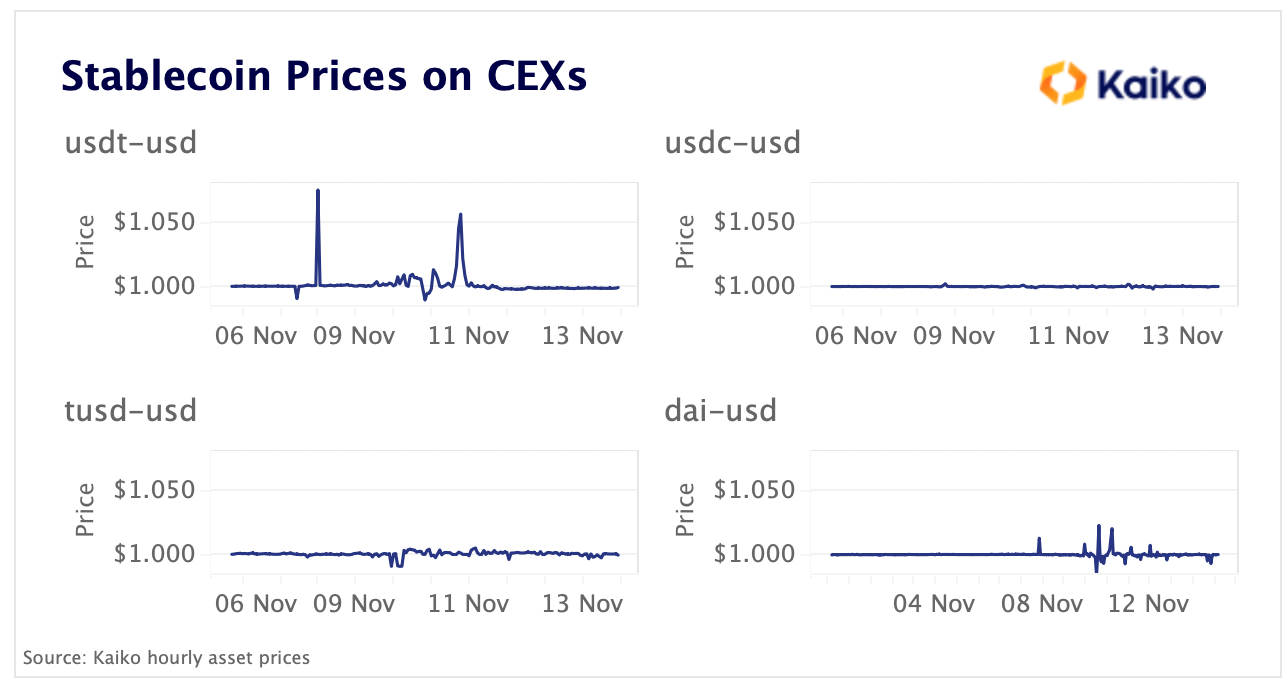

“USDT showed the sharpest price movements, first falling to $0.989 on Nov. 10 and then rising to $1.058 on Nov. 11. Since then it has been trading at a very small discount, suggesting continued selling pressure in the centralized spot markets. There was even speculation that Alameda was aggressively shorting USDT by borrowing USDT using USDC on Aave, and then selling it on other exchanges such as Curve,” Kaiko analysts concluded.

The brand new newsletter with insights, market analysis and daily opportunities.

Let’s grow together!

What are stablecoins and what kinds of them exist?

Stablecoins are cryptocurrencies with a fixed or stable exchange rate. They are a universal unit of account, convenient for trading, storing capital, and protecting against cryptocurrency volatility.

Stablecoins can have different sources and assets as collateral and value-holding mechanisms. The most popular are those whose value is backed by a peg to real assets.

The 10 most popular stablecoins

- Tether (USDT);

- USD Coin (USDC);

- Binance USD (BUSD);

- Dai (DAI);

- TrueUSD (TUSD);

- Pax Dollar (USDP);

- USDD (USDD);

- Neutrino USD (USDN);

- Fei USD (FEI);

- Gemini Dollar (GUSD).

You can find more details here.

Why are stablecoins so important?

Stablecoins play a crucial role in the market. For example, the Terra ecosystem collapsed in May after the Terra USD lost its peg to the U.S. dollar. Investors subsequently lost more than $40 billion.

The price of Tether (USDT) has remained relatively stable. Last week, though, this stablecoin briefly lost its peg and collapsed to $0.9713. The price then stabilized again.

IntoTheBlock data showed that total exchange inflows over the past seven days were $11.7 billion. During the same period, the outflows were about $13 billion. That means the net outflow of funds was about $1.7 billion. A separate CoinMarketCap report shows that the coin has lost $3 billion in the past few days.

Tether and other stablecoins such as USD Coin have seen significant outflows due to the desire of frightened crypto investors to withdraw funds from the market as soon as possible.

Unlike algorithmic stablecoins such as USDD and Terra USD, USD Coin and Tether are fully backed by real assets.

According to Tether, its current balance on Tron is $37 billion and on Ethereum, it is $32 billion. Other major players that own Tether are Solana, Avalanche, and Algorand.

As of September, 82.45% of those assets were in cash and cash equivalents, while the rest were in liquid assets: corporate bonds, funds, precious metals, secured loans, and other investments.

Therefore, Tether may well survive even significant pressure. It has, at least in the past.

TUSD is considered to be one of the least liquid stablecoins. It can be found only on 10 centralized exchanges (CEX). But the TUSD price held even despite the events around Alameda and FTX.

Even despite small fluctuations, stablecoins remain stable.

Stablecoins on exchanges at all-time high!! #crypto pic.twitter.com/ScoeubHKF8

— Altcoin Daily (@AltcoinDailyio) November 15, 2022

How can I make money on this?

Whale addresses with balances between $100,000 and $10 million in Tether (USDT) and USD Coin (USDC) have increased reserves in those stablecoins by 8.6% and 12.1%, respectively, as of November 8, according to analyst firm Santiment. Both have, among other things, fiat support (i.e., in the usual bank currency).

🐳 #Stablecoin accumulation is being shown by #crypto whales over the past three months, and there is significantly more buying power by large traders compared to the June bottom. $USDT and $USDC being accumulated has historically foreshadowed price rises. https://t.co/MxYGsi7tjY pic.twitter.com/jzh8GIsVNL

— Santiment (@santimentfeed) November 8, 2022

As mentioned above, USDT and USDC are the most popular stablecoins — among whales, too. They can help protect against crypto market volatility, as they maintain a $1 peg at the expense of fiat backing.