With the start of Monday, January 9, all crypto suddenly came alive. The market has been waiting to see such a pumping for a long time. The total capitalization reached $805 billion (all data at the time of writing).

Digital gold (aka Bitcoin), cryptocurrency #2 (Ethereum), and almost all altcoins went up sharply. BTC is now trading above $17,200, and ETH is trading around $1,300.

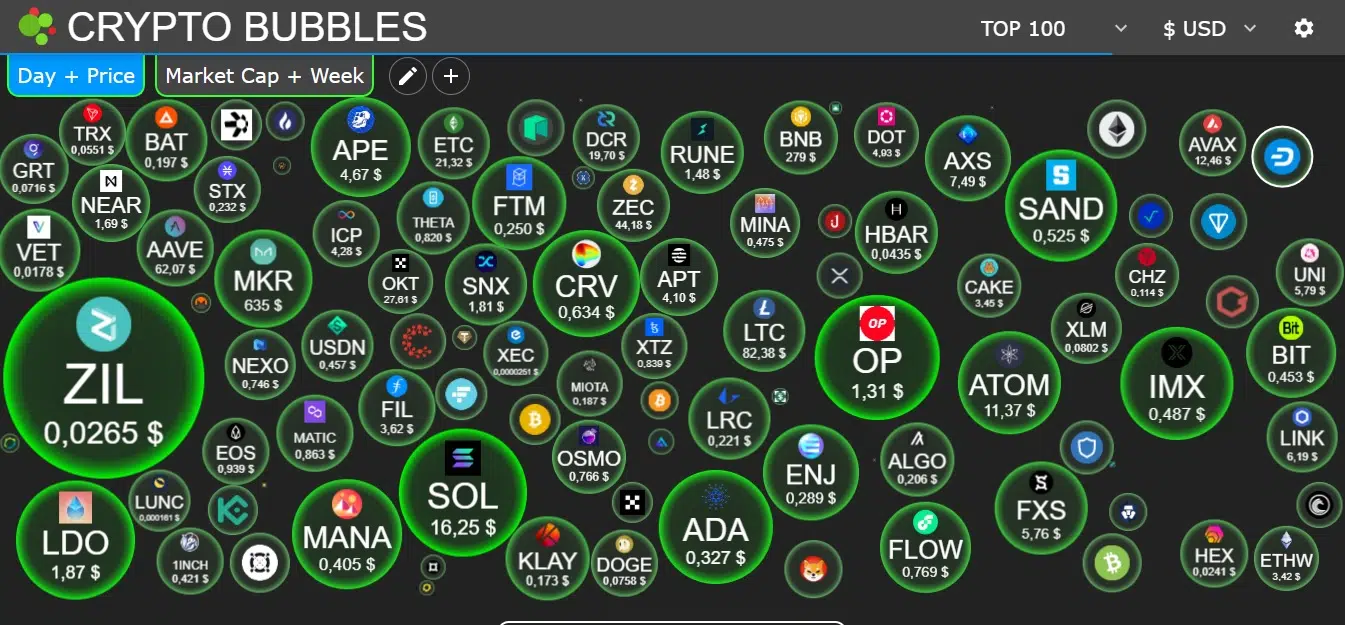

The value of some tokens soared by almost 50%. Zilliqa (ZIL) showed the most significant growth, with its value jumping from $0.01741 to $0.02676 in 24 hours. ZIL is the native governance token of the Zilliqa public blockchain. It is used to process transactions on the network and execute smart contracts (This is a program on the blockchain that automatically ensures that certain actions are performed if predetermined conditions are met.)

Also, Solana (SOL) and Optimism (OP) added 21% each.

The brand new newsletter with insights, market analysis and daily opportunities.

Let’s grow together!

Solana’s token rose in price from $13.47 to $16.43. And the Optimism coin, a second-tier solution designed to boost Ethereum’s speed, jumped in value from $1.10 to $1.34.

In fact, it is easier to name the coins that did not go up in price during the day. According to CoinMarketCap, they are Gemini Dollar (GUSD), TrueUSD (TUSD), and UNUS SED LEO (LEO).

Why is the crypto market up today?

Such a sudden “green day” in 2023 could occur for a few reasons.

First is the decline in U.S. unemployment and inflation. On January 6, official labor market data were released. In December 2022, the number of unemployed jobs rose to 3.5% (in November, the figure was 3.7%), and the number of people employed in non-farm industries increased by 223,000.

In addition, Atlanta Federal Reserve Bank President Rafael Bostic recently said that inflation is the biggest drag on the U.S. economy, and U.S. Federal Reserve officials “remain determined” to bring it down to the 2 percent target, according to Reuters. The publication of the official data is expected on January 12.

This data signals that the U.S. economy is in a stronger position than previously thought and that the U.S. Federal Reserve will be able to maintain its current monetary policy.

Also, November’s U.S. foreign trade deficit shrank by 21% to $61.5 billion. This is the lowest figure since September 2020, The Wall Street Journal writes.

As we know, altcoins are mostly pulling in the wake of Bitcoin. And its price, in turn, depends on the U.S. dollar.

The information about the slowdown in inflation was clearly received positively by crypto traders and investors, who saw the prospects of bullish growth.

It’s not just the crypto market that has revived. According to Forbes, as of January 6, stocks and bonds were also “greening up.” The Dow Jones Industrial Average gained 680 points, or 2.1%, its biggest daily gain since Nov. 30, while the S&P 500 (a stock index whose basket includes 505 stocks of the 500 largest-capitalized, select U.S. public companies traded on the stock exchanges) and the high-tech NASDAQ (a stock index made up of common stocks and similar financial instruments of all companies traded on that exchange) gained 2.3% and 2.5%, respectively.

The 10-year Treasury bond yield fell 16 basis points to 3.56%, the lowest in nearly three weeks.

The price of gold is also (XAU/USD) approaching a seven-month high, its highest level since last June, approaching $1,875.

China has the status of being one of the world’s largest consumers of gold. And on January 8, the country opened its air, land, and sea borders to travelers after a three-year COVID-19 quarantine.

Overall, the cryptocurrency sector has shown more growth than other asset classes, such as stocks, bonds, and gold. The MVIS CryptoCompare Digital Assets 100 Index (MVDA), which includes the top tokens, is up about 7% this month, outperforming global stocks by 2%, bonds by 1%, and gold by 3%, according to Bloomberg.

Is it the end of crypto winter, or just a little break?

Everything looks very positive. Even too positive. Will growth continue in the future? Many traders and investors remain optimistic about the future of the crypto market, say Crypto Beat experts.

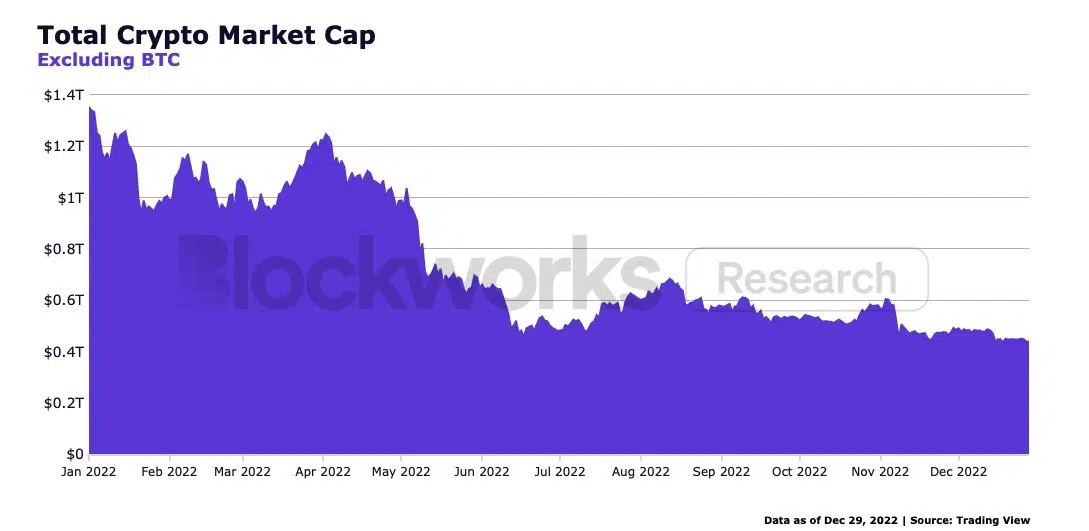

But Blockworks Research shows that crypto experienced a 77% decline in TVL (Total Value Locked measures the total value of all assets locked into DeFi protocols.) from $270 billion at the start of the year to $60 billion as of January 9. Also, the total crypto market cap fell 67%, from $1.35 trillion to $437 billion, excluding BTC.

Given the volatility of cryptocurrencies (that is, their ability to jump in price), it is impossible to 100% predict market movements. However, as accurately pointed out by a popular crypto trader on Twitter under the nickname Loma, today perfectly illustrates how quickly market sentiment can change “when we get a couple of green candles.”

“Once again, showing that the best narrative for crypto is the price going up,” he wrote.

So far, the crypto market is burning with green flames. What will happen next we’ll see on January 12 with the U.S. inflation report.

You have not selected any currency to display

![FireShot Capture 129 - See The Top Crypto Gainers And Losers Today [Updated] - CoinMarketCap_ - coinmarketcap.com - buidlbee](https://buidlbee.com/wp-content/uploads/2023/01/FireShot-Capture-129-See-The-Top-Crypto-Gainers-And-Losers-Today-Updated-CoinMarketCap_-coinmarketcap.com_.png.webp)