Contents

Everything you need to know about investing and profiting off LEO.

What is UNUS SED (LEO)?

UNUS SED LEO (LEO) was launched in 2019 through an initial exchange offering (IEO) as the latest crypto project of Bitfinex, the daughter company of Ifinex. Its launch was in direct response to the US government seizing the funds from Crypto Capital, Bitfinex’s previous payment processor.

One of the unique features of LEO is that it is one of the few cryptocurrency tokens with a limited lifecycle coded into its protocol. The crypto token was released with an initial floor price of $1/LEO token. Unfortunately, U.S. nationals were excluded from this IEO. The tokens were released onto two crypto blockchains, Ethereum and EOS at a rate of 64:36 percent. Bitfinex aligned itself with the interoperability between the two blockchain networks.

The brand new newsletter with insights, market analysis and daily opportunities.

Let’s grow together!

Despite its initial success on the market, its main crypto trade pair, USDT, does not have much liquidity. That aside, the token is still active on the exchange and undervalued despite ranking on the CoinMarketCap list of the top 100 cryptocurrencies.

Utility of the LEO token

When entering the competitive crypto market, the most important thing is to derive your value from its real-world utility. The LEO token has a list of use cases: working capital and capital expenditures repayment of debts.

The true value of LEO comes from its primary community, users of the Ifinex crypto network. LEO serves its community members by offering them discounts and reduced fees when acting on the exchange. Those discounts extend to lower deposit and withdrawal fees.

A drawback remains that LEO cannot create a leverage position.

What are the pros and cons of investing in LEO?

| Pros | Cons |

| 0.05% – 0,25% discounts | LEO is volatile |

| LEO cuts commission fees by 15% on Bitfinex and Ethfinex, applying to all pairs and stablecoins | There is a high starting valuation involved |

| Holders of LEO gain voting rights | The data on the dashboard is at risk of inaccuracy |

| LEO is listed on many major cryptocurrency exchanges | There is a high risk of manipulation in the price of the token |

How to buy LEO?

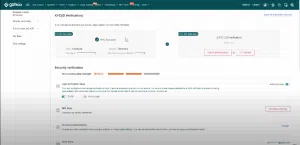

Step 1 – Register an account with Gate.io and complete the KYC

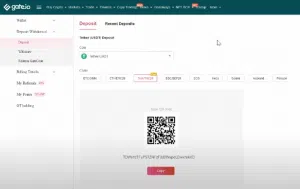

Step 2 – Deposit funds

Gate.io is a crypto-to-crypto exchange, so you must transfer crypto from your wallet or another crypto exchange.

Step 3 – Select LEO and set the trading pair to USDT/LEO

As mentioned above, you need to use crypto pairs to buy or sell LEO on Gate.io. BTC or USDT are your best options for LEO trade pairs.

Step 4 – Transfer your LEO tokens out of the exchange and into a secure crypto wallet.

Which exchanges support LEO?

LEO is available on limited crypto exchanges, which are:

– Gate.io

– OKX

– FTX

Is LEO a good investment?

LEO was released onto an established crypto network as a way for Bitfinex to redeem its position in the cryptocurrency industry. Leo was the utility token that was launched to revive the Ifinex network. LEO allows readers and investors to take advantage of the different rates. Trading commissions are awarded to those holding LEO, further incentivizing network participation.

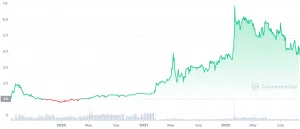

The overall growth of market capitalization has resulted in a continuous increase in the token’s price. The token’s primary exchange and its parent company, Ifinex, continue to promote services on the network and incentivize their investors to flock to the exchange and its native token.

Its buyback and burn mechanism is built into its protocol and does not favor a long-term holding period, but this does not rule out the benefits of investing in LEO as a short-term investment.

How can I make money on this?

The best way to make money with LEO is to leverage its unique community perks while trading crypto on the Bitfinex exchange. The lifecycle is a deterrent as far as holding LEO is concerned, but it is still possible to profit from the short-term volatility of the crypto token.