FTX bankruptcy documents showed that the exchange owes its 50 largest creditors $3 billion. And the problems are dragging on one by one.

Japanese crypto exchange Liquid, which FTX acquired in March, suspended trading and withdrawals. Genesis is also in trouble and many have started talking about the bankruptcy of its parent company Digital Currency Group. Bearish sentiment towards Grayscale Bitcoin Trust (GBTC) has intensified as its parent company, also Digital Currency Group (DCG). GBTC shares have fallen in price by 26% since the beginning of November.

Investors also turned their attention to Crypto.com and its CRO token. Concerns about potential insolvency and rumors that the exchange is as dependent on CRO as FTX is on FTT led to funding rates for the token’s perpetual future dropping to -3%. That is, CRO traders were paying a 3% premium for their positions.

Moreover, the situation in the cryptocurrency markets deteriorated sharply during November 19–20. The BTC price is now around $16,000 (the lowest in the last 2 years) and ETH is approaching $1,100, the lowest level since the end of 2020.

The brand new newsletter with insights, market analysis and daily opportunities.

Let’s grow together!

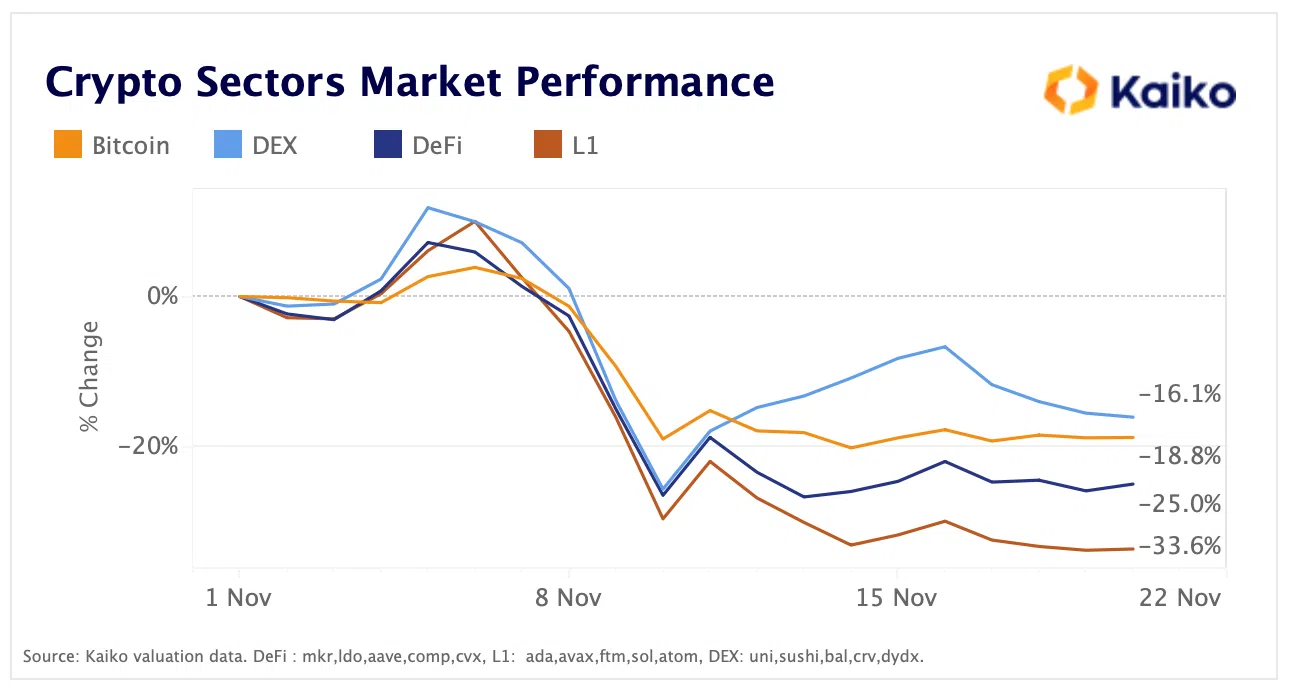

The drop has spread throughout the entire market and the tokens

According to Kaiko’s study, Layer-1 blockchain tokens are the worst performers. They have fallen 34% since the beginning of November due to Solana (SOL), which was previously backed by bankrupt FTX/Alameda. Decentralized finance (DEX) tokens suffered less, dropping 16%.

Notably, the token of the decentralized derivatives exchange dYdX rose 18%, suggesting that competition in the derivatives markets for the gap left by FTX is heating up. DeFi projects have also been hit hard by changing risk sentiment and are down 25%.

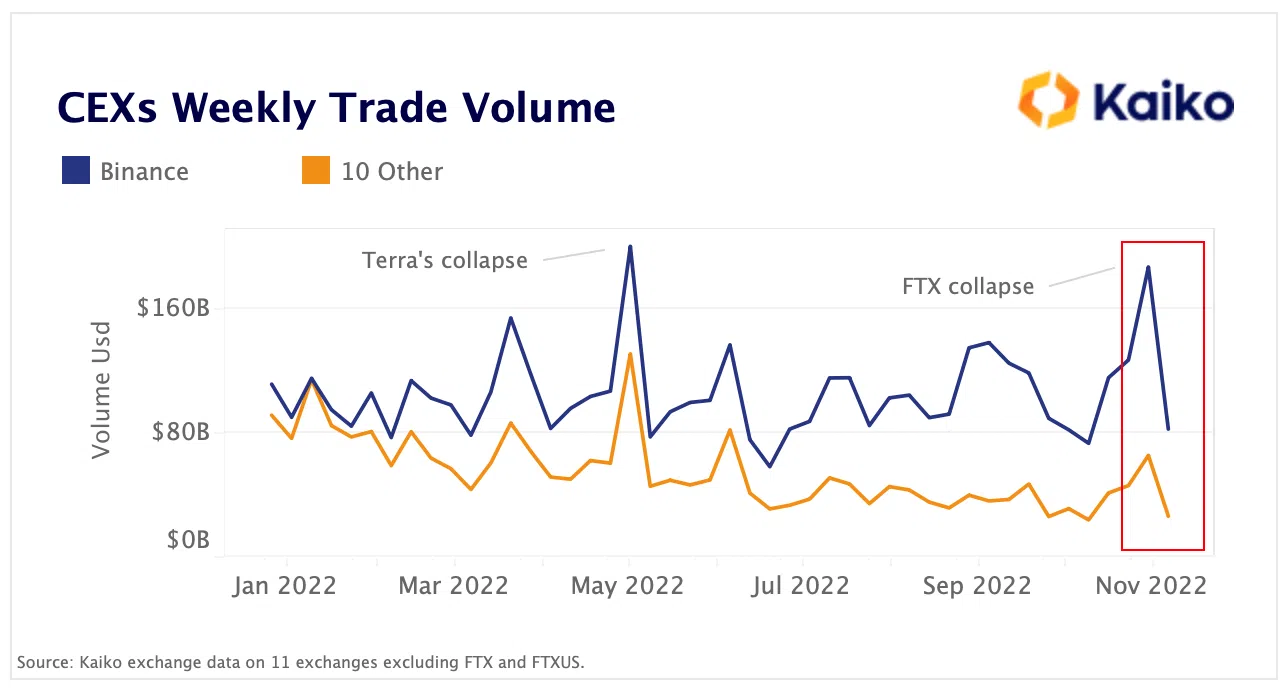

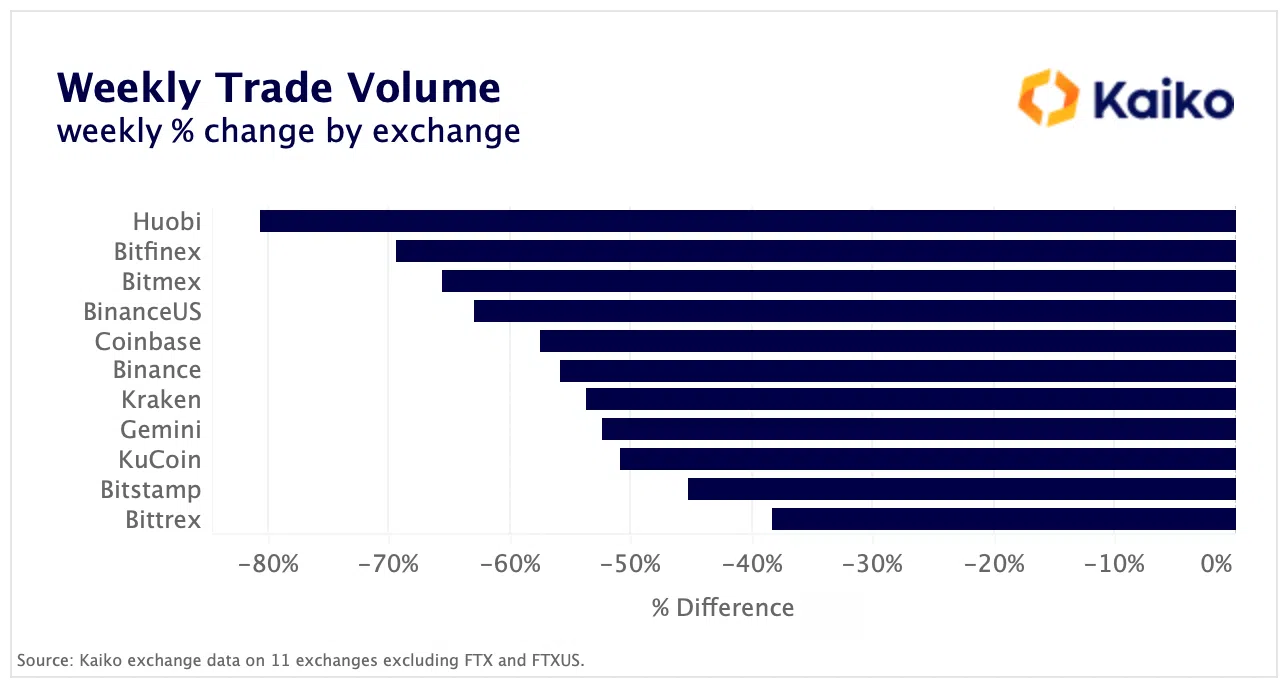

Trading volumes on the leading centralized exchanges (CEX) halved last week from a week earlier, falling to $100 billion.

Huobi and Bitfinex recorded the largest average weekly declines of 82% and 75%, respectively. Trading activity on Gemini dropped 56% after the exchange suspended its Earn program. Binance’s trading volumes dropped 60%.

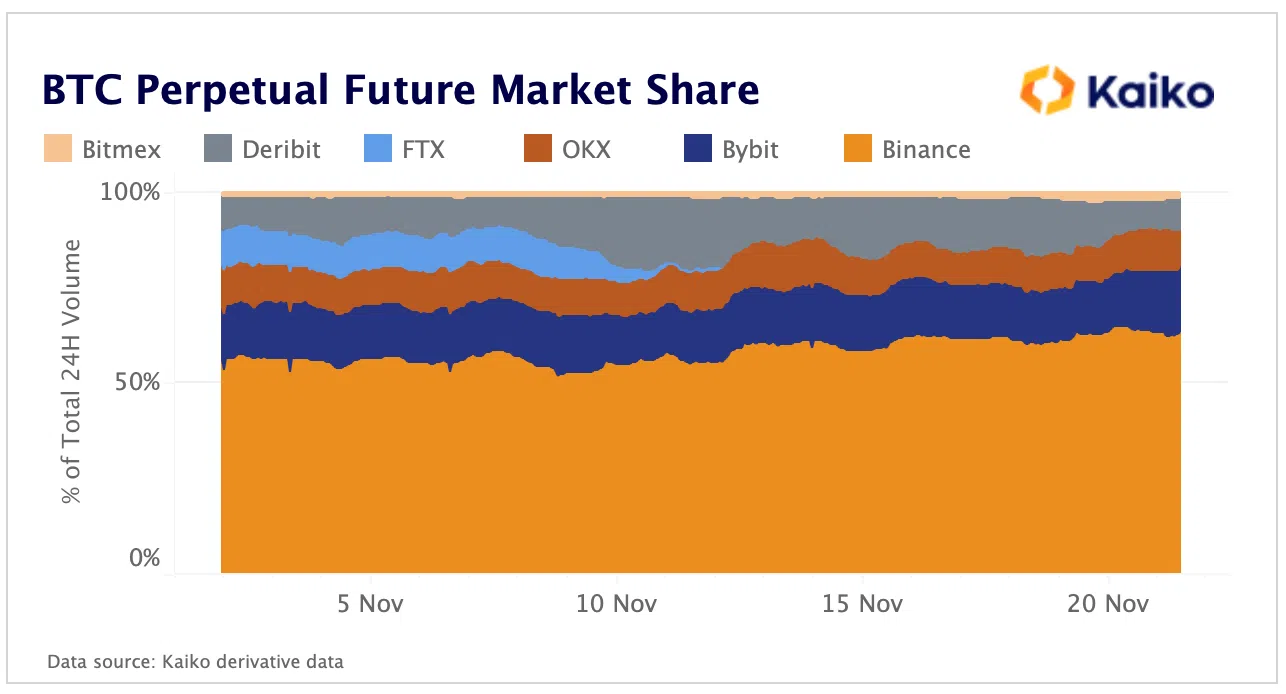

A fight for perpetual BTC futures

Before FTX collapsed, it accounted for about 10 percent of the daily volume of perpetual BTC futures. Now, derivatives exchanges are fighting for that share of volume. Since early November, Binance has increased its market share of perpetual BTC volumes by 7% (to 63%), with Bybit taking the rest.

Light at the end of the tunnel

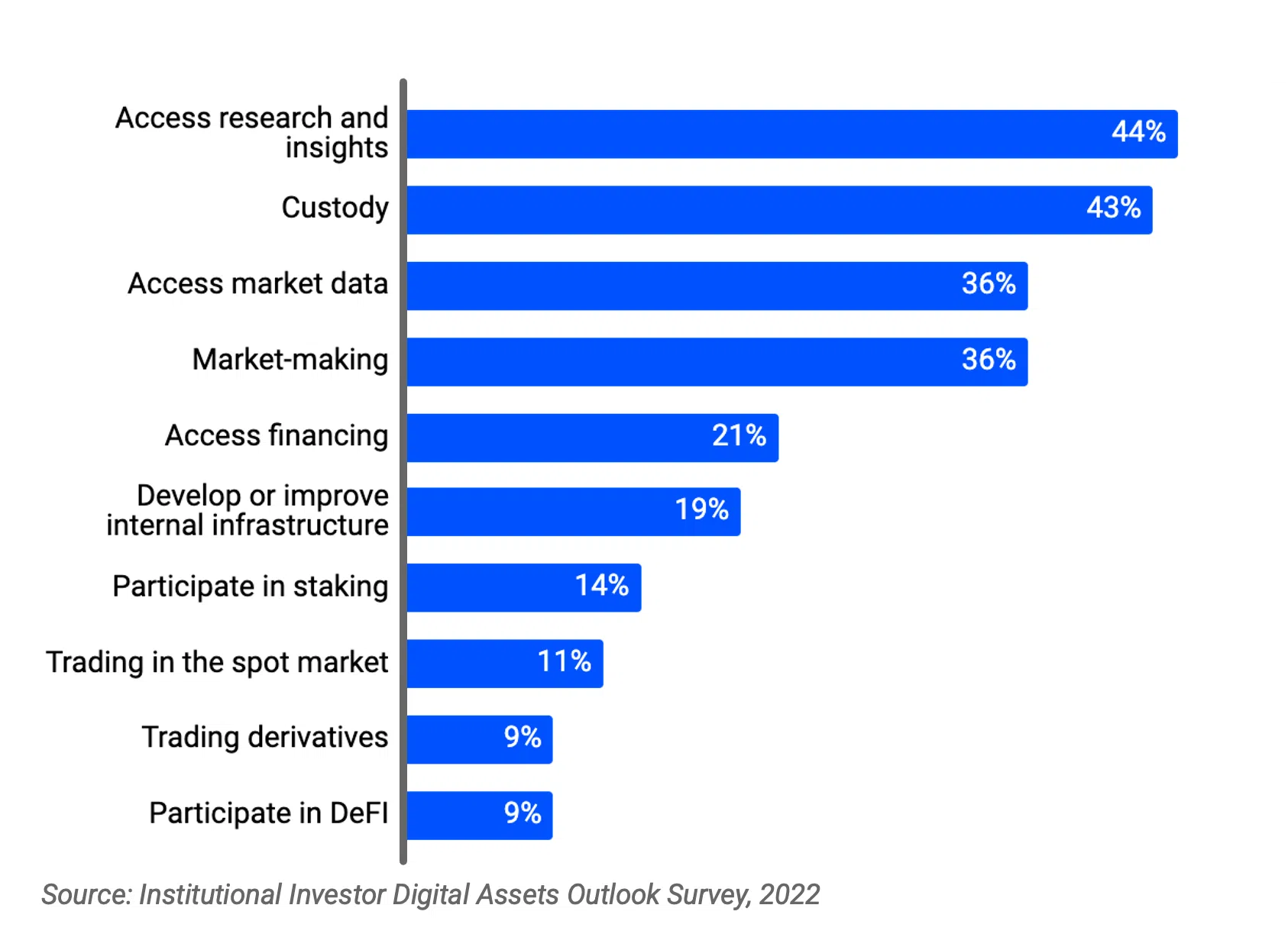

Coinbase’s 2022 Institutional Investor Digital Assets Outlook Survey also has some major notes. Crypto winter and the current market situation have a positive impact. For example, institutional investors have increased their investments. Many used this as an opportunity to learn and build for the future, to invest in innovative technologies. A total of 140 institutional investors participated in the survey, which lasted from September 21 to October 27.

62% of investors have increased their investments in cryptocurrency over the past 12 months (and 12% have decreased). Also, 58% of investors expect to increase their investments over the next three years. The majority (59%) take a “buy and hold” view.

Also, 72% of investors believe in the future of crypto assets. 29% expect prices to decline over the next 12 months. But 71% of investors believe in a bright future in the long term.

Nearly half (47%) of investors view Terra Luna’s collapse and 3AC’s bankruptcy as a call for policymakers to start regulating the crypto market. More than one-third (36%) see such events as an important reminder to firms to adopt better risk management strategies.

How can I make money on this?

Both studies suggest that despite a string of high-profile failures and losses since early 2022, investors and traders still believe in cryptocurrencies and that they have a great future ahead of them. If not now, then later.