We all believe in cryptocurrency and are waiting for the end of the recession. This year, by all appearances, we should not expect that. The market will bottom out in early 2023, according to experts at Huobi Research. The team and the analysts made several important conclusions in their forecast for next year. And whether they come true will be seen very soon.

What the year 2022 was like: the summary

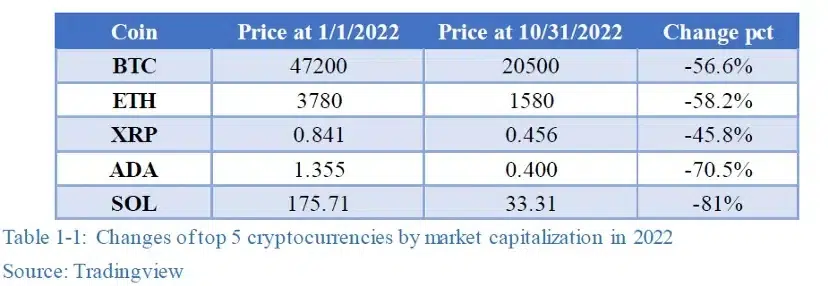

- The total market capitalization of crypto-assets fell by more than $2.2 trillion.

- The size of institutional business in centralized finance (CeFi) has shrunk by about 71.4%.

- There was the collapse of Terra, the bankruptcy of 3AC and FTX, and BlockFi and Genesis are under threat.

- Total investment and funding in the primary market exceeded $27.7 billion

- Ethereum has ushered in a new era of Proof-of-Stake (PoS).

- Layer2 projects showed unprecedented growth.

- X2E introduced the new GameFi business model.

- In 2022, there were about 320 million crypto users worldwide, of which more than 40% were Asians.

- New user additions dropped to 25 million from 194 million in 2021.

- The U.S., South Korea, and Russia accounted for the largest number of visits to CEX exchanges.

- The U.S. has the largest share in DeFi, with nearly six times as much traffic to DeFi as the second largest, Brazil.

- South America, South Africa, and the Middle East have the most interest in the crypto industry.

- In South America and Africa, 1/3 of citizens use Stablecoins daily.

- Multi-chain networks and high-performance L1 chains have evolved significantly due to the modularity of new L1 chains.

- The storage segment has seen diversified growth, with storage capacity and utilization rates gradually increasing.

- Domain names as application layer infrastructure Dapps and DIDs are booming.

- Ethereum’s stacking rate is only 12.56%; a new era of stacking as a service is about to begin.

- At the application level, TVL DeFi on chains is down more than 70% from its historical high; leverage is disappearing and ROI is declining.

- In the NFT market, market capitalization is down 42%, and the number of active users is down 88.9%.

- More than 42 sovereign countries and regions around the world adopted 105 regulatory measures and guidelines for the crypto industry; the positive ones accounted for 36% of all policies, a significant increase from last year.

10 key events in the crypto industry in 2022

- The collapse of Terra can be called the most infamous incident in history. It led to massive losses in the market: the price of UST dropped to $0.2 in a few days, and the price of LUNA dropped to almost zero. Terra’s market capitalization evaporated by $40 billion, and many investors suffered serious damage. On top of that, the 80,000 bitcoins sold by LFG further worsened the market as the price of BTC began to fall, and that led the market into a deeper bear market.

- 3AC Bankruptcy. Cryptocurrency hedge fund Three Arrows Capital (3AC) borrowed large sums of money from various companies and invested in various digital asset projects. As of March 2022, its assets under management reached $10 billion, and its portfolio included tokens such as Avalanche, Solana, Polkadot and Terra. After Terra’s collapse, news spread that Three Arrows Capital was facing liquidity problems and that the company was suspected of misappropriating client funds. Digital asset broker Voyager Digital said it loaned Three Arrows Capital 15,250 bitcoins and $350 million in stable USDC currency. The loans then totaled more than $675 million. Voyager Digital urged Three Arrows Capital to repay the loans. Three Arrows Capital did not repay the loans on time, and Voyager then demanded compensation from Three Arrows Capital in court. After the incident became public, other Three Arrows Capital lenders, including Genesis Global Trading, BlockFi, BitMex, FTX, and Blockchain, began demanding repayment of their loans. Three Arrows Capital was forced to liquidate and even sell 80,000 stETH (over $84 million) in the stETH/ETH pool on Curve, leading to the de-recoupment of stETH (stETH was once worth 0.94 ETH).

- The FTX collapse. In November, the company declared bankruptcy due to massive withdrawals by users, draining its liquidity to insolvency. This has to be the event of the year since it entered the current bear market, and its impact is beyond imagination and time.

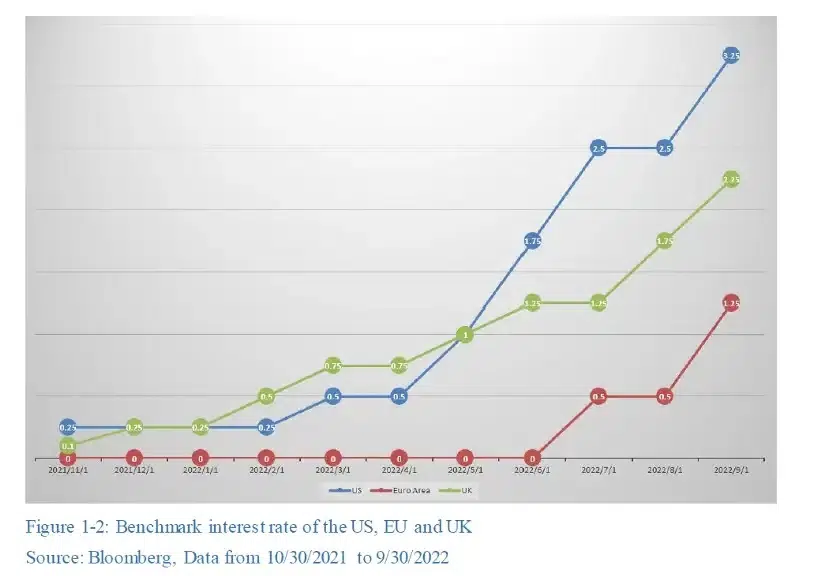

- Radical interest rate hikes. The U.S. inflation rate has reached its highest level since 1980, while the benchmark interest rate has also reached its highest level since 2008 in eight months, and is expected to be raised until the second quarter of 2023.

- The merge of Ethereum. In September, the long-awaited Ethereum merger took place, with the core network officially switching from the Proof of Work (PoW) consensus mechanism to Proof of Stake (PoS).

- Sanctions on Tornado Cash. In August, the U.S. Treasury Department’s Office of Foreign Assets Control (OFAC) added Tornado Cash and related cryptocurrency wallet addresses to its Specially Designated Nationals (SDN) list, prohibiting U.S. users from interacting with the protocol or any Ethereum addresses associated with it. Failure to do so could result in penalties.

- The biggest event in Layer2 this year was the release of OP on the core Optimistic Rollup protocol, Optimis. Optimism was the first to issue tokens from four well-known projects in Rollup.

- StepN skyrocketed and dropped. Once with 1 million active users and 4.72 million registered users with up to $122.5 million in revenue per quarter, STEPN was one of GameFi and Move-to-Earn’s most remarkable projects. At its peak in May, STEPN had 700,000 active users, representing nearly 20% of Solana’s unique daily paid users; since then, STEPN has seen a linear decline in active users and a steady decline in new users.

- Huobi acquisition. In October, the largest cryptocurrency exchange on the Chinese-language market was acquired by About Capital for $3 billion. This is the largest merger and acquisition deal in the cryptocurrency industry this year.

- Crypto market regulation. The regulatory framework for cryptocurrencies launched by the U.S. and EU will have a huge impact on the global cryptocurrency market. The U.S. and the EU will take the lead in creating a unified cryptocurrency regulatory system that will not only improve regulation and enforcement in their own jurisdictions, but also provide a benchmark model for other countries.

What awaits the crypto market in 2023?

The market will most likely bottom out in early 2023. Social moguls in Web2, such as Twitter, will continue to chase Web3, introducing the new SocialFi paradigm. The launch of the accelerated ZK networkThere are two main types of rollups, Optimistic and Zero-Knowledge (ZK) will begin. Regulation within the network will be strengthened, and some protocols may be compromised. Now, let’s get to the details.

- Market fluctuations continue, but the bottom has already been reached and the tipping point is likely to come in the first quarter of 2023.

- The value of SocialFi

SocialFi brings together the principles of social media and decentralized finance (DeFi). SocialFi platforms offer a Web3 (decentralized) will increase.

- Rollup

Rollups are one of several scaling systems that simply make a slow blockchain faster and cheaper. Other scaling systems include sidechains and state channels. has made significant progress with low transaction costs and steadily increasing TPS, laying the technical groundwork for future application deployments.

- From an app perspective, the multichain network landscape is contributing to the Dapps (decentralized applications) chain boom, the user experience will be greatly improved.

- More regulations will be imposed on cryptocurrency.

- More developing countries will accept cryptocurrency as a means of payment.

Huobi Research sees the bear market as a place full of both risks and opportunities. Investors should examine everything carefully to evaluate projects and be prepared for possible hacks and Ponzi schemes.

How can I make money on this?

Here are a few tips for surviving in a bear market. Consider parameters indicating the bottom. Parameters that indicate the bottom can be considered in determining “cheap price”; the capability of capturing the signs of the market touching the bottom ensures the best optimal time for buying underestimated targets.

Here are a few indicators that are informative for determining the bottom.

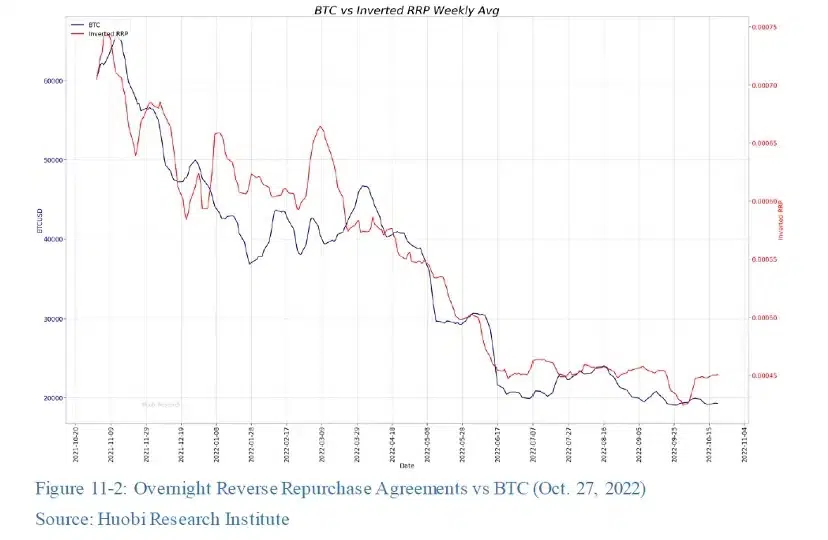

The Fed’s overnight reverse repo as a basic condition to effectively determine whether funds will flow into the cryptocurrency market.

The overnight Reverse Repurchase Agreement (ON RRP) of the Federal Reserve is a tool to absorb excess market liquidity. An increase in ON RPP means the Fed is absorbing more money, and vice versa. When determining the bottom of the market, we would like to see a continued reduction in the number of ON RPP, as it implies market liquidity is being released, equivalent to quantitative easing. Because it takes some time for money to flow, ON RPP is a leading indicator of market liquidity for one to two weeks ahead.

The brand new newsletter with insights, market analysis and daily opportunities.

Let’s grow together!

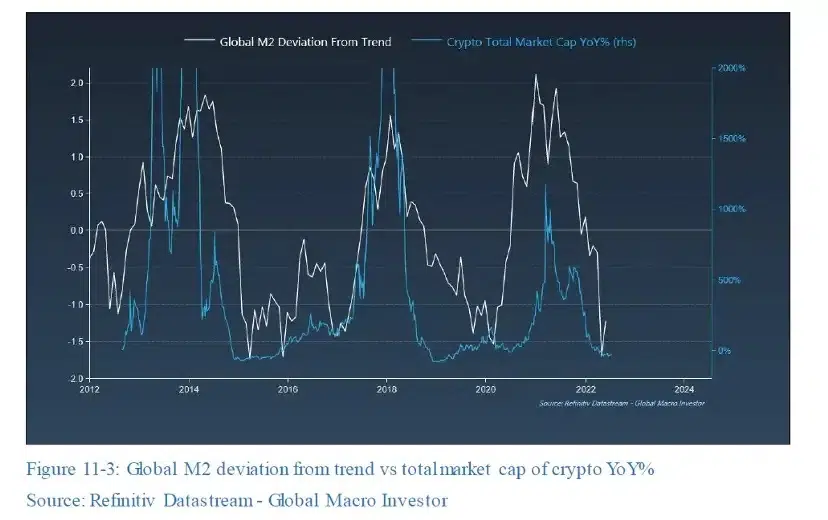

The price of Bitcoin and the total market capitalization of cryptocurrencies is proportional to M2. Bitcoin supply is limited; as major central banks issue more bills, more liquidity is freed up in the market, leading to the subsequent devaluation of currencies. The following graph shows the relationship between cryptocurrencies and M2, which explains the influx of funds into the cryptocurrency market.

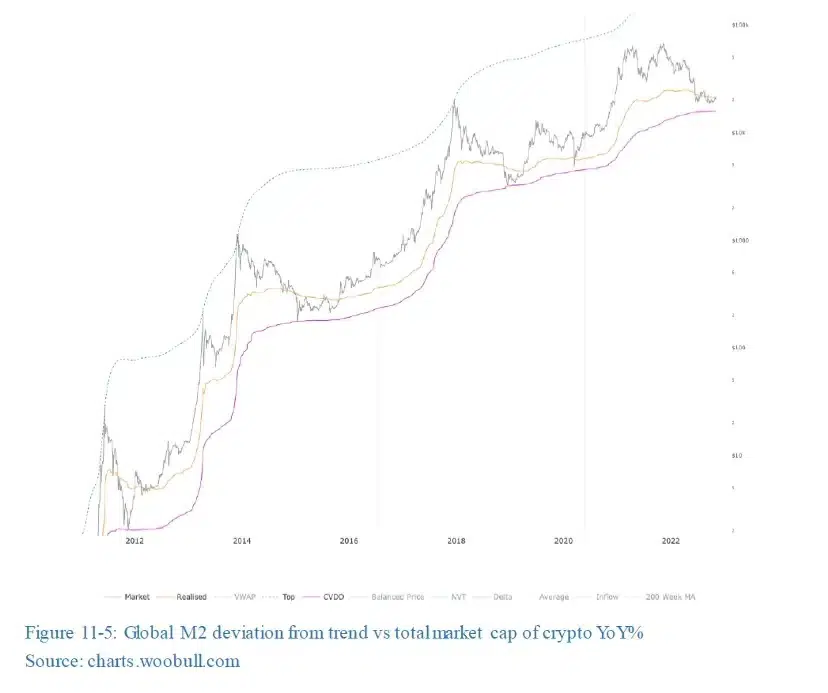

Cumulative value and days destroyed (CVDD). Cumulative value, provided by Coinmetrics, is an approximation of what the entire market is paying for Bitcoins. In this chart, the price cap is calculated by dividing by the total Bitcoin supply. CVDD, developed by Willy Woo, historically indicated the bottom of the market. When Bitcoin changes hands, the transaction carries dollar value but destroys the holding period of the previous holder. CVDD is the ratio of the cumulative sum of such value in days destroyed to the age of the market, calibrated by dividing by 6 million. This model accurately captured the bottom of the market in 2012, 2015, and 2019.