Contents

The U.S. Bankruptcy Court allowed the American arm of Binance to buy cryptocurrency lender Voyager Digital, which went bankrupt last year. The largest crypto exchange is ready to purchase Voyager’s customer base and assets for $1,022 billion, according to Reuters.

At $1.002 billion, the crypto lender’s asset portfolio is valued at $1.002 billion, and another $20 million is “additional consideration.”

According to the officially announced terms of the deal, Binance.US has already made a deposit of $10 million and will refund Voyager for “certain expenses” of up to $15 million.

If the deal is completed, the bankrupt company’s 3.5 million customers have a chance to get back at least most of their savings. Total creditor claims as of August 2022 were $1.8 billion.

The brand new newsletter with insights, market analysis and daily opportunities.

Let’s grow together!

Voyager estimates that the deal with Binance.US will allow customers to recover 51% of their deposits at the time of Voyager’s bankruptcy filing. The deal involves transferring Voyager customers to Binance.US. They can withdraw for the first time in July.

Voyager token (VGX) wants to go to the Moon

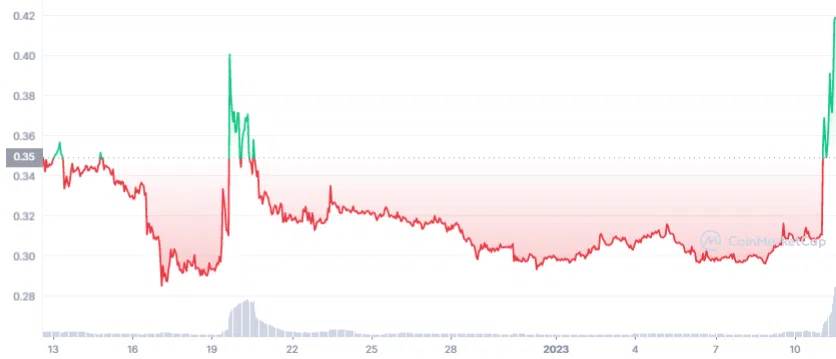

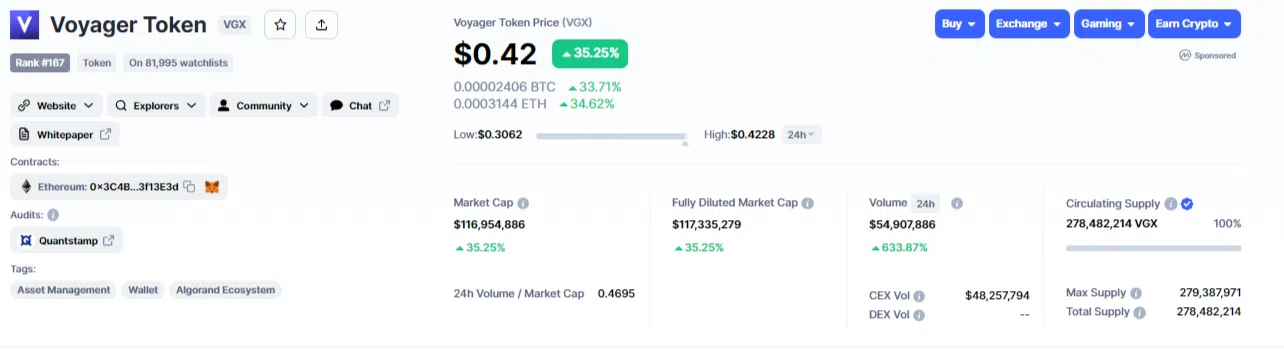

The value of the Voyager token (VGX) jumped sharply up amid news of the court’s preliminary deal approval. According to CoinMarketCap, the coin’s price soared 35%, to $0.42. It can be purchased on 25 different exchanges.

Trading volume for the day rose 892.99%, to $62,698,566. The total market capitalization now reaches $116,730,572.

As of January 11, there are 278,482,214 VGXs in circulation, with a maximum of 279,387,971 tokens and a total of 278,482,214.

Binance Coin (BNB) is now among the most trending cryptocurrencies, that is, those that people search for on CoinMarketCap. BNB can be used to trade and pay commissions on the Binance cryptocurrency exchange. However, the coin’s price has risen only 1% in the current day ($277.84).

Why is Voyager’s story not over yet?

The approval of the U.S. Bankruptcy Court for the Southern District of New York is only preliminary. This does not mean the deal is finalized. It still requires Voyager’s creditors’ approval. Then the court will once again review the agreement and make a final decision. And there is no 100% guarantee of a positive outcome for the two companies.

Binance is closely monitored not only by the U.S. Securities and Exchange Commission (SEC) but also by the Committee on Foreign Investment (CFIUS). The first regulator had previously filed a petition with a judge asking them to stop the purchase of Binance.US Voyager Digital. It believes that the U.S. exchange did not provide enough information about its finances and ties to the parent company.

CFIUS, on the other hand, can “veto” the deal because the Binance.US parent company has Chinese roots. This could be considered a threat to U.S. national security.

As of July 2022, Binance was inaccessible in some U.S. states due to legal issues. Authorities in Texas, known for their skepticism of cryptocurrencies and strict regulation, are still unwilling to allow Binance. According to CoinDesk, the Texas Securities Board and the Texas Banking Authority filed an objection to the sale because they argue that Voyager and Binance.US were “not in compliance with Texas law and are not authorized to conduct business in Texas.” They also object to the “disparate treatment provided to creditors in certain states.”

What happened to Voyager?

Voyager filed for bankruptcy last July. The reason was dependence on the bankrupt Singapore-based cryptocurrency hedge fund Three Arrows Capital (3AC). Voyager ended up owing Three Arrows Capital more than $660 million and also owed $75 million to the founder of the crypto exchange FTX, Sam Bankman-Fried, who had previously given the company a cash infusion of $485 million. In total, more than 100,000 creditors were listed in the application for restructuring.

This wave of bankruptcies was triggered by the collapse of crypto project Terra and its algorithmic stablecoin UST in May.

Voyager originally agreed to sell itself to the crypto exchange FTX, which won the asset auction, offering about $1.4 billion. As part of the failed preliminary deal, former customers of Voyager Digital were expected to get back up to 72% of the value of their funds, according to a Bloomberg report. But the trading process resumed after Sam Bankman-Fried’s exchange collapsed last November. Binance.US made its most lucrative offer in December 2022.

Why does Binance want Voyager, and which companies were acquired in 2022?

The acquisition of Voyager will be another step for Binance to continue its expansion in the market.

According to an Arcane Research report, the biggest exchange has achieved an impressive dominance of 92% in the spot market and 61% in the BTC derivatives market in 2022. The collapse of FTX and Celsius has only strengthened the company’s position.

Last year, Binance also completed the acquisition of Tokocrypt, an Indonesian cryptocurrency trading company. The latter’s employees will be cut by about 58%.

Also at the end of last year, Binance entered the Japanese market by acquiring Sakura Exchange BitCoin (SEBC). SEBC is a crypto exchange that also offers advisory services in addition to brokerage services.

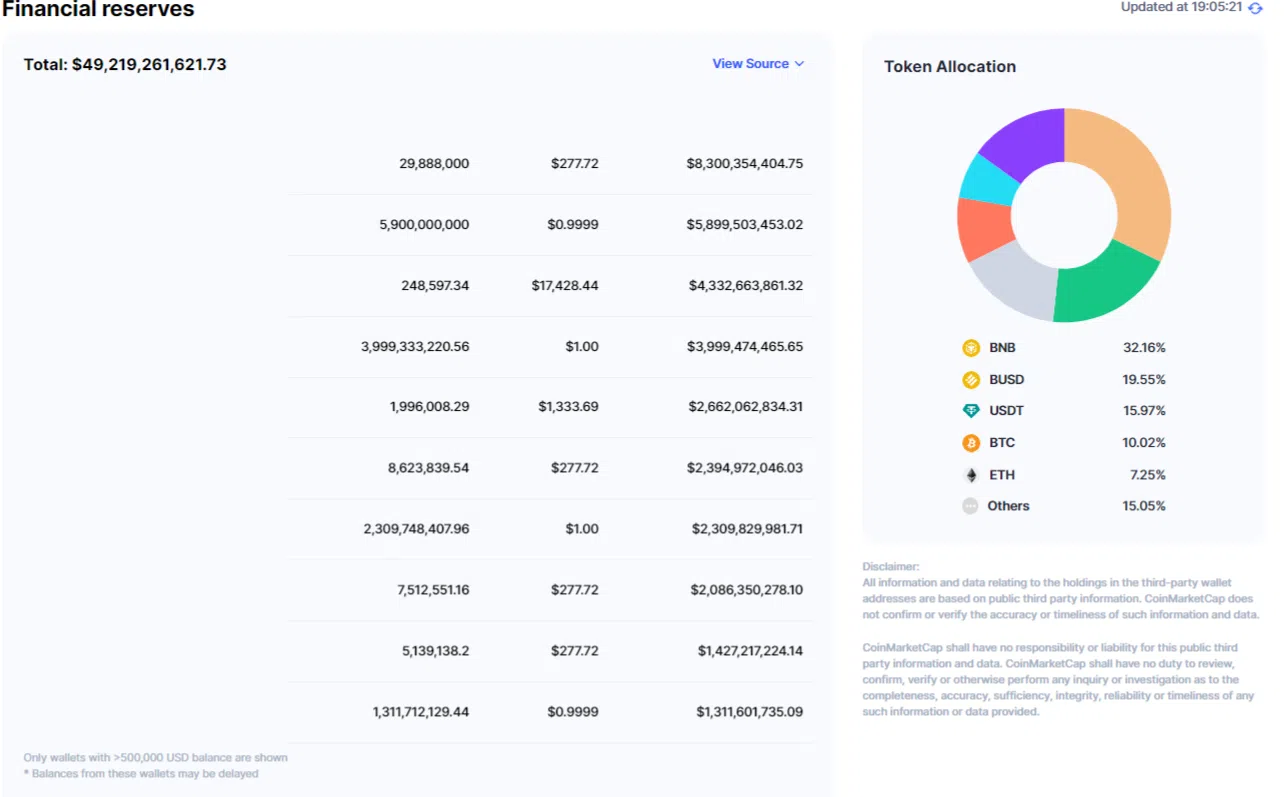

According to CoinMarketCap, Binance has $49 billion in assets as of January, 11. As of August 2022, the exchange had a daily trading volume of $76 billion and 90 million customers worldwide. The platform allows you to buy, sell and store your digital assets, as well as access more than 350 registered cryptocurrencies and thousands of trading pairs.