The Fed raised the rate by 25 basis points, from 4,5% to 4,75%. This is the smallest increase since March 2022, but now the rate is at its highest level since 2007. The crypto market reacted to the Fed’s announcement by rising. We’ll tell you below how much the Fed has affected assets and what to expect next.

It happened. Again

This is the eighth consecutive rate hike by the Fed since the beginning of 2022, so the decision was not unexpected. A bit more of a mystery was exactly how much the Fed would raise rates. CME Group, one of the world’s largest marketplaces for financial instruments such as futures contracts or options, had predicted earlier a 0,25% increase, which actually happened.

The rate hike is mainly to strengthen the economy. And one of the main goals of the Fed is to reduce inflation to 2%. On January 12, it became known that its level had already fallen from 7,1% in December 2022 to 6,5%.

If the rate does not rise, money will become cheaper, and credit and deposit rates will fall. Companies and people will take out more credit, actively spend money, and save less. This leads to a growth in demand and, consequently, an increase in inflation.

The brand new newsletter with insights, market analysis and daily opportunities.

Let’s grow together!

On the other hand, rising rates negatively affect the value of stocks as well as high-risk assets such as Bitcoin and other cryptocurrencies. Therefore, often before the Fed announcement, the entire market falls slightly, due to investors not wanting to take risks.

How did the market react to the rate hike?

Usually cryptocurrency falls when the rate goes up, but this did not happen now. The reason is that most market participants predicted the Fed’s actions, forecasting that the increase would be +0,25%. If the regulator had announced a +0,5% increase, the market would have gone sharply down.

Bitcoin even jumped to $24K after news of the Fed’s decision, but it did not stay that way for long and then dropped again. As of this writing, the first cryptocurrency is trading at $23.845, up 3,23% from the day before and 3,77% higher than a week ago.

You have not selected any currency to displayBitcoin as a whole has been performing well since the beginning of the year, rising 28,48% in January from $16.583 to $23.186. What is the reason for this rally and how long it will last, we reported here.

Ethereum rose slightly more. The coin gained 5,87% in 24 hours — from $1,572 to $1,670. In contrast to Bitcoin, which was in the plus even before the news about the rate, the value of Ethereum was most of the time in decline. This is mainly due to the general state of the market, which took a long time to recover after the collapse of FTX.

However, that all changed in early 2023 with rising inflation and falling unemployment. The asset gained 24,59% in January, going from $1,202 to $1,594. Ethereum’s recent fluctuations, however, are due to its transition to the proof-of-stake mechanism. Read about it here.

You have not selected any currency to displayThe following cryptocurrencies have grown in value most of all during the day:

- Loopring — from $0.3317 to $0.424 (+21,77%).

- Optimism — from $2.2693 to $2.82 (+19,53%).

- Convex — from $5.8352 to $7.01 (+16,76%).

- ImmutableX — from $0.7236 to $0.8439 (+14,26%).

- Synthetix — from $2.4256 to $2.64 (+8,12%).

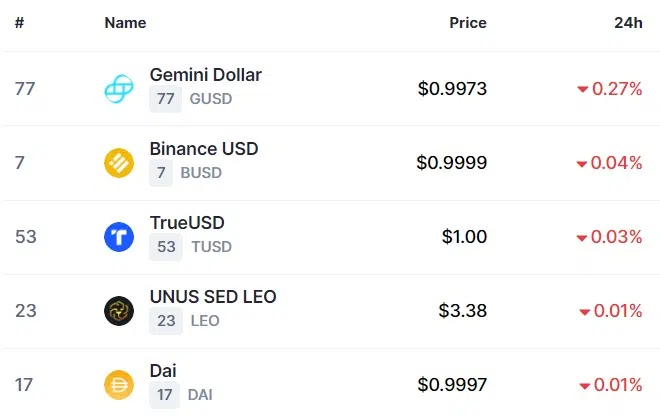

According to CoinMarketCap, only five digital assets of the top 100 cryptocurrencies by market capitalization have gone down:

What may follow next?

The answer to this question is partly contained in a statement by Fed head Jerome Powell. Here are his main points:

- The Fed will aim to bring inflation down to 2%, so, probably, the rate hike will continue.

- The Fed will take into account financial conditions and other factors in shaping its policy. Therefore, there is a chance that if the economic situation normalizes, the rate will stop increasing or even begin to decrease.

- “It used to be the norm to raise the rate every second meeting. Now, when it is clearly seen that inflation is going down, there is no point in pausing,” Jerome Powell said.

There is no point in speculating whether there will be another increase or not. The rate will be hiked again and will continue to be hiked until the economic situation is in order. However, the question remains: by how many basis points will they raise the rate?

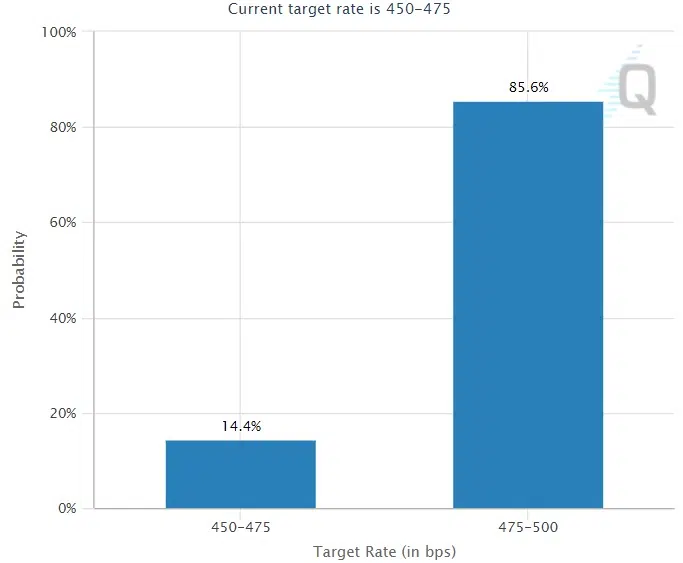

Relevant projections have already begun to appear on the CME Group’s Web site. At 85,6%, the Fed is likely to raise rates by 0.25% to 5% while 14,4% is expected to lower them by 0,25% to 4,5%. We will know what the next Fed verdict will be on March 22, 2023.

What are your predictions? Write about it in the comments.