Against the background of recent events related to the collapse of FTX and the following fall of the entire market, Solana was no exception and is also rapidly going to the bottom. The coin shows one of the worst performances in terms of market capitalization and has already lost its 15th place at the top. Investors are scared, but there is a chance that things will change soon. More about that is below.

What’s going on with Solana right now?

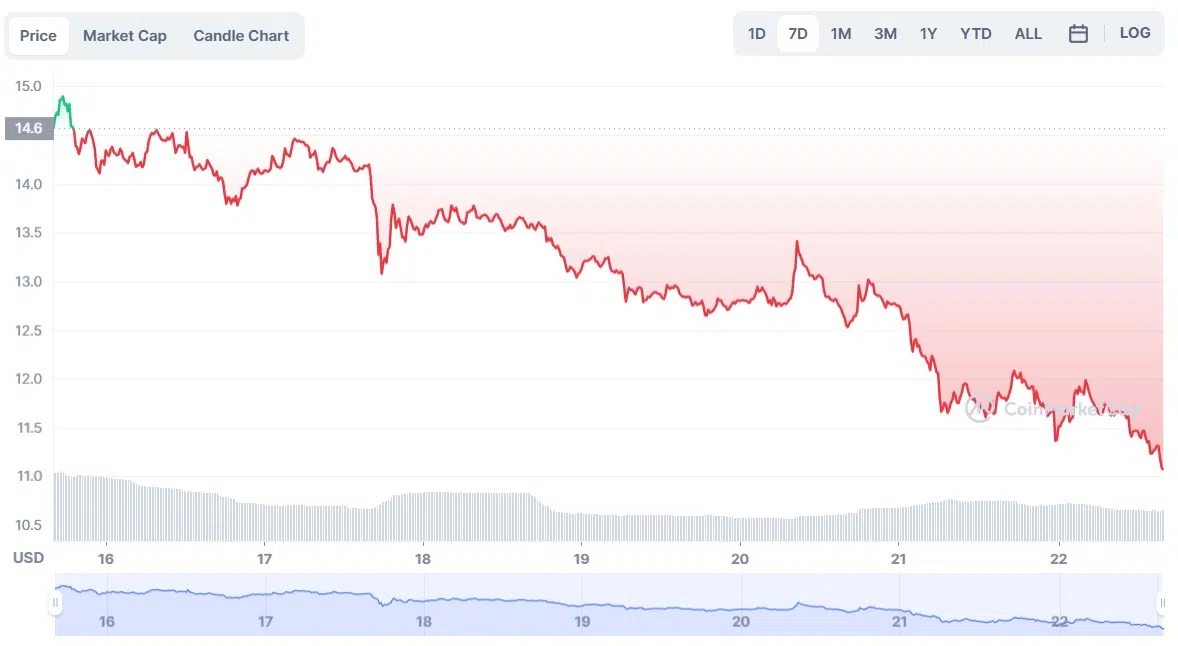

Solana has been struggling to stay around $10 since the market crisis began. It’s not easy, the coin has shown more than 15% negative weekly losses and has been trading at $11.78. At the time of writing, SOL is trading at $11.26 per coin, showing a 4.37% drop in price over the last 24 hours or 22.8% over the last week. The market capitalization is $4.08B.

Many people believe that the bottom has not been reached yet and the coin will make the investors sweat. SOL traders and holders are not willing to buy the altcoin because they are not sure about the growth in the near future. And now, after SOL closed below the weekly high of $20, if even more likely the coin will fall even lower.

Probable SOL scenario

However, it’s not all bad. Ambcrypto analysts noticed on the daily chart that the coin could rise in price in the near future.

The brand new newsletter with insights, market analysis and daily opportunities.

Let’s grow together!

“For example, the Money Flow Index a technical indicator that is used to determine the current trend was near the oversold zone, indicating a bullish signal. The Chaikin Money Flow

an indicator that reflects changes in buying and selling pressure, based on volume and price changes also declined significantly, which could indicate a possible market bottom,” the analysts explained.

Another important bullish signal was found by CryptoQuant specialists. According to them, the Relative Strength Index determines the strength of the trend and the probability of its change is in the oversold position. This suggests that the value of Solana may rise in the near future. The only thing that might prevent this is the exponential moving average strip

an indicator based on averaged historical data; the longer the period of coverage when calculating, the more global the indicator reflects, which has shown a huge bearish advantage.

The fact that coin development activity has increased in the last week may also push the token up. This suggests that developers are doing everything to improve the blockchain. Moreover, just recently the volume of SOL has increased, which is also very encouraging.

Solana’s connection to FTX

After the collapse of the FTX crypto exchange, Solana has been hit hard. The coin is already down 96% and, as we said above, will be down some more. It would seem that the connection between SOL and a(the native FTX coin, which also went down after the platform collapse) is not obvious, but they do have one episode together. It happened in January 2021, when blockchain was just emerging and FTX creator Sam Bankman-Fried wasn’t yet that famous. At the time, SBF publicly stood up for the trader, who criticized Solana and said that the coin had no prospects. Sam Bankman-Fried responded that he was ready to urgently buy back all of SOL from him at $3 apiece if he didn’t like the token.

Now that FTX went bankrupt, the situation has changed, and the trader wrote a response tweet, and also offered to SBF to buy from him all his savings at the same $3.

Karma is a bitch, isn’t it? https://t.co/mIUCrVW6aM

— CoinMamba (@coinmamba) November 8, 2022

Incidentally, after the controversy in January, the value of SOL rose 87 times, peaking at $260, and Sam Bankman-Fried became one of the most experienced investors in the crypto world.

How can I make money on this?

So far, Solana is trading below the $20 resistance level after several bounces from the $15 area. Something else that could affect the value of SOL is the potential bankruptcy of Genesis. Then, according to experts, the price could lose areas of $5–6.

If the SOL drops below $10, it will start a sell-off, which is very profitable for the bears.