Contents

- 1 The Ace of Alts – a crypto trader and enthusiast since 2017, with a free Discord for traders (1,4K Twitter followers)

- 2 The Parman – Bitcoin security mentor and author (15K Twitter followers)

- 3 Eric Yakes – author of The 7th Property: Bitcoin and the Monetary Revolution, Bitcoin expert (10K Twitter followers)

- 4 jyn urso – Margot Paez. She is a fellow at the Bitcoin Policy Institute and is currently on leave from her PhD to focus on researching Bitcoin’s energy and environmental impact. She also enjoys thinking about how Bitcoin can help us fight the structural challenges of climate change (10K Twitter followers)

A bull run in the cryptocurrency market is a period during which cryptocurrency prices are constantly rising. However, since the beginning of the year, we have seen periods when the price of bitcoin and altcoins jumps up and down. For many coins, there are signals that they have bottomed. But at the end of the day, that is not always the case. So what’s going on in the crypto market?

And what will happen if Hong Kong allows private investors to invest in crypto?

The Ace of Alts – a crypto trader and enthusiast since 2017, with a free Discord for traders (1,4K Twitter followers)

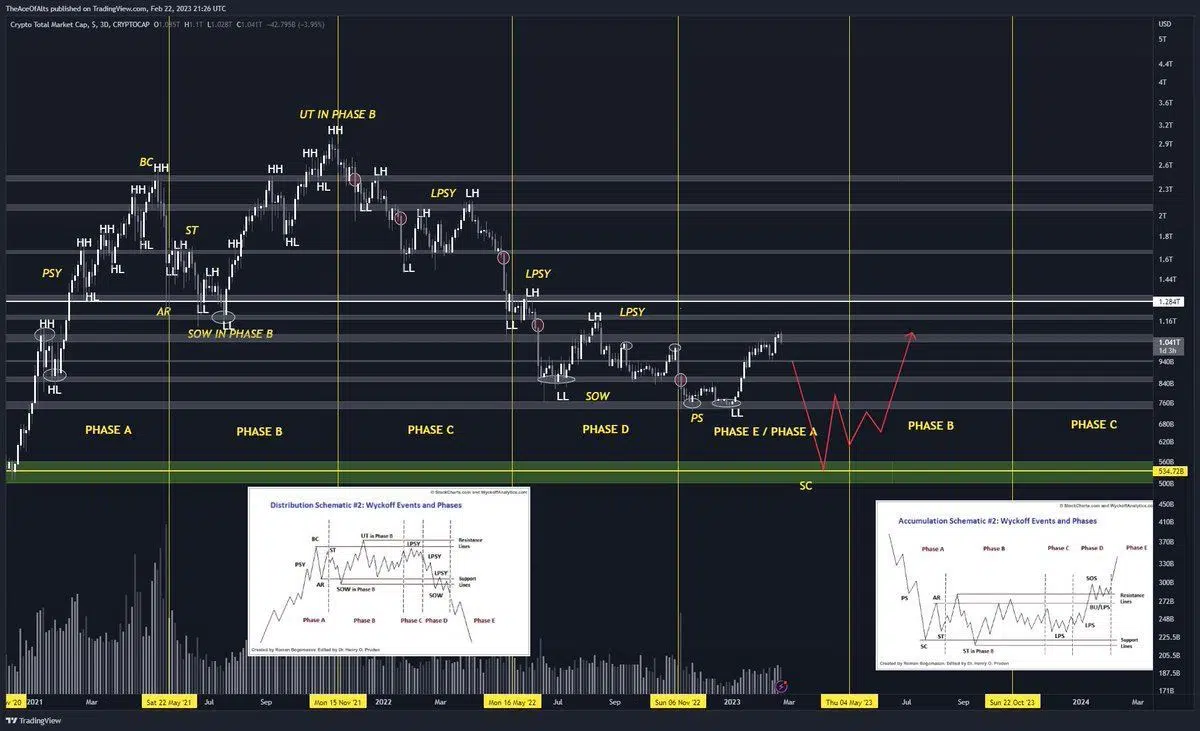

I have quite the contrary opinion to most in regard to where I think we are within the market cycle. It is my view that we are currently in a large bull trap that will soon complete, and we will dump – sometime in March, April, or May. To support this view, I have a couple of different theses. The first one being that the total crypto market cap has been in Wyckoff distribution since the start of 2021 (attached chart below). I believe the market is in the final stages of this distribution “phase E”. This is where I think the final markdown will take place to a market bottom of the total crypto market cap of $500 billion. From here, the total will follow an accumulation schematic till late 2024, when the bull run will begin again.

I think Bitcoin will go through a number of accumulations and distributions over the next year on the daily chart. I believe it is currently at the top of an accumulation range (see the chart attached). It is my view – we will take out the lows and have a “spring” before a big rally in June, July time.

The brand new newsletter with insights, market analysis and daily opportunities.

Let’s grow together!

Also supporting this is the strength of the dollar. I think the dollar continues to grind up to the 110s, where it will make a lower high. This will mark the bottom of the market. I guess sometime in April.

I think Hong Kong allowing private investors to invest in crypto will be very positive long term. The Asian market has always been massive for crypto and opens the door to a large influx of capital. With the US tightening crypto regulation, the Asian market might just be the driving force crypto needs to force it to new highs next bull run.

Bitcoin has always been in a bull run. Zoom out if you don’t see it. What’s important, is not necessarily the price of the bitcoin, but the number of people that come to the realization that it inevitably will become money and therefore, act rationally, and save it in bitcoin, rather than “trade” Bitcoin to earn today’s low-quality money. Those people only ever increase in number and eventually will own all the available bitcoin. Others who are buying to sell for profit will end up with dying money (fiat), as their plan is to sell. They are not “adopters”. The people adopting Bitcoin will be spending it when it’s accepted universally as money. When that day comes, it will not have a fiat price, it will just be the world’s money. So, gamble and trade if you must, but do accumulate to hold for the long term. You must also hold it in your own private wallet. If you don’t, and just leave it on the exchange, it’s similar to buying gold online, and never having it delivered. When third parties hold everyone’s bitcoin, they only have to show you a number on a screen and not actually have full reserves – in this way, they can sell nothing and get rich, as FTX did.

If people in Hong Kong invest in crypto, sadly, they are likely to get burned, unless some of them stumble upon Bitcoin and understand why it’s important. Only Bitcoin can ever become money that replaces fiat. Every other crypto is a token produced from nothing (i.e. at no cost) by a group of techy individuals and sold to the gambling public. In this way, they enrich themselves by “printing” money. Better to be the printer than the sucker who buys printed money. Bitcoin is different because it was only ever mined, right from the beginning, open to anyone.

In the long run, it will be a bull run. Once Bitcoin decouples based on fundamental monetary adoption, it’s all over. I think the cause of the next bull run will either be macro-driven or, hopefully, based on the fundamental monetary adoption of Bitcoin. If we see Bitcoin and lightning network adoption take off in developing economies, things will get wild.

jyn urso – Margot Paez. She is a fellow at the Bitcoin Policy Institute and is currently on leave from her PhD to focus on researching Bitcoin’s energy and environmental impact. She also enjoys thinking about how Bitcoin can help us fight the structural challenges of climate change (10K Twitter followers)

I think the bad players got washed out, so probably the slow accumulation phase of an upcoming bull run is my guess.

Well, any big money investment in bitcoin can play a role in pumping the price, but I really don’t know how much money there is in Hong Kong compared to other places to say what kind of impact that would have. I suspect the next halving in 2024 will have the biggest effect.

You have not selected any currency to display