Contents

- 1 Q. Who are the founders, and what is the history of CrowdSwap?

- 2 Q. How is CrowdSwap different from other DEXs?

- 3 Q. What kind of problems have you faced during the development?

- 4 Q. CrowdSwap has a special feature, a portfolio manager, which helps to optimize crypto investments on your platform. How does it work?

- 5 Q. What mechanism does CrowdSwap use to provide users with the best prices?

- 6 Q. In terms of CrowdSwap as an infrastructure provider, what do you offer?

- 7 Q. What are fast-lane transactions?

- 8 Q. A thing you rarely see in DeFi projects is customer support. Do you have it?

- 9 Q. DeFi projects often run into security problems. How do you deal with this issue?

- 10 Q. Do you have any loyalty, ambassador, or VIP programs?

- 11 Q. Is there staking or yield farming on your platform? What rewards can a user get?

- 12 Q. Tell us more about your native token, CROWD.

- 13 Q. You have your own launchpad called Crowd Sales. What are its advantages?

- 14 Q. Ripple’s CTO recently accused the well-known DEX Uniswap of having fake decentralization. In his view, if one person or group has a legally enshrined right to tell others, then it is not decentralization. Similar accusations are often made against other DEXs as well. What would you say in defense if your exchange was accused of the same?

In the world of decentralized finance (DeFi), there are many services, including exchanges. Most of them are not user-friendly, especially for those unfamiliar with Web3 and crypto. In addition, such platforms often fall victim to hackers due to poor security.

Strong competition in the crypto market has led to more customer-centric, feature-rich, and user-friendly platforms like CrowdSwap.

CrowdSwap is a German-based decentralized crypto exchange (DEX) that offers advanced features for seamless crypto trading and investing with the best prices and fees. Also, it has its own launchpad and other perks. Among the investors and partners of the project are DappRadar, BeInCrypto, Chainlink, CoinMarketCap, Polygon, CoinGecko, and others.

We spoke with Christian Mülder, co-founder and CEO of CrowdSwap. He told us about the most interesting features of the platform, such as the rewards and VIP programs, yielding and staking, the best price search algorithms, the simple cross-chain swap, its native utility token, CROWD, and much more. We share with you the most interesting ones.

The brand new newsletter with insights, market analysis and daily opportunities.

Let’s grow together!

Q. Who are the founders, and what is the history of CrowdSwap?

A. With a rich background spanning two decades in software development, I began my journey as a software architect, honing my expertise in crafting robust and efficient systems. In 2008, I took a significant leap by founding my own company, operating in the Web2 space and specializing in software solutions for the utility sector. However, in 2016, I decided to sell the company, transitioning into an investor role. Nevertheless, it became evident that my true passion lies in collaborative teamwork, creative pursuits, and initiating impactful IT projects.

However, by 2019, I had begun contemplating the potential for enhancing the DeFi space during that period. Subsequently, in 2020, I reached out to Vahid Hassani, a former colleague, my current co-founder, and the CTO of CrowdSwap. Together, we embarked on a journey to establish CrowdSwap, driven by our desire to create a platform where users could conveniently consolidate their transactions from Ethereum mainnet swaps and efficiently manage associated fees. Our approach was akin to implementing Layer 2 (L2) solutions on the mainnet, fueling the inception of our current endeavor.

Delving deep into the challenges prevalent on the Ethereum mainnet, we dedicated ourselves to finding innovative solutions. Throughout 2020, we meticulously crafted prototypes, striving to refine and enhance the existing framework. As the year drew to a close, we assembled a core team of two individuals, laying the foundation for the CrowdSwap project. With a current workforce of 25 dedicated professionals and additional part-time contributors, our team has grown substantially. The majority of our members are focused on developing quality assurance, diligently ensuring the reliability and efficiency of our solutions while expertly organizing development tasks. Simultaneously, our sales and marketing teams are experiencing rapid expansion.

Q. How is CrowdSwap different from other DEXs?

A. When building an exchange, the key lies in establishing competitive advantages that revolve around pricing differentials, speed optimization, and delivering superior user experiences. These fundamental principles have guided our endeavors over the past 15 years and continue to serve as the cornerstone for our ongoing improvements. By prioritizing affordability, efficiency, and enhanced user interactions, we are committed to offering an exchange that surpasses industry standards.

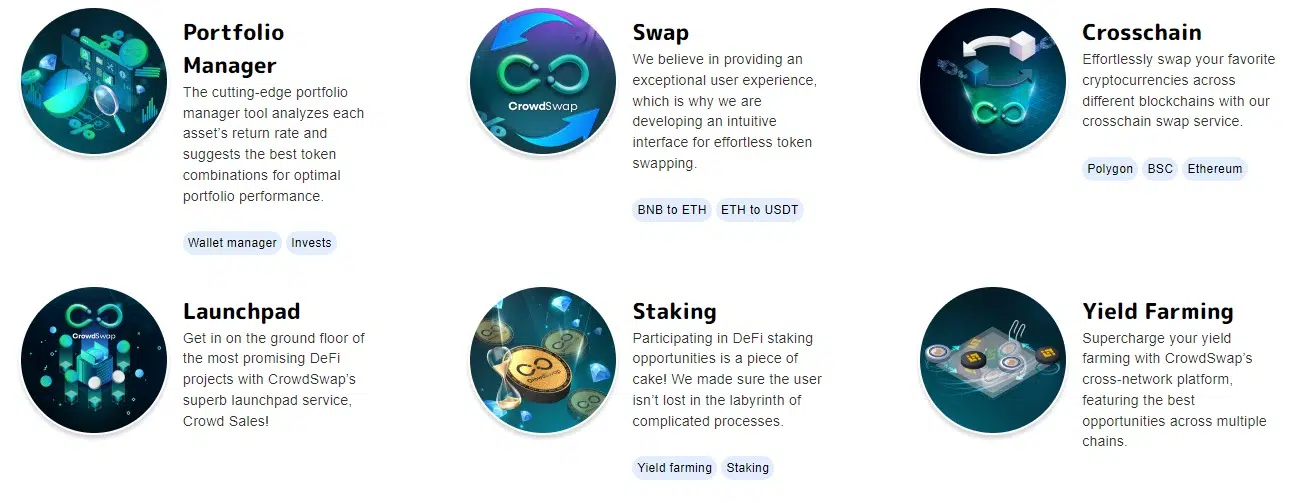

Our goal is to make it as easy as possible for users to manage their portfolios. When we launched zkSync, which enables account abstraction, we aimed to onboard the next billion users. We continue to strive towards simplifying the use of DeFi products with features like the portfolio manager, a new pool concept with sustainable incentives, and a cross-chain swap widget for seamless integration with external websites.

Q. What kind of problems have you faced during the development?

A. The journey we embarked on in 2020 was not without its fair share of challenges, stemming from the stark contrast between the DeFi landscape then and what it has evolved into today. Back then, the scarcity of projects offering support and traction was apparent. Zeely, Web3 competitions for user engagement, and social platforms were non-existent. Furthermore, the absence of Launchpad-like platforms hindered the seamless integration of tokens into the community.

We have successfully established our own Launchpad, accompanied by an array of exceptional services tailored to the needs of projects. Our focus extends beyond the realm of business-to-customer (B2C) interactions; we are dedicated to equipping projects with the necessary tools to kickstart their ventures effortlessly. From a technical perspective, our team initially lacked substantial expertise in Web3 development. At the onset, finding skilled Web3 or smart contract developers was a challenge. To overcome this, we devised a comprehensive plan to cultivate seasoned developers from our existing pool of object-oriented specialists. Through meticulous training and hands-on experience, we transformed them into proficient blockchain developers. This strategic solution has led to the formation of a formidable team of blockchain developers, each boasting a minimum of two years of experience in this domain.

Navigating the regulatory landscape also presented a significant hurdle. The choice of the country in which to launch a crypto project can significantly impact its prospects. Unfortunately, Germany, my home base, did not provide favorable regulatory conditions for initiating our venture. This underscored the need for a comprehensive understanding of legislative intricacies when establishing a startup or small company within the crypto space.

Choosing the right jurisdiction for funding purposes is of paramount importance, as selecting an unfavorable country can lead to substantial tax implications. In such cases, a significant portion of the funds raised may be depleted due to tax obligations, placing you at a disadvantage compared to projects operating in more favorable jurisdictions. Consequently, it became evident that in order to effectively compete, we needed to establish a presence in countries where projects like PancakeSwap and others had successfully founded their companies, often outside the confines of the EU. This strategic decision allowed us to mitigate potential tax burdens and operate on a level playing field.

Q. CrowdSwap has a special feature, a portfolio manager, which helps to optimize crypto investments on your platform. How does it work?

A. Throughout the evolution of DeFi, numerous narratives have emerged, each capturing the attention of the industry at various stages. Even in 2021, the hype surrounding decentralized exchanges (DEXs) persisted, driving the pursuit of technical advancements. Enhancements such as constructing pools that eliminate impermanent loss remain a pertinent objective. However, the overarching goal should be to facilitate broader access to DeFi, extending beyond simple asset swaps. DeFi offers a vast array of opportunities for asset utilization, including yield farming, lending and borrowing platforms, staking, and potentially leveraged trading. Yet reaching these possibilities often presents formidable barriers. On our platform, we strive to simplify the DeFi experience, aiming to make it as user-friendly as a conventional banking terminal. Just as anyone can effortlessly navigate a bank terminal, our portfolio manager seeks to provide similar ease of use. By integrating user-friendly functionalities, users can seamlessly access their assets, conduct transactions, and gain insights from on-chain data. Additionally, our portfolio manager will offer trending information to help users navigate the dynamic crypto space effectively. The focus lies not only on technical advancements but also on democratizing DeFi by empowering individuals with user-friendly tools and insightful resources. By expanding access and enhancing usability, we aspire to unlock the full potential of DeFi for a broader audience.

Q. What mechanism does CrowdSwap use to provide users with the best prices?

A. Consider a scenario where you have established a history of utilizing SushiSwap on Ethereum and benefiting from its competitive pricing. When Binance Smart Chain introduced its decentralized platform, SushiSwap seized the opportunity to expand onto BSC, providing liquidity within this new environment. As a loyal SushiSwap user, if you wished to purchase a token on Binance Smart Chain, you might have naturally turned to SushiSwap for the asset swap. However, this decision would have resulted in a significant loss, typically ranging between 50 and 80 percent of your funds. The reason behind such losses lies in the limited liquidity of BSC pools, which are unable to compete with the leading decentralized exchange, PancakeSwap, on that chain.

On our platform, our best price routing mechanism ensures not only the analysis of liquidity pools within a single chain but also an initial focus on one chain to obtain the best prices. We prioritize considering liquidity pools with amounts exceeding $20,000, disregarding smaller ones. When confronted with a situation where a single pool remains the only option on a particular chain, we provide clear signals of significant negative price impact, advising against executing swaps within such pools.

Our platform employs an aggregator mechanism that entails analyzing all liquidity pools and constructing a model or graph of their interconnections. For instance, if you wish to convert USDC to ETH, our system navigates this graph to determine the shortest, fastest, and most cost-effective route. This process may involve utilizing multiple liquidity pools across different DEXs. Instead of executing individual swaps on each DEX, our platform consolidates all necessary transactions into a single, streamlined transaction. While this mechanism operates seamlessly within a single chain, our future vision entails abstracting the concept of chains. By doing so, we empower users to effortlessly perform cross-chain swaps without the need for in-depth knowledge of the underlying processes. Users can simply express their desire to exchange USDC for Ethereum, and our system will autonomously identify the best option, even if it necessitates swapping across different chains like Polygon. This user-centric approach ensures a transparent experience, with all actions encapsulated within fast-lane transactions executed seamlessly across chains.

Also, here are some measures we can take to ensure faster transaction execution: Firstly, it’s essential for users to be aware of the various fee options and how they impact transaction speed. By adjusting fees accordingly, we aim to achieve nearly instantaneous transaction execution while keeping the fees as low as possible.

When it comes to cross-chain functionality, we have implemented a fast peer-to-peer cross-chain network. In this network, we always act as the taker on the destination chain, allowing us to promptly respond to all requests. Unlike other peer-to-peer networks, where you may have to wait for days for someone to fulfill your order, our cross-chain functionality significantly reduces execution times to around 10 to 30 seconds rather than 30 minutes.

Q. In terms of CrowdSwap as an infrastructure provider, what do you offer?

A. Our platform is offering comprehensive support to early-stage projects seeking to enter the DeFi space by conducting token sales. This serves as a crucial avenue for projects to raise initial liquidity for their liquidity pools while simultaneously accessing our extensive network of influencers and social media channels to generate traction. Additionally, we offer a range of yield farming and staking opportunities, customizable to suit project preferences. Moreover, we extend our functionalities as an API or SDK, enabling seamless integration into projects’ existing platforms without unnecessary technical burdens. CrowdSwap has successfully partnered with traditional entities like Enerjisa, an energy company in Turkey, which leverages our technology for their payment solution, and a hydrogen marketplace project in the B2B (business-to-business) sector, utilizing our swap widget for streamlined payment processes. In the DeFi realm, we have collaborated with TMN and Vida, who have embraced staking liquidity pools and yield farming. Furthermore, we provide yield farming opportunities and staking options, both locked and unlocked, tailoring our services to align with the specific requirements of each project.

Q. What are fast-lane transactions?

A. Regarding the simplicity of our exchanges and platform usability, we have made significant efforts as developers to streamline the user experience. Traditionally, in DeFi processes like yield farming, users face multiple steps and complexities. For example, when investing in a yield farm, users often need to bridge their assets to the appropriate chain, swap tokens, obtain LP tokens, and put them to work. This entire process can be time-consuming and may not offer the best prices for swaps or cross-chain transfers. To address this, we developed the best-price routing algorithm in 2022. This algorithm ensures that users get the best swap prices available on each chain and enables cross-chain functionality. Unlike most bridges that transfer the same tokens, our solution allows users to swap any asset into any asset across several chains.

For instance, if you find a yield farming opportunity on our platform and want to invest your USDC from a different chain, our system takes care of all the required processes automatically. This streamlined experience extends beyond yield farming and also applies to activities like participating in a launchpad sale. We believe that the user experience in DeFi should prioritize the user’s financial goals, such as earning passive income, rather than burdening them with technical complexities like studying bridges. Our aim is to make the entire process as seamless and straightforward as possible.

Q. A thing you rarely see in DeFi projects is customer support. Do you have it?

A. With a background rooted in IT and software development, particularly within the B2B sector during the Web2 era, we bring a wealth of experience in providing extensive support to company employees. However, upon entering the decentralized finance (DeFi) space, we quickly recognized a glaring gap in the level of customer support available. This realization was triggered by personal encounters, such as a delayed transaction on PancakeSwap, where the lack of efficient support channels left users grappling with uncertainties and challenges. Driven by these experiences, we have made customer support a top priority in our DeFi endeavors, aiming to ensure timely responses, maintain security standards, and address any software bugs that may arise, thus offering an enhanced level of assistance to our users.

Q. DeFi projects often run into security problems. How do you deal with this issue?

A. We employ standard mechanisms such as internal bug bounty programs and regular audits of our smart contracts whenever we make changes or release new versions. We also focus on improving our team’s expertise in security-related matters. Additionally, we have initiated a program to conduct audits on our own smart contracts, which helps us identify and address vulnerabilities proactively. Furthermore, in collaboration with a partner project specializing in identity management, we have developed additional security measures for our smart contracts. For instance, one such measure involves allowing the use of a smart contract only if the user has completed a valid KYC (know your customer) or KYP (know your partner) process. Although this approach is not yet widely adopted in DeFi, we are exploring other security options that could be beneficial when executing smart contracts. Account abstraction and the use of unique factors like NFTs and multi-factor authentication are potential avenues for enhancing security without necessarily resorting to KYC or KYP requirements.

Q. Do you have any loyalty, ambassador, or VIP programs?

A. The CrowdSwap platform offers a range of bonuses and benefits through our loyalty and ambassador programs. Participants can take advantage of these programs to unlock various rewards. To become an ambassador, individuals must meet specific criteria, which can vary depending on the program. Details are here.

When someone registers their wallet address using your referral link, their wallet becomes linked to your affiliate or ambassador account. Subsequently, whenever these wallets engage in transactions on CrowdSwap, the platform earns fees based on its business model. As an affiliate, you can earn a percentage of these fees, ranging from 20% to 50%, depending on the monthly volume generated by your affiliates. This presents a unique opportunity for individuals with a wide reach to promote CrowdSwap and its functionality, with unmatched payouts within the DeFi space.

CrowdSwap also features a loyalty program called VIP, which offers additional benefits. The VIP program consists of five ranks, each providing distinct advantages. These benefits may include early access to new pools and launchpads, giving VIP members an edge over non-VIP users. To qualify for the VIP program, users need to hold a specific amount of CROWD tokens. The precise token thresholds required for each rank are dynamic and determined accordingly. For instance, individuals holding the top percentages (3%, 10%, 20%, and 50%) of Crowd tokens will be eligible for the corresponding VIP ranks. Accumulating points through actions like token holdings, staking, and contributing to liquidity pools determines your rank in the VIP program.

Q. Is there staking or yield farming on your platform? What rewards can a user get?

A. CrowdSwap provides staking options for Crowd tokens on the Polygon network with a 25% annual percentage yield (APY). Currently, staking is unlocked, but future plans include introducing locked staking for different durations. When adding new staking pools on different chains, the initial APY is around 25%, gradually decreasing as older staking pools are introduced. For yield farming, we offer our own liquidity pools and partnerships, allowing you to earn Crowd tokens based on your pool share. We are dedicated to improving these opportunities by enabling auto compounding and integrating various yield farming options. Our aim is to provide a secure and reliable interest rate throughout the year, emphasizing sustainable returns.

Q. Tell us more about your native token, CROWD.

A. CROWD tokens serve as the utility token for transactions within our platform, including fee payments and cross-chain transfers. We are interested in exploring deflationary mechanisms and potentially implementing token burning. Holding Crowd tokens grants access to our VIP program, and we plan to introduce additional benefits such as ‘feeback’ rewards. Additionally, we are developing a DAO system where CROWD token holders can exchange their tokens for sCROWD tokens, providing voting power and influence within the platform’s governance.

Q. You have your own launchpad called Crowd Sales. What are its advantages?

A. While any project can use our sales platform, we only promote projects that meet our minimum requirements. These requirements include having a documentation team, sensible tokenomics, and avoiding rug pools. Additionally, a white paper and a comprehensible business model are necessary. To ensure security, all projects must undergo a Know Your Business (KYB) process. This helps us prevent scams and protect investors. As an investor, whether you need to go through KYC (Know Your Customer) depends on the project’s decision.

Crowd Sales offer fixed-amount sales, providing more certainty compared to fair launches, where the final price is uncertain and investors can lose their positions.

There are some issues with these kinds of launches. Most of the time, it looks great and yields positive results. However, many people no longer benefit financially from these launches. To address this, we have decided to only have fixed funding sales. For example, a sale can be set at $250,000, which can be divided into multiple rounds. The initial round may have a lower price, and subsequent rounds may have an increased price based on predefined ranges. The investor will always know how many tokens they will receive based on the amount they invest in the sale.

We act as a software service provider but can assist with marketing and promotion if the project desires. The actual sale period usually lasts 3–5 days, since we’ve found that longer durations are not as effective. The most significant traffic occurs at the beginning and end of the sale, with little activity in between.

After the sale, all token distribution and management are handled through our platform. Investors receive their tokens based on a predefined schedule defined by the project, and the project receives funding from the sales contract. All fees have already been deducted from the project to support crowdsourcing as a revenue model.

Q. Ripple’s CTO recently accused the well-known DEX Uniswap of having fake decentralization. In his view, if one person or group has a legally enshrined right to tell others, then it is not decentralization. Similar accusations are often made against other DEXs as well. What would you say in defense if your exchange was accused of the same?

A. Uniswap, as a protocol, is not considered fake decentralization in my view. Uniswap represents the core of smart contracts and decentralized finance (DeFi) and can demonstrate its decentralized nature through the transparency of its smart contracts. However, when it comes to DAOs, there is room for improvement. For instance, if voting power is directly tied to token holdings (one token equals one vote), it may not be fair as wealthy parties can accumulate significant voting power by buying many tokens. One alternative approach, as suggested by Vitalik Buterin, is quadratic voting, where voting power is calculated based on the square root of the token holdings. This mechanism allows for a more equal distribution of voting power among participants, promoting a more inclusive and decentralized decision-making process. However, implementing such mechanisms requires careful consideration and evaluation of community dynamics and feasibility.