Blockstream CEO Adam Beck said that according to his calculations, Bitcoin could well rise in price to $10 million by 2032. This rise is justified by BTC’s historical profitability during previous halving procedures as well as other factors. We explain why this figure is realistic by naming three long-term factors for Bitcoin’s growth.

Halving

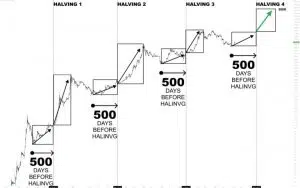

Halving is the phenomenon of Bitcoin emissions gradually decreasing over time. Because fewer and fewer new Bitcoins are being mined, their price rises, and the asset experiences deflation. This logic is fully supported by the historical statistics Adam cites.

Between January 2013 and December 2022, the price of Bitcoin rose an average of 2.036 times a year, which means 1,200 times in a decade. If this trend continues, during the next two halving cycles, Bitcoin will presumably reach a value of $10 million per coin and its capitalization will rise to $200 trillion. Despite the big numbers, the logic here is very simple: the more halvings Bitcoin experiences, the more expensive it becomes.

More and more hodlers

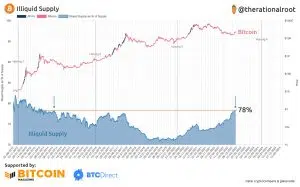

As reported by TheRationalRoot, Bitcoin’s illiquid supply has reached its highest level since 2014 — only 22% of the world’s existing Bitcoins are now available for trading (which brings the market closer to a so-called supply shock).

The brand new newsletter with insights, market analysis and daily opportunities.

Let’s grow together!

Simply put, this means that the number of hodlers is constantly increasing; in fact, they are constantly withdrawing Bitcoin from the market. A regular decrease in the supply of the asset will inevitably push the price up.

2023 will create many millionaires

and most of them will be #Bitcoin hodlers— The Bitcoin⚡️Energy Standard (@romoolo) February 12, 2023

Network effect

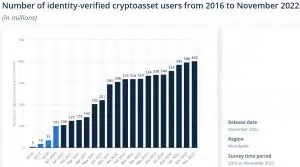

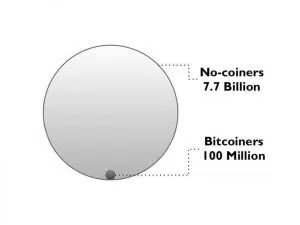

The ever-increasing number of users on the network creates a steady growth in demand for an asset. The Network effect and Metcalfe’s law describe this increasing demand as the adoption of a product expands.

The number of new users in crypto is growing very fast. The crypto industry is now at the level of the Internet of the 1990s, when only individual technical people could use the Internet. It took about 15 years for the internet to take over the market and become a mass product. For Bitcoin, the years of such widespread adoption would be 30-32.

The simultaneous pressure on the price from all of these factors will result in Bitcoin being well worth $200,000 by 2025. From the experts’ point of view, these numbers don’t seem fantastic, as we are at the very beginning of the growth of a huge new market. If we use Adam Beck’s calculation model, then in 2032 the value of BTC will reach $10 million.