Contents

Large exchanges or stablecoins sometimes fail, which surprises people unfamiliar with the details. If a user stores their decentralized currency on a centralized exchange and loses it, it’s their fault, says Reddit user Oscar_G_13. And such a sad fate may potentially overtake even a giant like, say, Coinbase.

“So before any other exchange falls, understand that by not moving your coins and allowing a centralized company to “hold” them for you, you are consciously accepting the potential loss of said currency,” he pointed out.

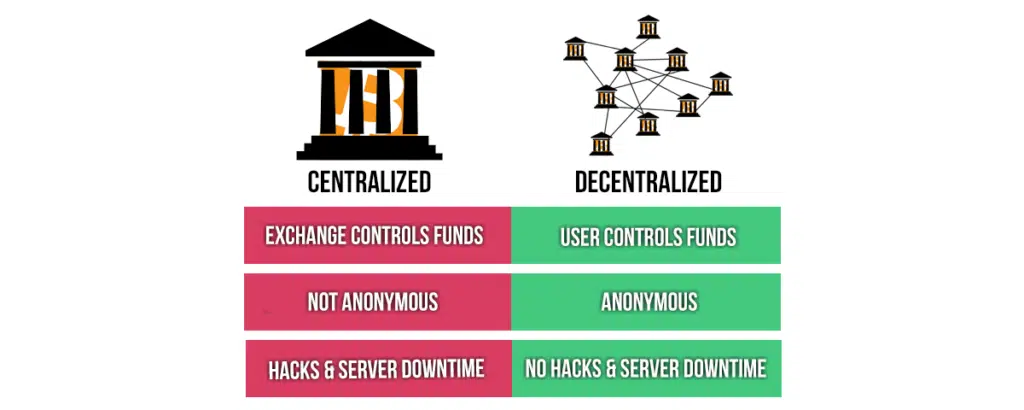

One way to secure digital savings is using decentralized exchanges or DEXs.

What is a decentralized exchange (DEX)?

DEX is a peer-to-peer (P2P) trading platform where users can trade cryptocurrencies in a non-custodial manner without needing an intermediary to facilitate the transfer and storage of funds. DEX replaces intermediaries — traditionally banks, brokers, payment systems, or other institutions — with blockchain-based smart contracts that enable the exchange of assets. This makes transactions cheaper because parties do not pay storage fees to traditional centralized exchanges.

The brand new newsletter with insights, market analysis and daily opportunities.

Let’s grow together!

At the same time, traditional financial transactions are not transparent. DEX, on the other hand, offers complete transparency of funds movements and mechanisms to facilitate exchange. Also, user funds do not pass through a third-party cryptocurrency wallet during trading, and DEX reduces counterparty risk.

Traders using decentralized exchanges do not have to disclose their private keys because the wallets are stored on the external market, and DEX is not in charge of the funds.

DEXs uses the same “gas” fee structure as the Ethereum blockchain on which they are usually based. But charge a low fee, around 0.3%.

You probably also need to know about AMMs

DEXs use smart contracts to execute market transactions, distributing transactions to an autonomous code (automated market maker or AMM). Still, there are many order execution options with varying degrees of decentralization. Like a market maker in the stock markets, AMM ensures that there is always a buyer and a seller for every transaction. And it is a decentralized application (DApp) in which users provide liquidity collectively and directed by an algorithm.

Okay, what the heck is a smart contract?

Smart contracts are programs stored in a blockchain and triggered when predefined conditions are met. They are usually used to automate the execution of an agreement so that all participants can be immediately sure of the result, without intermediaries, and to save time.

Why are there so many different networks?

Many blockchain networks and cryptocurrencies use various blockchain technologies, including Bitcoin, Ethereum, Avalanche, and Polygon. Ensuring interoperability and exchange between different blockchain networks is an area in which cross-chain bridges, sometimes also called blockchain bridges, help.

Exchanging between blockchains is possible without a cross-chain bridge, but it is expensive and takes more time. In this scenario, users must first convert their crypto into fiat currency without a cross-chain bridge, which often involves a fee. Then they use the money to obtain another desired type of cryptocurrency, which requires additional fees and time.

A bridge can also transfer smart contracts and NFTs from one blockchain environment to another. One of the characteristics of the cross-chain bridge is that it allows users to exchange one cryptocurrency for another without first exchanging it for fiat currency.

Also, with DEX, users can trade new and little-known cryptocurrencies that were previously difficult to exchange elsewhere.

Is it really that hard, or is it just me?

Yes, decentralized exchanges are not very user-friendly and can be pretty challenging to use for those who are not familiar with decentralized blockchain technology. Users must first familiarize themselves with external wallet platforms to interact with DEX. Then they need to fund their wallet by transferring fiat (money controlled by governments and central banks) or cryptocurrency. And then link that wallet to the DEX interface to make a trade. Also, the current DEX technology does not allow fiat trading or withdrawals to one’s bank account.

Unlike centralized exchanges run by private companies with employees, DEX cannot fundamentally recover lost, stolen, or misplaced funds. And they gave limited speed: transactions take time to be checked and validated.

Five best DEX on the market right now*

dYdX — trade volume (24h) $1.8 billion

This decentralized cryptocurrency exchange supports open-ended trading. dYdX is based on smart contracts on the Ethereum blockchain and the 0x protocol (it simplifies the P2P exchange of assets based on Ethereum) and allows users to trade without intermediaries.

It is best for short selling and derivatives (secondary contracts or financial tools that derive value from a primary underlying asset). The platform allows users to make P2P short sales, long positions, and options on any ERC20 token. dYdX also offers perpetuals (perpetual futures contract, also known as a perpetual swap — an agreement to non-optionally buy or sell an asset at an unspecified point in the future) and trading with up to 20x leverage.

From time to time, dYdX offers various rewards programs. For example, among users trading on the second-level protocol dYdX, 25.00% of the initial supply of the DEX’s tokens (250,000,000 DYDX) was distributed based on a combination of paid commissions and open interest.

UniSwap (V3) — trade volume (24h) $1.7 billion

UniSwap (V3) protocol allows to swap (exchange one cryptocurrency for the equivalent value of another cryptocurrency) Ethereum ERC20 tokens without using an order book (it’s an electronic list of buy and sell orders for security. It has two sides: bids and asks, that are awaiting execution). So clients don’t need to wait for so long. The swap rate depends on the demand for both tokens and the balance of the swap pair.

UniSwap V3 was introduced last year, launched on the Ethereum core network, and then deployed to Optimism, which is a Layer 2 scaling solution for Ethereum that can support all of Ethereum’s dApps. As a result, it was possible to increase the number of Ethereum transactions per second and reduce the commission.

The platform rewards liquidity providers according to the degree of risk they take on the market.

PancakeSwap (V2) — trade volume (24h) $290 million

This AMM DEX runs on Binance Smart Chain (BSC). The innovations of PancakeSwap V2 are permissionless liquidity pools (a digital stack of cryptocurrency locked into a smart contract that creates liquidity for faster transactions) controlled only by algorithms. These algorithms allow PancakeSwap to work fully automatically, regardless of market makers.

PancakeSwap V2 has a referral rewards program (users can get a percentage of referral fees).

Kine Protocol — trade volume (24h) $241 million

It is also Ethereum-based. The P2P engine supports all transactions. This DEX made it possible to convert smart chain assets between Ethereum, Binance Smart Chain, Polygon, and the Avalanche network with low fees.

Honeyswap — trade volume (24h) $146 million

DEX is built on the Genesis blockchain. And this is the only exchange where you can purchase HNY, the digital currency issued and distributed by 1Hive DAO (a decentralized autonomous organization, community-driven entity with no central authority). Honeyswap users who provide liquidity to pools can now bet their liquidity tokens and earn extra interest.

*according to CoinMarketCap.