Contents

If you’ve decided to get into cryptocurrency, it’s not enough to want to do it. Buy cheaper and sell higher. What could be easier? Well, in that case, everyone around would be successful traders and investors.

To consistently make money in the cryptocurrency market, you need to understand what the best strategies are. Then you will clearly understand what to do and how to behave in the long term. And this is very important because the crypto market is very unpredictable.

What is a crypto trading strategy?

You can quickly go broke if you rely on news and rumors and trade based on them and your intuition. You can’t be sure of success all the time if there is no concrete plan of action in case situations develop in different directions.

The brand new newsletter with insights, market analysis and daily opportunities.

Let’s grow together!

Experienced traders always work based on well-thought-out methods. That’s why beginners must understand different trading strategies from the beginning, so they don’t disappoint the crypto market and understand how to earn steadily.

Cryptocurrency trading strategies are essentially methods of planning and executing trades that a trader follows in any given situation. It is on their basis that they decide when and what trades to make, when to exit, and how much money to risk depending on the position.

A cryptocurrency trading strategy is the clearly defined step-by-step plan needed to achieve profit (if you decide to get involved with crypto). Special analytical forecasting tools are usually used to draw it up.

This plan, if adhered to, will reduce financial risks and help guard against ill-considered emotional actions.

Types of crypto trading strategies

Here are six of the most popular methods of trading cryptocurrency. But before you choose any particular one, you should do your analytics and choose the most convenient one.

Scalping

This strategy allows traders to profit from small changes in price over short periods. The trader’s task with this approach is to add up small profits, which in the long run will bring good money. Traders who use such a strategy are called scalpers.

Sometimes they use leverage (that is, borrowed funds provided by a broker to a trader) to open more trades and hard stop losses (an exchange order placed in the trading terminal by a trader or investor to limit their losses when the price reaches a predetermined level for risk management). They are traded within 1 minute, 15 minutes, and 30 minutes. Deals usually last from a few seconds to no more than an hour.

Day trading

This strategy assumes entering and exiting positions on the same day. Day traders benefit within one trading day. They trade on more extended time frames than scalpers.

The task of a day trader is to get the most out of small market movements and volatility (a statistical financial indicator that describes the variability of prices) of bearish (pessimistic sentiments and trends) and bullish (optimistic sentiments and trends) markets. Technical analysis is needed to develop strategies for day trading. Therefore, day trading and scalping are more suitable for experienced traders.

Buy and hold (HODLing strategy)

With this strategy, traders hold trading positions for a long time: months or even years. Therefore, they often ignore short-term price changes. Such position traders often focus on daily, weekly and monthly timeframes when making transactions. Assessment of market price trends is usually made based on fundamental analysis.

Arbitrage trading

Such traders buy cryptocurrency in one market and sell it in another to profit from the price difference. On one exchange, the price of Bitcoin can be, for example, $24,000, and on another, $24,500. In that case, the trader will transfer the purchased BTC to an exchange with a higher rate to sell them more profitably.

Swing trading

With this strategy, transactions usually last from one day to several weeks or months. This strategy is also called a medium-term strategy because it is between a daily strategy and a HODLing strategy. The trader working with this strategy will not make spontaneous decisions like the short-term strategy. This style is best suited for novice traders.

Dollar-cost averaging (DCA)

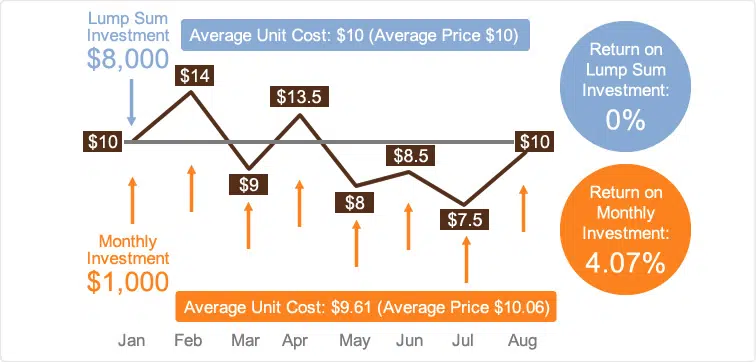

In this strategy, a predetermined amount of money is spent on purchasing a selected cryptocurrency, which is then inverted at regular intervals, but in small increments, allowing the trader to benefit from market growth. At the same time, the assets are not exposed to market risks. Investing continues regardless of market movements until the target is reached. Purchases are made on both highs and lows.

DCA allows you to invest in your preferred cryptocurrency over a long period without being affected by extreme highs and lows (as is the case when investing large amounts at once). However, it is a long-term strategy, and you will have to pay more commissions when trading.

Advantages of trading cryptocurrencies

- Sharp price fluctuations. Because of their high volatility, cryptocurrencies tend to attract speculators and investors. Price changes even within a day can bring traders excellent profits (although the risks are also high).

- Almost complete anonymity. Transactions with cryptocurrencies happen online, and there is no need to disclose personal information. Therefore, there is a big plus in better privacy than traditional currencies. Each exchange has its own Know Your Customer (KYC) process to identify users or customers. It allows financial institutions to limit financial risk by keeping wallet holders anonymous.

- Round-the-clock market. The cryptocurrency market is fully decentralized and operates around the clock. Therefore, people can make transactions worldwide at any time.

- Peer-to-peer (P2P) transactions. Cryptocurrencies do not require the involvement of a financial institution as an intermediary, reducing transaction costs.

Disadvantages of trading cryptocurrencies

- Cybercrime. Hackers are constantly targeting cryptocurrencies. That’s why you need to take serious care of your cybersecurity and use advanced technology.

- Scalability issues. The number and speed of transactions cannot compete with traditional currency trading. In March 2020, for example, there was a multi-day delay in trading for this reason.

- Regulatory problems. Because cryptocurrency and its trading are decentralized, there is also no legal structure to protect crypto assets and investments (with few exceptions from a few countries where the central government enforces order).

Advice from professional trader

Renowned crypto trader Ezekiel Chew, who earns 6-figure sums and teaches bank traders, shared his tips for successful day trading of cryptocurrencies.

- Learn to understand charts. One of the best ways is price action; technique. Once the charts become clear, you’ll understand why the market is in a particular direction and what strategy would be best.

- Trade by sticking to a strategy or combination of methods that have been repeatedly tested and proven to work.

- Use only a reliable trading system. Pay attention not only to technical aspects but also to the business behind the trade. The system also dramatically affects whether or not you will become a successful trader.

The bottom line

Developing a cryptocurrency trading strategy that is right for you is not easy. You have to take into account both personal qualities and financial capabilities. After reviewing six of the most popular methods, perhaps you’ll choose one (or more) of the ones you like and are most comfortable with.

If you try several trading techniques, make a diary in which you record the results of all transactions. Then you will be able to determine the most successful strategies. Good luck!