The Law Commission of England and Wales, tasked with reviewing and updating the law, wants to extend ownership rules to cryptocurrencies and NFTs (NFTs are digital assets whose uniqueness and ownership can be demonstrated and verified using distributed ledger technology (DLT). NFTs can be used to create a tokenized proof of ownership of a unique digital version of an underlying digital asset (images, video, or other digital content) or a physical asset (paintings, sculptures, or other tangible assets.). According to the document, digital assets could be equated to personal property. This will make life easier for crypto investors: it will be possible to recover losses in case of hacking or fraud through lawsuits. But the Сommission’s proposals would not apply in Scotland and Northern Ireland, which have their legal systems.

Property law in England and Wales currently recognizes two types of personal property: “things in possession” and “things in action” (such as company stock). To record digital assets, the Legislative Commission proposes creating a new category called “data objects,” which would account for things made up of data in electronic form.

However, the project is still only halfway through its final draft. It will take another 18 months for the Commission to evaluate it. And the public consultation on the rules is due to conclude on November 4.

The British government has also asked the Commission to study rules for decentralized autonomous organizations (DAOs), which are blockchain-based governance bodies. The Commission will look into DAOs after digital assets.

The brand new newsletter with insights, market analysis and daily opportunities.

Let’s grow together!

So, as you understand, the legal status also determines what taxes you have to pay and how much you have to pay.

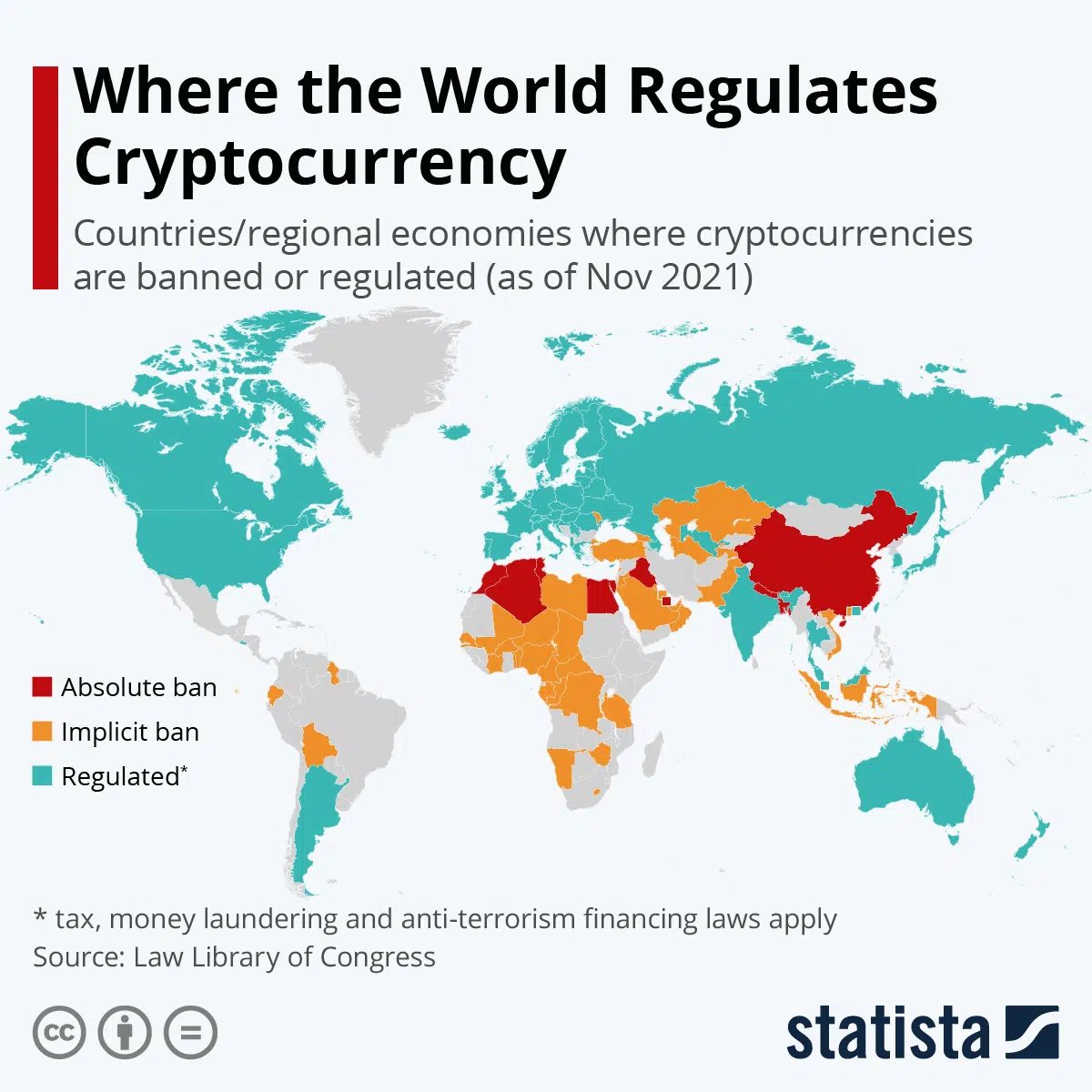

Which countries have decided on the legal status of crypto

- The USA. On July 21, 2022, the Securities and Exchange Commission (SEC) filed an insider trading case alleging for the first time that an employee’s alleged transmission of material nonpublic information for trading crypto assets constitutes securities fraud. The SEC complaint alleges that specific cryptocurrencies are securities and therefore subject to the Securities Act of 1933 and the Securities Exchange Act of 1934. However, many legal nuances still need to be resolved.

- Spain. In 2022, the Spanish Treasury officially confirmed that taxpayers do not need to declare cryptocurrencies under the Model 720 Declaration, even if their total value exceeds €50,000. Also, no Spanish legislation explicitly addresses cryptocurrency coin offerings; Initial Coin Offerings (ICOs) may fall under Spain’s general securities and investments laws. Concerning the classification and commercialization of cryptocurrency, the Comision Nacional del Mercado de Valores (CNMV) proclaimed in an unofficial announcement that cryptocurrencies are per se not securities under Spain’s laws.

- Canada. For income tax purposes, Bitcoin and cryptocurrencies are treated by the Canada Revenue Agency (CRA) as a commodity. Any income from a bitcoin transaction is treated as business income or capital gains and must be reported as such. And, of course, taxes are paid in the same way. And cryptocurrency exchanges must register with the Financial Transactions and Reports Analysis Centre of Canada (FINTRAC).

- Australia. The Australian Taxation Office considers bitcoin a financial asset with a value that can be taxed when certain events occur. Capital gains tax is charged if you trade, exchange, sell, gift, convert it into fiat currency or use the crypto for purchases. You must also keep records of all transactions you make using Bitcoin for tax purposes.

- El Salvador is the only country worldwide that has declared cryptocurrency a legal tender. In June 2021, the country’s Congress approved President Nayib Buquelet’s decision to accept bitcoin and altcoins as payment officially.

And here are the countries where crypto is outside the law (yes, there are such)

- Algeria. Cryptocurrencies are banned there after a 2018 financial law made it illegal to buy, sell, use or store them.

- Bolivia. Since 2014, there has been a total ban on the use of bitcoin or any other crypto.

- China. Since 2021, the country’s authorities have been actively opposing cryptocurrencies. And on September 24 last year, they altogether banned transactions with cryptocurrencies.

- Colombia. In 2014, financial institutions warned that they could not “protect, invest, broker or manage virtual money transactions.”

- Egypt. The country’s main Islamic advisory body issued a religious decree in 2018 classifying bitcoin transactions as “haram,” meaning “sin.” And in September 2020, Egypt’s banking laws were tightened to prevent the trading or promotion of cryptocurrencies without a Central Bank license.

- Indonesia. As of early 2018, the country’s central bank banned the use of cryptocurrencies, including bitcoin, as a means of payment.

- Iraq. The country’s central bank banned the use of cryptocurrency in 2017. In early 2021, the Interior Ministry of the Kurdistan Regional Government issued a similar order banning money brokers and exchanges from dealing in cryptocurrencies.

- Kosovo. Earlier this year, the government announced a ban on cryptocurrency mining.

- Nepal. Bitcoin has been illegal here since August 2017.

- Northern Macedonia is the only European country with an official ban on cryptocurrencies.

- Turkey. On April 16, 2021, the Central Bank of the Republic of Turkey issued a decree banning the direct or indirect use of cryptocurrencies, including Bitcoin, to pay for goods and services. The next day, Turkish President Recep Tayyip Erdogan went further and issued a decree to include cryptocurrency exchanges in the list of firms subject to anti-money laundering and terrorist financing regulations.

- Vietnam. The issuance, delivery, and use of bitcoin and other cryptocurrencies as a means of payment are illegal and punishable by fines. However, it is possible to trade and own crypto as an asset in the country.