Contents

The price of BTC fell below $22,000 after a speech by the head of the Fed. He spoke about the high probability of the next key rate increase. Let’s consider what risks exist in connection with this, as well as give an expert opinion on the most likely scenario for the crypto market in 2023.

The market is preparing for policy tightening

During his last speech, U.S. Federal Reserve Chairman Jerome Powell said he would allow interest rates to rise (and even increase the speed of rate hikes) and said that so far there are no signs of a noticeable decline in inflation. Referring to the latest statistics this year, according to him, there is a slowdown in the decline of inflation (which means that the factors that accelerate the growth of inflation are starting to work again). In this regard, the head of the Fed warned of the high probability of further tightening of monetary policy in the near future.

Immediately after this statement, Bitcoin showed a long red candle, which brought the price of the first cryptocurrency below $22k. Now almost the entire cryptocurrency market is in the red zone.

The brand new newsletter with insights, market analysis and daily opportunities.

Let’s grow together!

Immediately after the Fed chief’s statements, the following assets reacted negatively:

- Gold fell in value by 4%

- Bitcoin fell in value by 2%

- NASDAQ is down about 1%

As we predicted a month ago, Bitcoin’s recent rally to $25k was false, and we are seeing a gradual pullback under pressure from tighter monetary policy.

Fed's interest rate hiking policy over the last year has pretty much tamed inflation in the USA

source: https://t.co/u6AJDSWDhO pic.twitter.com/8EsLCrctKu

— Satoshi Flipper (@SatoshiFlipper) March 6, 2023

Is a new cycle of crypto winter ahead?

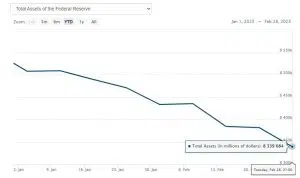

The Fed’s balance sheet has continued to shrink over the past quarter; in other words, there is less and less money in the system. In the first two months of this year, the U.S. Fed withdrew $168 billion from the system as part of a program of tightening monetary policy. At the moment, the balance of the Fed is equal to $8.339 trillion (see chart below). Since the beginning of the key rate hike in 2022, about $600 billion has been withdrawn from the system, and the process continues.

So the Fed’s balance sheet is now down about 6.5% from its peak. So far, it is not so critical for the market and the financial system, but we must remember that the policy tightening program has a cumulative inertia effect; the slowdown effect will not appear right now but in about six months.

During the last crisis in 2018-2019, when the regulator conducted the same rate hikes, the liquidity crisis in the interbank market began when the Fed’s balance sheet was reduced by about 18%. The regulator then responded almost immediately to this crisis by launching the printing money and sharply lowering its key rate. As a result, the Fed’s balance sheet began to rise again, and six months after that, the famous Bitcoin rally began. In 2018, BTC reached the then-unbelievable $20k price for the first time.

If the current speed of tightening continues, the Fed’s balance sheet will shrink by another $500 billion to 600 billion by this fall, which will already be a pretty big total. Plus, by the fall, the economy will feel the full effect of the Fed’s high rates, which usually show up with a delay after 6-9 months. So the fall of 2023 could be very difficult for all markets, including cryptocurrencies, for a variety of cumulative reasons.

Dangerous economic slowdown

The head of the Fed also had to make excuses to U.S. senators for the central bank’s actions, as many businesses are closing and people are losing their jobs in the U.S. as a result of tighter monetary policy. As an example of how aggressively the Fed’s plans were met by the senators, you can watch this video of Elizabeth Warren speaking.

Senator Elizabeth Warren says about 2 million people will lose their jobs as a result of the Fed’s anticipated monetary tightening. She asked Jerome Powell to explain why these people must lose their jobs as part of the effort to bring down inflation.

Further rate hikes, which the Fed has already warned about, will lead to more and more bankruptcies, so persistently continuing to raise rates is risky for the economy and cannot be sustained for long. We can accurately predict that because of this Fed policy, global economic stress will peak by the autumn of 2023, and the crypto market will likely see new lows.

🇺🇸Jerome Powell (FED Chairman) and Elizabeth Warren (Senator) fought over rising unemployment ‼️😳

In the past 74 years, the US has only avoided a recession once when unemployment moved up by 1%😬#Crypto #CryptoNews #cryptomarket #Bitcoin #ETH #SHIB #FLOKI #FED #SEC #MTGOX pic.twitter.com/XmEpV2XUau

— Ajay Kashyap (@EverythingAjay) March 9, 2023

What does it all mean?

Earlier, we quoted famous crypto expert and economist Arthur Hayes, who predicted a month ago that the most likely scenario is that the Fed will continue to raise its key rate in 2023. Until the tightening suddenly results in the bankruptcy of some major player (such as some system bank), at which point the Fed will be forced to perform an urgent reversal, as it already did in 2018. As you can see from the Fed’s current performance, everything is going exactly as predicted.

According to Arthur Hayes, the price of Bitcoin in this scenario will slowly fall as the rate increases (which is exactly what is happening now; Bitcoin fell 4% during February), but after a future crash in the economy and a Fed reversal, there will be an incredible rally in the cryptocurrency market.

Arthur notes that it’s important for all players in the market to have the patience and stamina to get to the point of this reversal, which will happen around the end of 2023 or in 2024.

![FgmIugCXwAAO2hD[1] - buidlbee](https://buidlbee.com/wp-content/uploads/2023/03/FgmIugCXwAAO2hD1-300x217.jpg.webp)