The October edition of Bloomberg Cryptos Outlook pays much attention to Bitcoin. According to the publication, October has historically been the best month for Bitcoin (BTC) since 2014, with an average monthly gain of about 20%. Now commodities have peaked, which could mean Bitcoin has bottomed out. So, a change in the economic situation could cause Bitcoin to outperform most major assets again. Ethereum’s switch to Proof-of-Stake (PoS) might help it build a base above $1,000 and Bitcoin around $20,000.

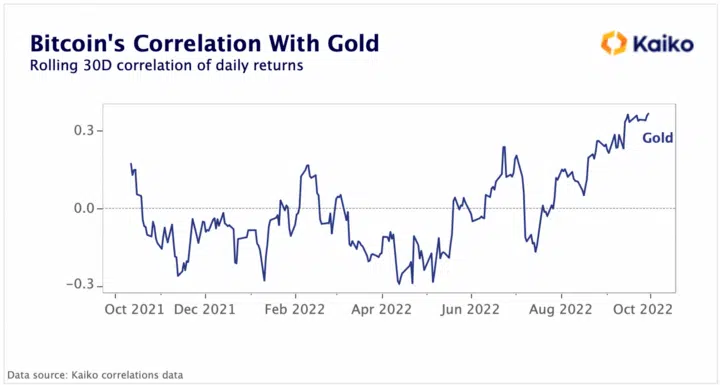

This is also evidenced by Kaiko, the leading provider of institutional-level cryptocurrency market data. According to the company’s latest report, cryptocurrency markets performed better than traditional assets in the third quarter. And Bitcoin’s correlation with gold reached its highest level in more than a year.

“It’s the potential for the benchmark crypto to shift toward becoming a risk-off asset, like gold and US Treasuries, that may play out in 2H,” the analysis claims.

And no matter what former Ripple development director Matt Hamilton says, BTC is still superior to other cryptocurrencies (and not only).

The brand new newsletter with insights, market analysis and daily opportunities.

Let’s grow together!

Easy: Bitcoin was revolutionary and proved the concept of artificial digital scarcity. All the rest are where the actual innovation is now happening and business models are forming.

— Matt Hamilton (@HammerToe) October 5, 2022

Bloomberg’s analysis of the ratio of money supply, commodities, and Tesla shows that Bitcoin is ahead of everyone else.

“Our analysis vs. money supply, commodities, and Tesla shows Bitcoin gaining the upper hand,” says Bloomberg.

However, if we compare Bitcoin to Elon Musk’s auto company, cryptocurrencies may bottom up faster. Tesla’s potentially limitless number of shares, compared to the severely limited number of bitcoins available, could increase the relative value of the cryptocurrency. The cryptocurrency’s additional supply will drop to less than 1% in 2025, while the 12-month rate of change in the number of Tesla shares outstanding has averaged about 5% for more than ten years.

In the short term, a world bent on recession will drive more growth for Bitcoin than with Tesla, and in the longer term, the limited supply could give the cryptocurrency an edge.

Crypto dollars — go!

According to a Bloomberg report, the most widely traded digital assets in October were tokens pegged to USD, or stablecoins.

As of October 4, the value of the most popular stablecoins on CoinMarketCap was nearly $150 billion. Most of these are Ethereum-based tokens, and the fact that the world is increasingly looking to the dollar by using digital assets organically may be the main reason why China is trying to launch its own central banking digital currency.

What’s up with Ethereum and other altcoins?

The chart shows that Ethereum outperformed the Nasdaq 100 index in the third quarter. Nascent technology and more volatile cryptocurrency tend to outperform the stock index on their way up, but the Merge could mark a tipping point.

Most of the cryptocurrencies of Layer-1 will not bring profits to shareholders. Three networks have negative real returns: Cardano (-0.18%), Solana (-0.68%), and Fantom (-2.38%).

These three cryptocurrencies have a supply/demand dynamic in which the current fee income paid in their home currency is insufficient to offset current inflation/issue. If this situation persists, it could undermine future application development activity on these networks.

In Bloomberg’s list of Layer-1 crypto assets, only two networks have real returns better than Ethereum’s prime rate of 5.03%. Polkadot’s is 5.8%, and Cosmos’ is 5.1%.