Contents

- 1 The war in Ukraine increased the trading in stablecoins

- 2 Elimination of millions of dollars in crypto trading

- 3 Purging of illiquid creditors

- 4 Binance is still unbroken

- 5 Uniswap evolution

- 6 The great Merge

- 7 Scam on a galactic scale

- 8 BTC loses liquidity

- 9 How do we evaluate assets now?

- 10 Macroeconomics affects crypto

The year 2022 saw many pivotal incidents that significantly impacted the cryptocurrency market. Russia’s attack on Ukraine and the collapse of several large companies changed trends, and this will have an impact in 2023 as well. We read more about those key events and how they affected the big picture in Kaiko’s research.

The war in Ukraine increased the trading in stablecoins

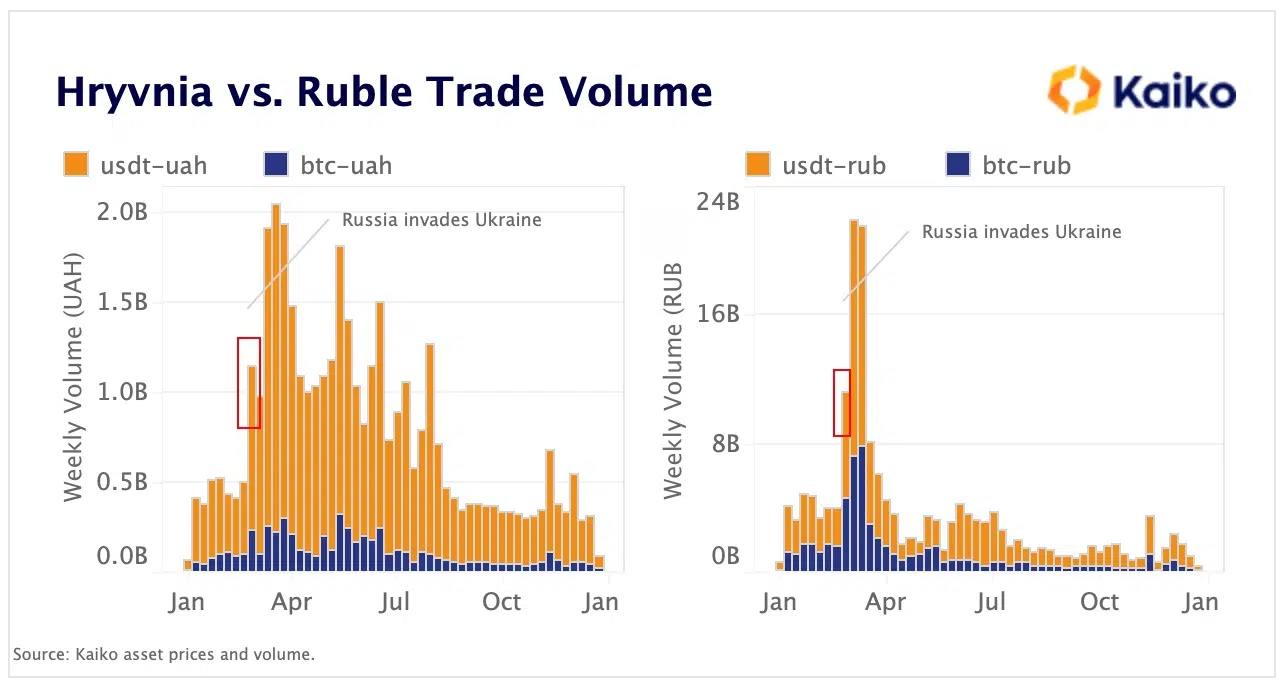

Trading volumes in both ruble and hryvnia increased immediately after Russia’s invasion of Ukraine, helped by a record devaluation of the local currency and market disruptions. Interestingly, the bulk of the share came from stablecoins, not BTC. Meanwhile, weekly volumes of Tether (USDT) jumped more than five times at the start of March compared to the beginning of the year. This coincides with the start of the war in Ukraine in late February.

While trading volumes in hryvnia remained steady throughout the year, trading volumes in rubles quickly returned to prewar levels. This was mainly due to the imposition of international sanctions against Russia, restrictions on major payment networks such as Mastercard and Visa, and crypto exchanges.

Elimination of millions of dollars in crypto trading

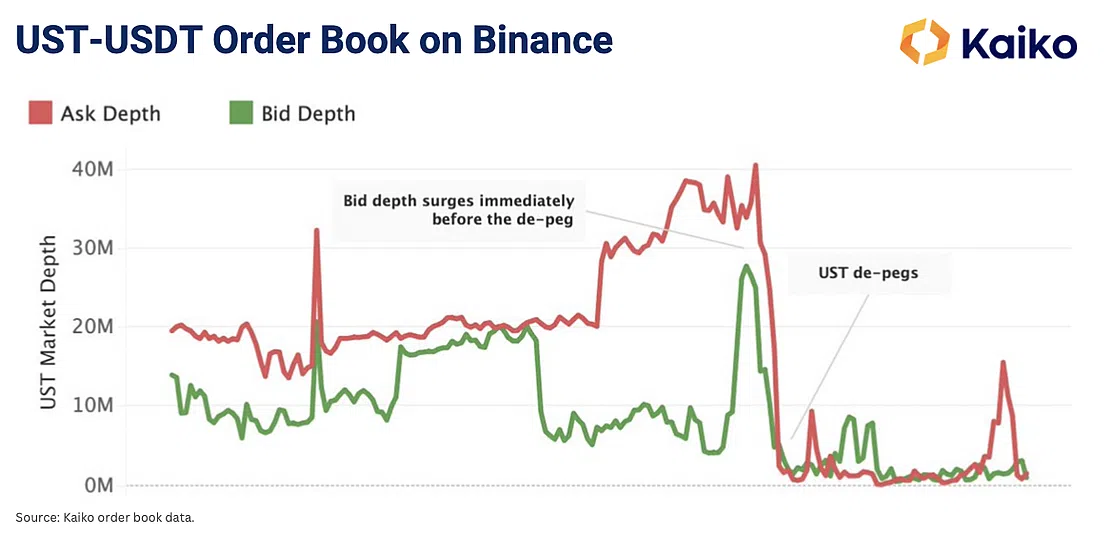

TerraUSD (UST) was one of the fastest-growing cryptocurrencies in history: its market capitalization rose from $2 billion to $18 billion in just six months (from late 2021 to April 2022). But after a series of events, stablecoin lost its 1-to-1 peg to the U.S. dollar. Along with it, the entire Terra ecosystem collapsed.

The brand new newsletter with insights, market analysis and daily opportunities.

Let’s grow together!

Purging of illiquid creditors

Following Terra (and because of the rumors connecting Celsius to it), one of the largest centralized cryptocurrency lenders, Celsius, which managed about $12 billion in assets, went bankrupt. The company invested most of its customers’ funds in Lido Staked Ether (stETH). As a liquid token, Celsius could use stETH in other DeFi protocols. However, stETH was less liquid than ETH and began trading at a discount to ETH of about 5% as investors expected Celsius to liquidate its assets. Following Celsius, the contagion spread to other financial crypto platforms.

Binance is still unbroken

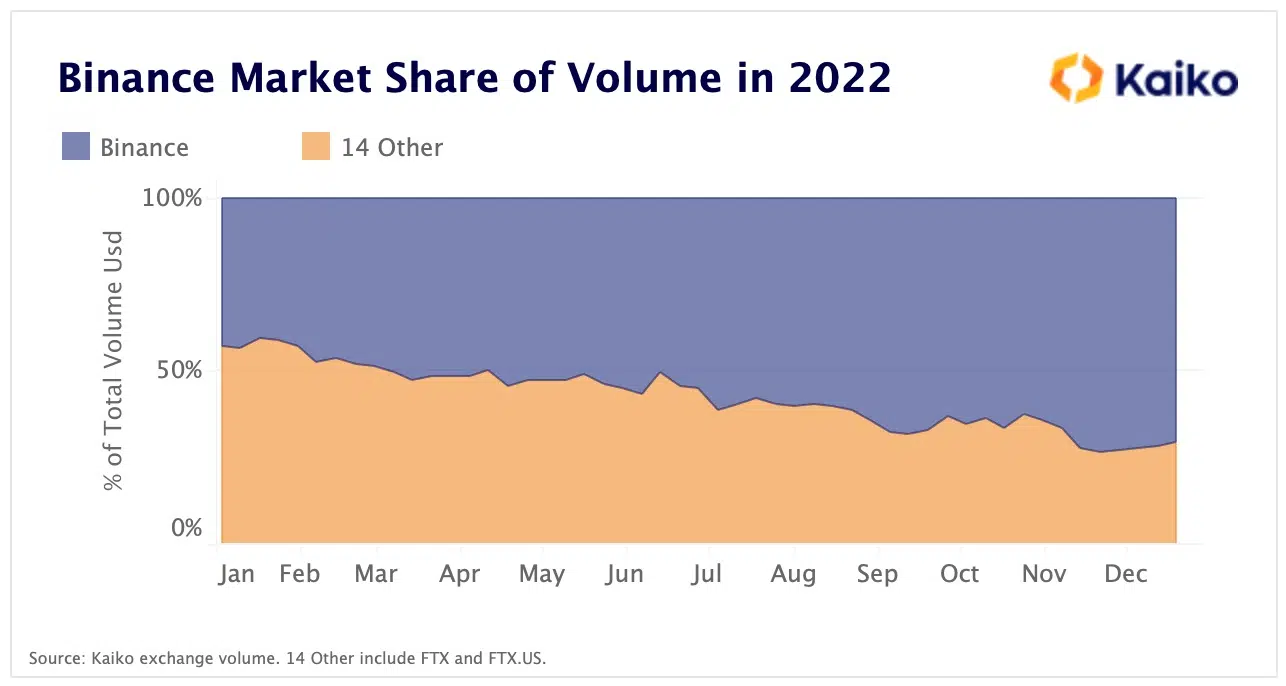

Binance eliminated fees for 13 BTC pairs in July, which immediately led to an increase in trading on its platforms. The exchange’s market share rose to more than 72% compared to 14 other exchanges (43% at the beginning of the year).

Uniswap evolution

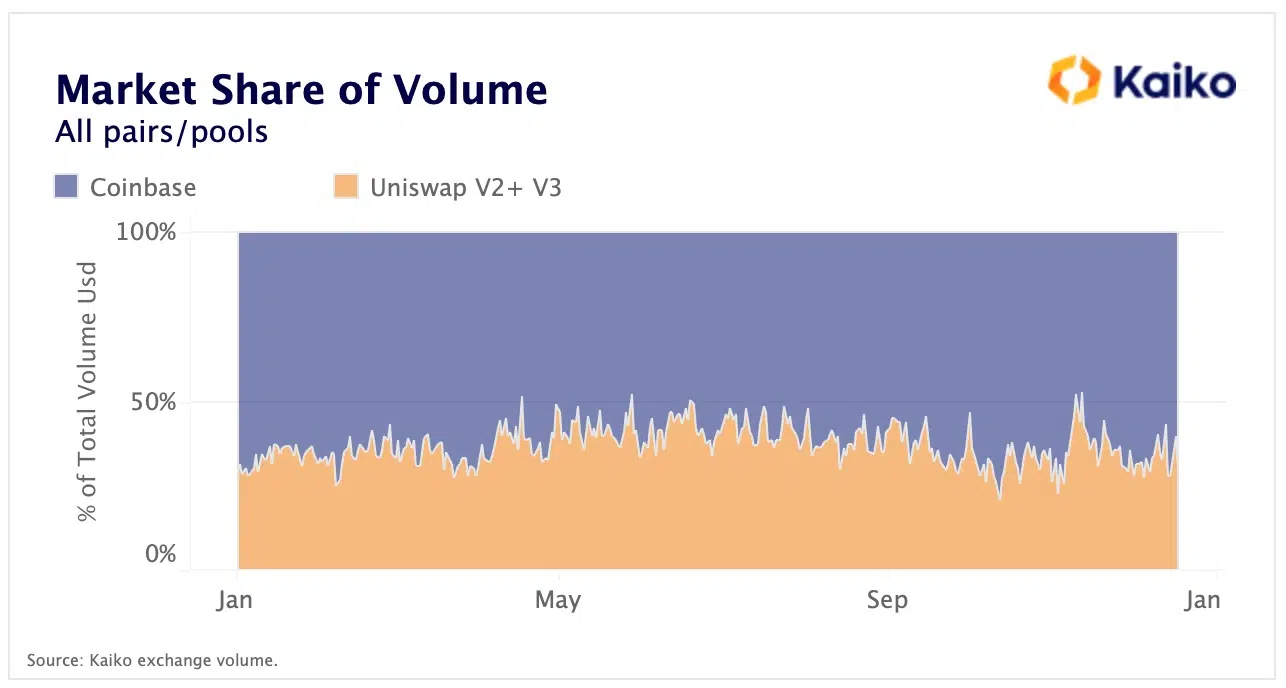

The largest Ethereum decentralized exchange (DEX) Uniswap has become a formidable competitor to centralized exchanges (CEX). This year, for the first time ever, its trading volume almost equaled that of Coinbase. Uniswap now accounts for more than 80% of Ethereum DEX volume.

The great Merge

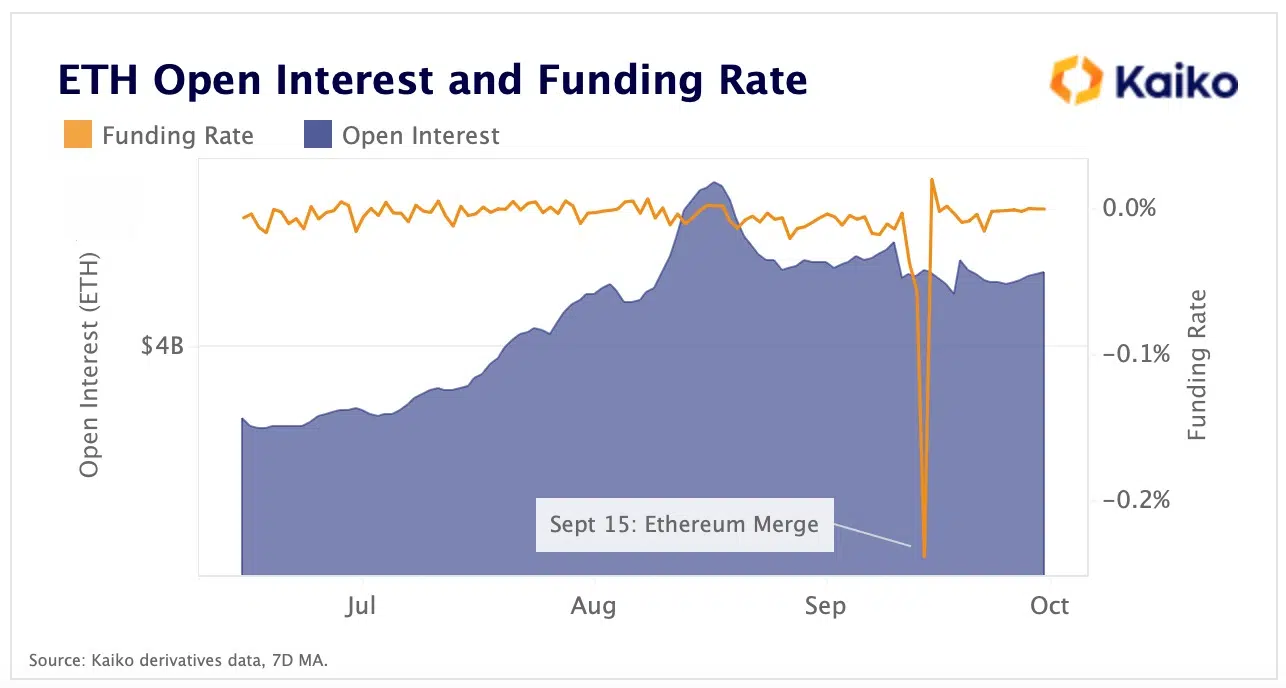

In 2022, the Ethereum network successfully transitioned to a Proof-of-Stake consensus mechanism, thereby reducing energy consumption by about 99% and removing the need for mining. In August, open interest in perpetual Ethereum futures reached an annual high of $6 billion, and funding rates were primarily positive.

Scam on a galactic scale

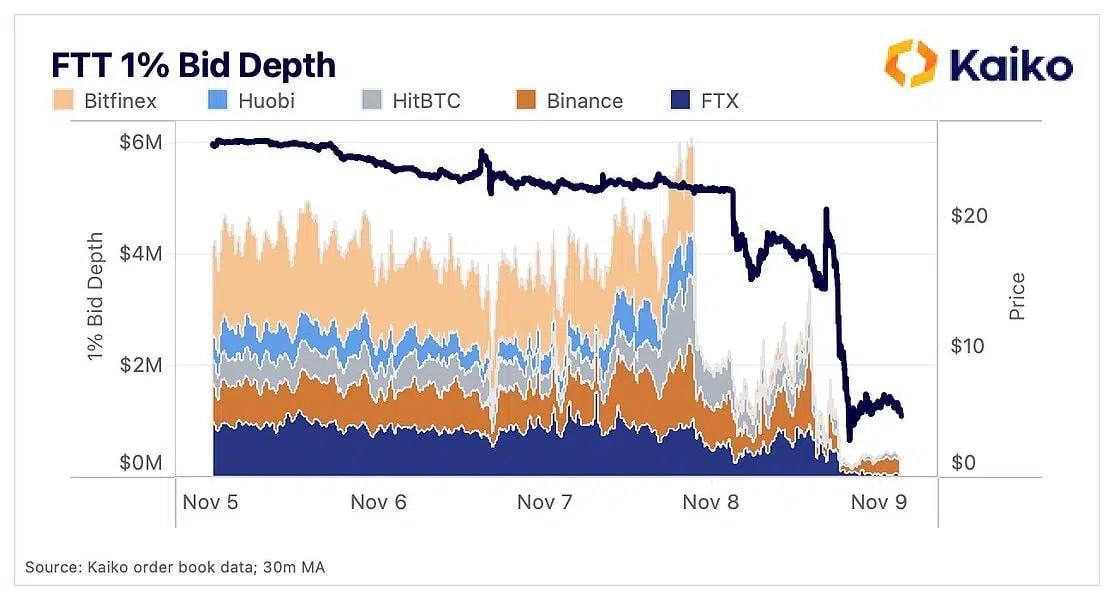

The FTX collapse was the largest in 2022 and the most publicized event in cryptocurrency history. Here’s what was happening to the market value of the exchange’s token, FTT.

BTC loses liquidity

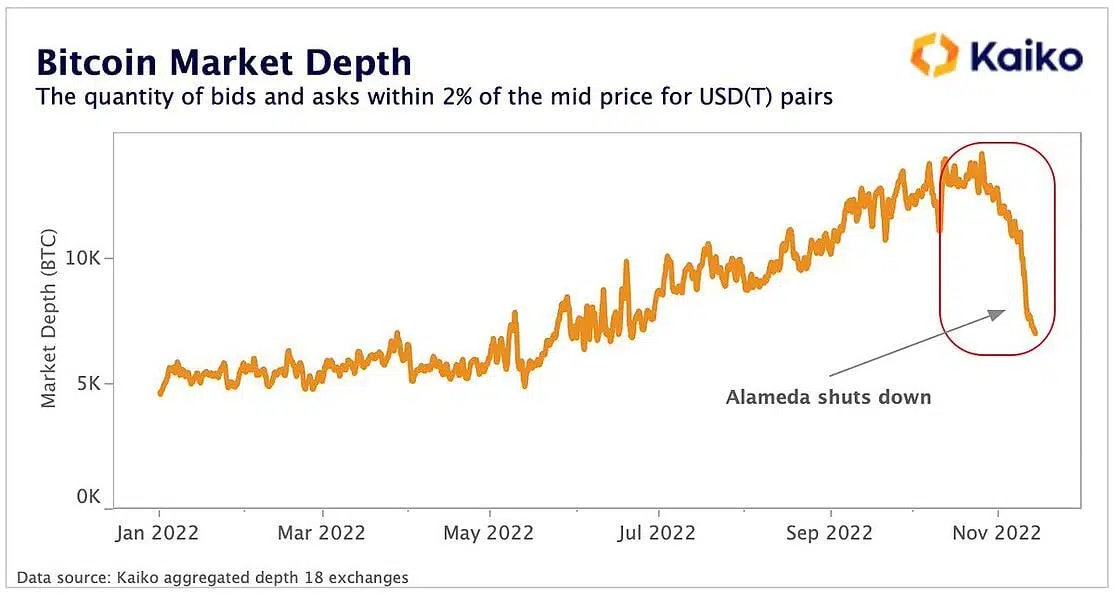

The cryptocurrency market is dominated by just a few market makers, including Wintermute, Amber Group, B2C2, Genesis, Cumberland, and the now defunct Alameda. Recall that about 130 companies in the FTX group, including Alameda Research, declared bankruptcy in the U.S. on November 11 after facing a “liquidity crisis.” The loss of one of the largest market makers has harmed the liquidity of the cryptocurrency markets.

Since November 2, BTC liquidity within 2% of the average price has fallen from 11,800 BTC to just 7,000 BTC, the lowest level since early June. BTC market depth on Kraken dropped 57%, Bitstamp dropped 32%, Binance dropped 25%, and Coinbase dropped 18%.

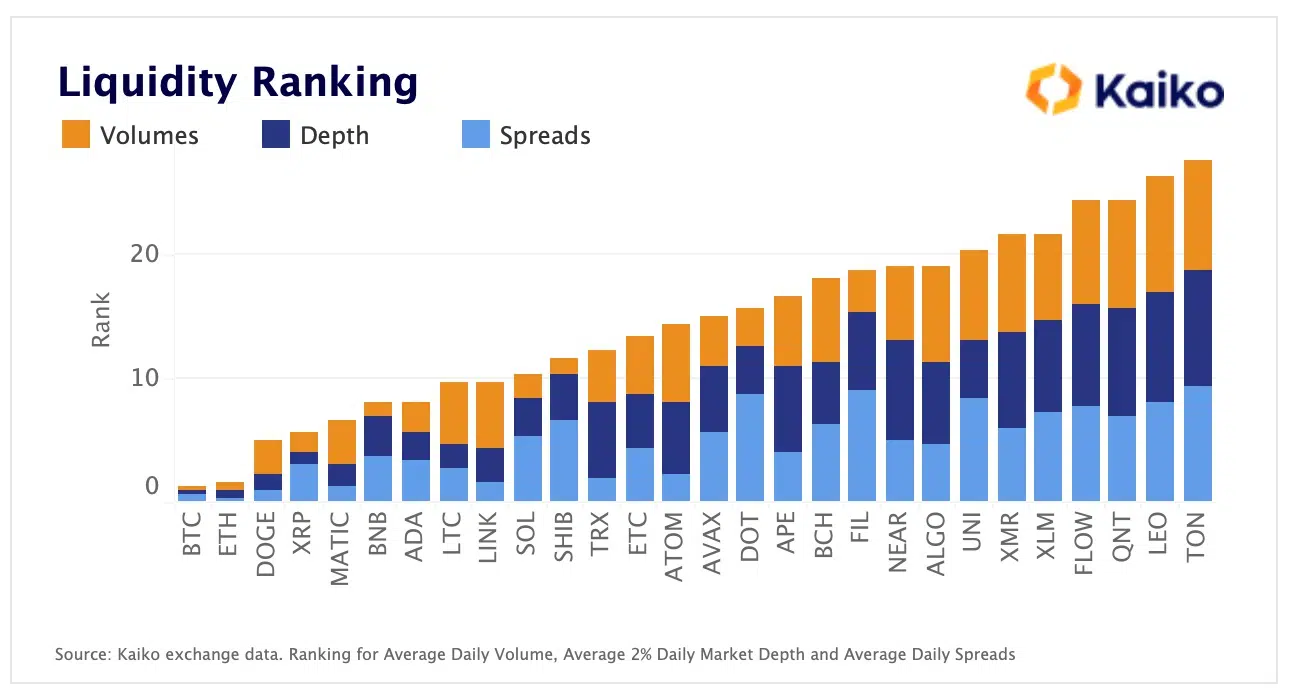

How do we evaluate assets now?

Alameda has distorted the value of numerous tokens on its balance sheet, which turned out to be virtually illiquid in the open markets. A more thorough approach to evaluating the value of tokens is needed, and liquidity should be one of the metrics investors will consider in the future to assess risk. Overall, the top 10 crypto assets attract 80% of total market liquidity.

Macroeconomics affects crypto

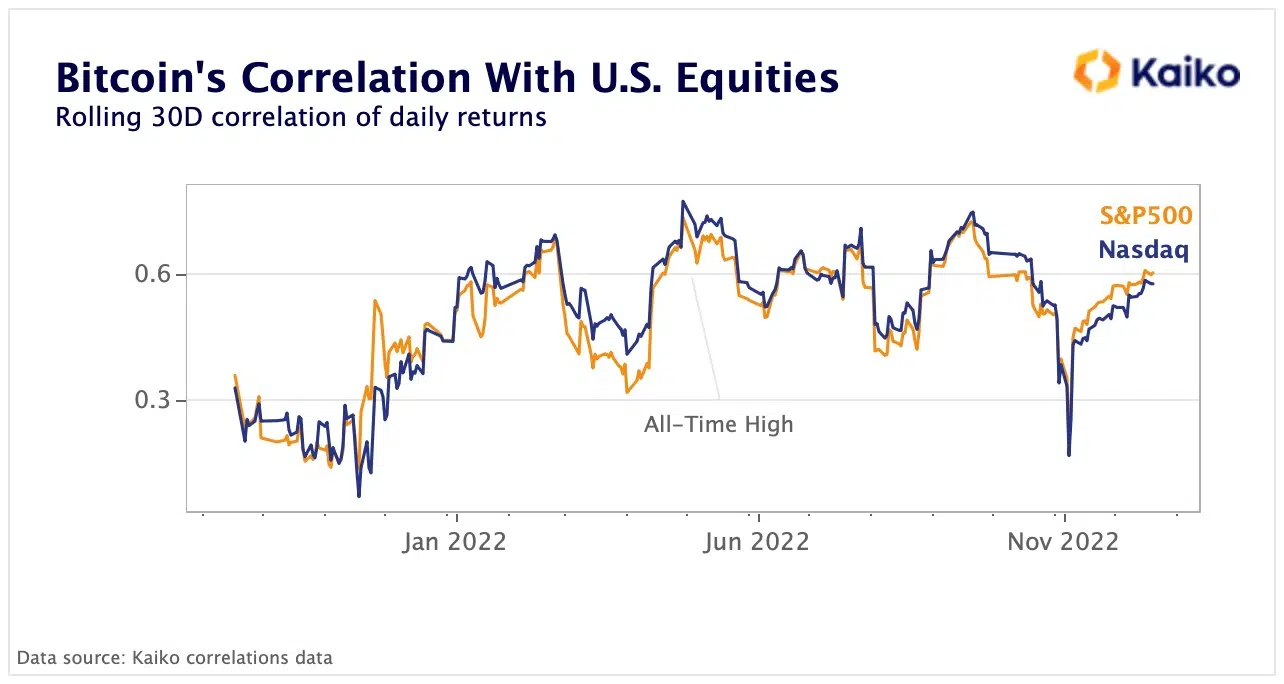

This year, the world’s central banks ended nearly a decade of loose monetary policy and raised rates. Risky assets sold off, registering double-digit losses, and the correlation between BTC and U.S. stocks hit a record high in April.

How can I make money on this?

The Kaiko researchers drew some important conclusions about crypto and how it has proven itself in 2022. You can look closely at the main events of the past year and learn important lessons from them that will help you at least not to lose savings in 2023.

Here are the key conclusions of 2022:

- Cryptocurrency has proven that it can be used in times of extreme uncertainty, especially for stablecoins, allowing citizens to avoid unstable currencies. The war in Ukraine also demonstrated how quickly sanctions and restrictions could curb the unwanted use of cryptocurrency.

- One has to be as careful as possible about how financially secure the exchanges are. In 2023, pay attention to what is happening with decentralized finance (DeFi) protocols. The Terra crash showed how important online data is when investigating warning signs about the state of a token or project.

- The stETH crypto token played a huge role in the collapse of Celsius and the broader credit crisis. It helped expose the problem of centralized platforms investing customer funds in high-risk DeFi protocols. So if the returns seem too good to be true, they probably are.

- Uncertainty about the strength of Binance’s financial fundamentals led to a $6 billion outflow in December, but the exchange held firm. But growing scrutiny from regulators and customers could reach a boiling point in 2023. People want full transparency!

- Centralized exchanges still dominate the cryptocurrency market. However, DEX is becoming increasingly competitive with CEX, especially after the collapse of FTX.

- Although the price of ETH fell after the merger, in the long run, the update paves the way for future scalability improvements and the development of Layer-2 projects built on top of Ethereum. But it has also heightened concerns about censorship.

- Liquidity is crucial, and it’s what let FTT down. The token’s market value exceeded $8 billion but slipped to zero. It seems that FTT was highly vulnerable because it had no utility, liquidity, or demand. Many people were not paying attention.

- Despite the decline in liquidity due to the collapse of FTX/Alameda, market makers are once again entering the markets. But now, they will be as scrupulous as possible in choosing the exchanges to entrust their funds. They will be more likely to look at regulated exchanges.

- Market value and fully diluted valuation are theoretical figures that do not accurately reflect the value of a token, especially if a large holder wants to cash out. This will have to be taken into consideration.

- Concerns about a global recession and liquidity squeezes will continue to weigh on risk assets. However, the U.S. Federal Reserve and other central banks are expected to slow the pace of rate hikes in 2023.