Stablecoins are crypto coins with fixed or stable prices. The most popular ones are connected to the USD price. Is there any sense in you using them? Or, what’s even more important — can you earn on them and how?

Let’s see.

What stablecoins are there?

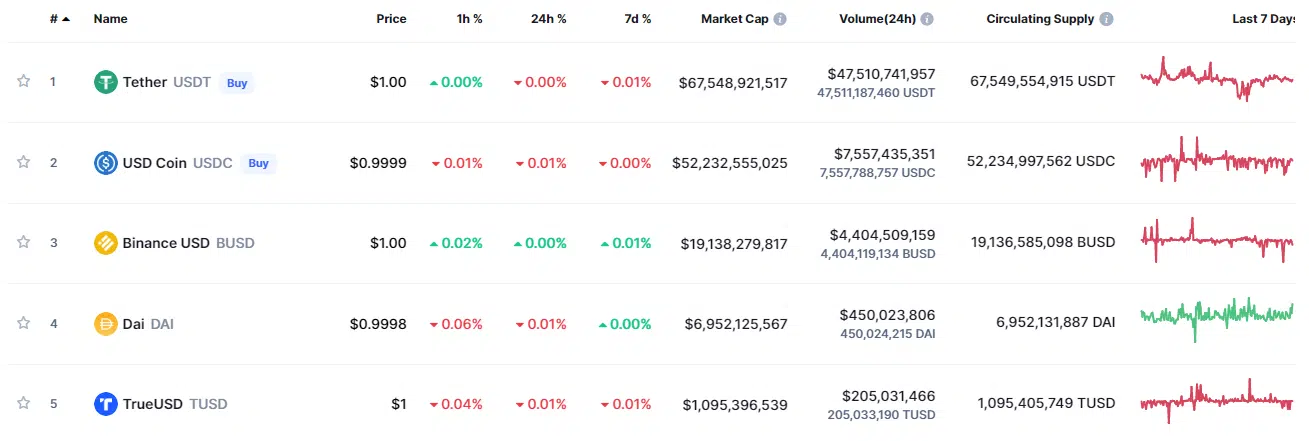

On CoinMarketCap, 132 stablecoins are present. The top 5 are USD stablecoins, with USDT by Tether in the first place.

But even if we look through the whole list, we will see the first non-USD stablecoin only in 16th place. This is STASIS EURO (EURS), connected to the EUR price.

We can also see that some stablecoins, like USDC or USDT, cost exactly $1, while others can be slightly (or even not slightly) different in price. And, of course, those who monitor crypto market news know the sad story of LUNA — a stablecoin that crashed.

The brand new newsletter with insights, market analysis and daily opportunities.

Let’s grow together!

So, how does it work? What guarantees the stability of a stablecoin?

It depends on the stablecoin type:

- Fiat-collateralized stablecoins form a reserve of fiat currency (dollar, euro, etc.) or precious metals to guarantee the price. This type includes USDT.

- Crypto-collateralized stablecoins also form a reserve, not fiat currency, but cryptocurrency. For example, the ETH reserve guarantees the value of the stablecoin DAI.

- Algorithmic stablecoins guarantee their price with the help of computer algorithms. This is similar to the price guarantee of fiat currencies with the difference that central banks have a public monetary policy. This gives them credibility. Algorithmic stablecoins don’t have this advantage, so they are more vulnerable in a crisis. A striking example is LUNA, which belongs to this type.

Okay, that’s clear. In the best case, one USD-stablecoin will equal $1. But the question arises: why invest in it if you can invest in regular fiat dollars?

Why invest in stablecoins?

The most straightforward answer to this question is that it is more convenient to pay with them than with regular dollars. Stablecoins have all the same advantages as other cryptocurrencies. Among other things, they are subject to different tax laws.

It’s also worth mentioning that many exchanges use them as intermediate currencies to convert one cryptocurrency to another. So you can buy stablecoins and not even know about it 🙂

This fact is also why stablecoins can be considered a way to earn money — exchanges and DeFi platforms are interested in them.

For example, Binance offers a 6% annualized interest rate for just keeping USDT in your account — like a deposit in the bank:

You can earn more by farming: when you lend your currency or put it in a liquidity pool — a cryptocurrency vault where a trader can quickly exchange one currency for another.

The DeFi platform PancakeSwap, for example, offers up to 38.91% for farming CAKE-BUSD. CAKE is the cryptocurrency of the platform itself.

Look for more opportunities to make money on exchanges and platforms in the Earn sections. Later we will publish a selection of platforms and exchanges with the best offers for you.