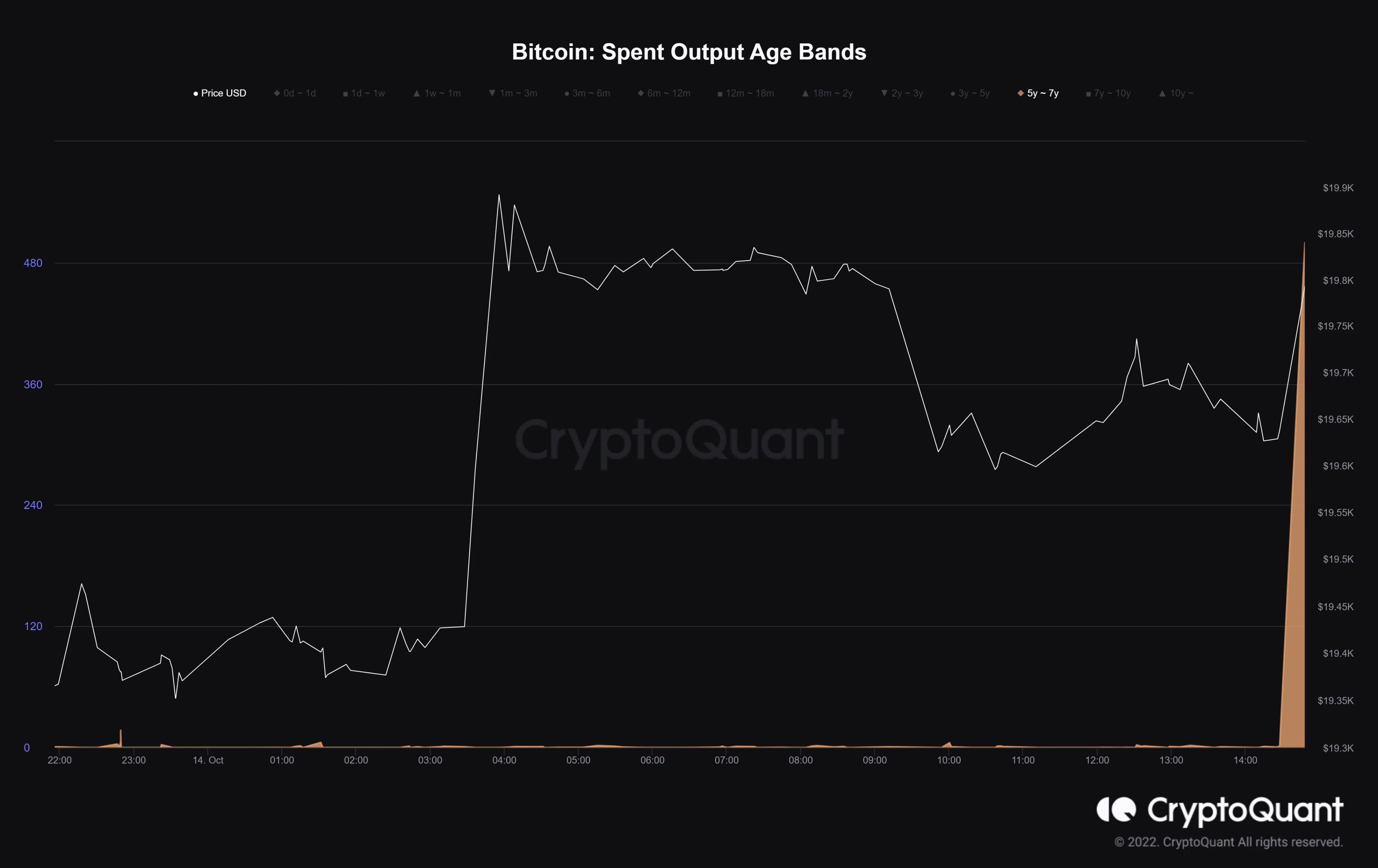

A Bitcoin whale made a transaction after more than five years of silence. That would be nice, but it’s about 500 BTC, which at the time of writing is about $9.6M. By global criteria, that’s not a huge amount, but the circulation of old coins is usually not a good sign. Read more about it below.

What is known?

The transaction was found by analyst JA_Maartun. According to him, the whale bought these coins between October 2015 and October 2017, that is, 5–7 years ago.

It is not yet clear what the owner of the coins plans to do with them, but there is an opinion that the transfer of old coins is a bad sign. Perhaps their holder wants to move funds to another wallet, but usually, the transfer means that hodler wants to sell the assets. If coins are being transferred to exchanges, it is unlikely that it is done for the purpose of reorganizing the wallet.

In this case, analysts did not record coin inflows to major crypto exchanges, that is, there was no huge leap in transaction time, which could indicate that it was a portfolio reorganization. For now, we can only guess where the displaced funds will go. Incidentally, experts detected a more powerful transfer in August, when more than 5,000 people began moving bitcoins that had been lying unused for more than seven years. Then they moved a total of ~5,000 BTC or $96M.

The brand new newsletter with insights, market analysis and daily opportunities.

Let’s grow together!

A bitcoin address that had been dormant for nearly nine years transferred the entire balance of 5,001.51 BTCs to a new wallet on August 28, with a floating profit of more than $96 million. Funding source: https://t.co/kvIFpdMnex

— Wu Blockchain (@WuBlockchain) August 29, 2022

Why is it so important?

Reddit user partymsl found out that more than 66% of the total bitcoin supply hasn’t moved in a year. This is a new record, which was recorded using the so-called illiquid supply metric (aka HODL metric).

This indicator is based on the number of coins that are not moved out of the wallet in a given period of time and in relation to the total supply on the market. The graph below shows the illiquid supply in relation to the value of Bitcoin.

According to the chart, illiquid supply falls during a bull market because many hodlers begin to lock in profits, and rises during a bear market because many begin to hold positions for the long term. partymsl noticed that now the rise in illiquid supply usually happens just before the last phase of a bear market decline, like in 2018, but in December 2021, when bitcoin was $49K, everyone thought that the rise in illiquid supply was indicative of a still going bull market.

It turns out that it is better not to use this metric to predict short-term prices, but in the long run it may turn out that the lack of frequent transactions is the beginning of the end of the bear market.

No matter how many transactions are made, the total number of bitcoins in circulation is limited by the number of coins mined. So, according to Satoshi Nakamoto’s whitepaper, there can be no more than 21 million. There is an assumption that for various reasons (for example, because people lose access to their wallets due to the loss of the seed phrase) 1–10% of the total number of bitcoins will remain in circulation. Whether this is true or not, we will not know yet, but we already know what will happen when all possible bitcoins are mined.