Contents

What’s new in the crypto market over the past 24 hours? We list the main events in the world as briefly as possible.

Controversial situation in the U.S. economy

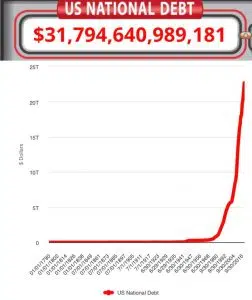

- BTC side movement continues: after yesterday’s small growth of BTC above $27k, today Bitcoin rolled back to $26k again. Analysts are inclined to be flat in the near future, as the positive scenario (a pause in rate growth) is already taken into account by the market. Now there is a need to follow the news on US government debt negotiations.

- But there’s been no positive news on the government debt, with Biden administration officials and Republicans saying there’s been no progress. And here are the first signs of the approaching U.S. debt shock: the U.S. Treasury has asked the government for permission to postpone all its payments due to a lack of funds starting next week.

- Added to that is the chaos of crypto regulation in the US: Ethereum falls under the scope of the US Securities and Exchange Commission (SEC) and the US Commodity Futures Trading Commission (CFTC) simultaneously, the regulators announced today. This confuses the situation even further, forcing crypto companies to leave U.S. jurisdiction until the situation is clarified.

CEX rating in 2023

Well-known analyst WuBlockchain released its ranking of cryptocurrency exchanges, breaking them down into segments by degree of influence:

The brand new newsletter with insights, market analysis and daily opportunities.

Let’s grow together!

- T0 — Binance

- T1 — Coinbase, OKX, Upbit

- T2 — Bybit, Kraken, Bitfinex, Deribit

- T3 — KuCoin, Bitget, MEXC, Gate

The rating is based on a set of factors: the impact on the market, trading volume, number of users, and estimated profitability of the exchange.

Old Grandpa transforms into a crypto hippie

Bitcoin seems to be undergoing some kind of unexpected transformation into something new, thanks to Ordinals/BRC20. And it’s not even about the fact that it entered the top 3 among blockchains distributing NFT (although a couple of months ago it seemed like a joke). In this thread, an expert describes fundamentally new features that may appear in BTC in the near future:

- BitStake Protocol. The first staking platform with a launchpad for BRC-20 tokens.

- Omnisat. This is the first BRC-20 AMM on Bitcoin.

- BRC721. The new advanced standard for NFT on Bitcoin.

So if you think the BRC20 ecosystem consists only of shitcoins and weird inscriptions, you’re wrong. Here are three projects in active development: two of them are building a real DeFi-platform on Bitcoin rails, while the last one implements the famous ERC-721 standard on the Bitcoin network.

There is a very interesting situation in Litecoin

Litecoin will soon have a halving at the end of July 2023. This will be a significant event for the Litecoin network. Every halving historically pushes prices to new records after some time.

But the situation is actually even more interesting. In May, the new LTC20 standard was launched, which leads to a gradual increase in the intensity of transactions on the blockchain, effectively creating a new market similar to BRC20.

Traditionally, Litecoin has shown patterns that were then repeated in Bitcoin, so halving LTC is worth taking a closer look at. Those who want to try to speculate on the halving should start entering LTC, because bigger speculators will start entering the coin as the event approaches.

To understand what opportunities halving gives, let’s look at the dynamics in the example of BTC: