Things are sad in the crypto mining industry — it is running on the edge (for example, the largest miner in the world is on the verge of bankruptcy and has already stopped paying its debts). CrуptoSlate shared its analysis of what’s going on in the mining industry, and we also looked into some opinions from ordinary miners on Twitter.

СryptoSlate: the sales-off will continue

We have already written about the very difficult situation in mining in the second half of 2022. Not much has changed since then — the situation is slowly getting worse.

According to CrуptoSlate, the total assets of the world’s nine largest publicly traded Bitcoin miners fell from 125,171 BTC in the second quarter to 102,407 BTC in the third quarter. Miners are losing revenue and resources due to the difficulty of mining and unprecedentedly high hash rates. In 2022, the average hash rate rose every quarter and analysts estimate it will rise even higher in the fourth quarter.

The brand new newsletter with insights, market analysis and daily opportunities.

Let’s grow together!

With Bitcoin at a constant price, this creates a lot of tension and uncertainty in the mining industry (we do not even consider the situation with Bitcoin falling because the consequences could be catastrophic).

#Bitcoin miners are at risk of bankruptcy because the average cost of mining 1 $BTC is higher than its current price. #Cardano doesn't have this problem and seems to be anti-fragile in the current economic crisis. https://t.co/lx7rwmseAE

— Cardanians (CRDN) (@Cardanians_io) November 1, 2022

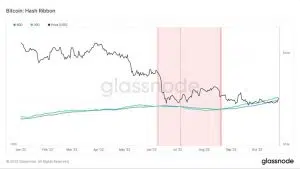

The Hash Ribbons indicator shows the so-called capitulation of miners. According to this important indicator, the maximum surrender usually ends when the 30-day line crosses the 60-day line — we have seen three such cases since the beginning of the year, shown by the dark red lines in the chart below.

If current conditions persist, we may see another wave of miner capitulation before the end of the year, which will create additional selling pressure on both miners and Bitcoins.

A visualization of the gradual decline in monthly Bitcoin mining revenues is shown in the chart below (keeping in mind that when revenues fall, costs on the contrary only rise):

What do ordinary miners say?

As an illustration that not all companies are able to live and work under such pressure, we can give a fresh example — the stocks of the world’s largest mining company Core Scientific have fallen by 70% in the last month. The company is on the verge of bankruptcy:

One of the world’s largest #bitcoin mining firms Core Scientific, is halting all debt financing payments – SEC Filing pic.twitter.com/iSlxCIgD2f

— Dylan LeClair 🟠 (@DylanLeClair_) October 27, 2022

On Twitter you can also read the opinions of some miners, because of the economic and energy crisis now it is more profitable to just buy Bitcoin, than to mine it:

Do we all reach out to our local power authorities and persuade them to take action now to help prepare for a financial crisis that would affect everyone? For the power company, this might be more effective than mining in acquiring bitcoin (cheaper to buy/accept it vs mine)

Another analyst from Twitter sums up that the increasing difficulty of Bitcoin mining (which will continue according to all forecasts) can kill the industry:

The increase in hash rate exacerbates the revenue side as it potentially decreases the relative hash rate contribution and therefore potential volume of mined coins.

Bitcoin Miner Iris Energy is close to default on $103m of loans made to special purpose vehicles by NYDIG.

The loans, which are secured by ASIC miners, have monthly principal and interest payment obligations or $7m/month while the miners generate $2m in monthly profit. pic.twitter.com/919Sdb1040

— Dylan LeClair 🟠 (@DylanLeClair_) November 2, 2022

Brief conclusion

To summarize, modern POS mining is all about risk, uncertainty and a very fragile state of affairs. The option of falling prices is not even possible to consider seriously, one can only hope for an increase in the price of Bitcoin. At the current price, it will continue to slowly die in the mining industry. And without mining, is Bitcoin itself possible? — is a rhetorical question.