Following investigations by the Swedish Tax Agency, it has been revealed that numerous crypto firms in Sweden utilized misleading business descriptions to evade tax obligations spanning from 2020 to 2023.

In light of these findings, Swedish crypto miners are facing a collective tax liability exceeding $90 million, stemming from four years of non-compliance with tax regulations.

The Swedish Tax Agency, known as Skatteverket, scrutinized the activities of 21 crypto-mining entities over the aforementioned period. It emerged that 18 of these firms submitted “misleading or incomplete” information in an attempt to exploit tax incentives.

Among the deceptive practices identified, some crypto firms misrepresented their business activities to evade value-added tax (VAT) on taxable operations. Others devised strategies to sidestep import duties on mining equipment and income tax on mining proceeds.

The brand new newsletter with insights, market analysis and daily opportunities.

Let’s grow together!

In a statement, the Swedish Tax Agency underscored the detrimental impact of such practices, noting that they result in the depletion of tax revenue through erroneous VAT payments, unreported crypto assets, and unpaid taxes.

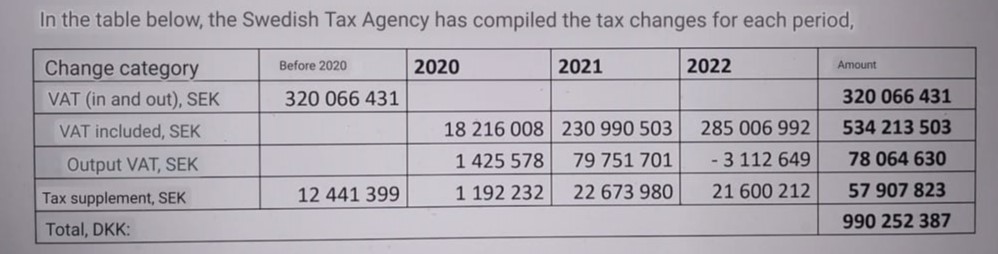

The crypto mining firms implicated are now obligated to settle their tax arrears, totaling over 990 million Swedish krona ($90 million). This encompasses outstanding VAT dues amounting to 932 million krona ($85.4 million) and additional tax penalties totaling approximately 57.9 million krona ($5.3 million).

Although some mining firms contested the tax demands, the administrative court upheld appeals from only two of them, with the rest rejected. The adjusted tax liabilities reflect the outcomes of these legal proceedings.

In a separate development, in November 2023, Hive Digital Technologies, a crypto mining company, expanded its operations in Sweden by acquiring a commercial property and data center in Boden. This move was characterized as a strategic step to enhance the company’s regional presence and reinforce its commitment to environmental sustainability and energy efficiency.

The newly acquired property will accommodate Hive’s next generation of ASIC servers, thereby bolstering its Bitcoin production capacity. Hive, which operates data centers in Canada, Sweden, and Iceland, emphasizes the use of renewable energy sources in its mining operations, aligning with principles of environmental responsibility and ESG (Environmental, Social, and Governance) criteria.