Contents

Today we decided to distract from the traditional monotonous economic news and another threat from the SEC. Instead, let’s take a look at an unusual way to invest in a market that is still at the beginning of its growth and therefore available for most people to enter. Using Rare Sats as an example, we’ll look at one facet of the fast-growing Ordinals market. We’ll also look at the Apple Vision Pro, whose success is very important to all Web3 enthusiasts (why? all explained later in the article).

What are rare sats or satributes?

Rare sats are satoshi separated from certain blocks, transactions, or BTC. Of course, there can be as many rare sats as you want; it all depends on the selection criteria and what sats crypto society would like to call rare or high value. In fact, this is a collection of specific art invented in the Bitcoin field.

At the moment, 6 groups of satributes are particularly valuable — they are unique digital exhibits from the history of blockchain’s life:

The brand new newsletter with insights, market analysis and daily opportunities.

Let’s grow together!

- Uncommon — the first sat of each block.

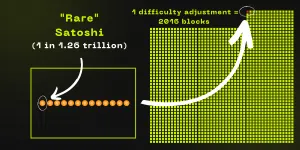

- Rare — the first sat of each era of increasing $BTC difficulty.

- Epic — the first sat of each halving era.

- Vintage — the sats that are mined in the first 1000 blocks.

- Nakamoto — one of the sats that Satoshi Nakamoto personally mined.

- First Transaction — one of the sats that were sent by Satoshi Nakamoto to Hal Finney on January 12, 2009. In fact, it is actually a piece of the first human-to-human transaction in the history of the Bitcoin blockchain.

What is sats hunting?

To find rare sats before, you had to install BitCore and dive into the search via the console. It’s a complicated, old-school option, but there simply weren’t any alternatives before. But now, in the Ordinals era, Web3 services that automate this search are starting to appear.

- SatScanner. The process is very simple; you have to go to the site and type in your wallet address. Then click on “Scan” and wait; the service will check the wallet for rare sats.

- Sating. This is a great scanner for rare sats. It works exactly like SatScanner, but Sating has one more very cool feature, which is the sats extractor. The service will help you transfer certain sats from your wallet to your other wallet. Thus, you will make yourself a “vault” with rare sats.

Usually, “sats hunting” looks like regular fishing; you just keep transferring your $BTC from exchange to your wallet and back so many times until you finally manage to capture rare sats on your next withdrawal. You will not be able to get it out of the exchange wallet on purpose because coins are randomly given out from the exchange’s liquidity pool. If you are going to do such fishing, it is better to research your exchange’s public wallets beforehand to see if there is anything valuable there at all.

The failures in this fishing are quite high due to randomness. And Bitcoin blockchain transactions are expensive, so the activity costs money (if you try a lot while fishing, this money will become significant).

What to do with rare sats?

You can make your own inscription on rare sats and sell them later for the price (or keep them in your collection). It is like having a diamond engraved. Some rare sats themselves buy out the famous NFT brands in order to release their inscription on this noble canvas.

The bad news is that this market is still too young, so what to do with rare sats is still open. Most prefer to just collect them or invest in HODL mode until this market matures and the big money comes in. The good news is that, according to the rapid evolution of Ordinals, that’s only a couple of years away.

Apple Vision rules?

Many have already called this product innovative and a breakthrough. We are not going to be subjective about the new Apple Vision Pro device, but just a couple of days after the release we suggest looking at the reaction of the stock market.

As you see, the price is strictly inside the “fat” channel, on a large timeframe looking like a flat. There is no trend breakout, which usually indicates a passive market reaction (but nothing like a revolutionary product). In our opinion, as the information noise cools down, a breakout of the lower channel to the area of $160 per share is very likely.

But what does this have to do with crypto? The fact is that all AR/VR solutions are closely related to the topic of metaverse; this is an important development trend in Web3 (incidentally, recently officially supported at the government level in China). It is the success or failure of such devices that will determine the metaverse’s fate, in which a huge amount of money is already being invested. Not only for the development of the universe itself but also for the purchase of virtual land and artifacts like NFT in various games.

Therefore, we recommend everyone who wants to invest in Web3 products related to the metaverse keep a close eye on the first sales figures of devices from Apple, which will appear in the next year. It’s a reliable indicator of what the chances of future success are for digital universes.

A new alternative for #BNB

Exchange tokens are traditionally considered a kind of analog of stablecoins, acting as collateral indirectly tied to the profits of a particular exchange. We have written many times that the specificity of exchanges is to generate money on commissions, which works the same way in a falling market as in a rising one. So investing in an exchange token is a proxy for investing in the exchange itself, which is available to everyone.

In light of the furious regulator’s attack on Binance, traders have begun exiting #BNB en masse and actively looking for a similar instrument. As we wrote at the beginning of the week, among all CEX exchanges, OKX gained the most in new users and capital inflows (running from attacks from Binance and Coinbase).

Another plus for OKX is its regular and super-powerful procedures to burn its exchange coins, taking quite large amounts out of circulation (the deflationary model). For example, yesterday OKX completed its 20th buyback from the market and burned #OKB for a total of about $260 million.

Given the above reasons, if you like exchange tokens and are a long-time fan of #BNB, you might want to look into #OKB.