The CEO and co-founder of popular exchange BitMEX, Arthur Hayes, explained who is pumping Bitcoin and Ethereum. The businessman’s statement appeared not without reason: during the last 24 hours, the digital assets market grew sharply, reaching a total capitalization of $1T. Find out what this is related to below.

What’s up with the cryptocurrency market?

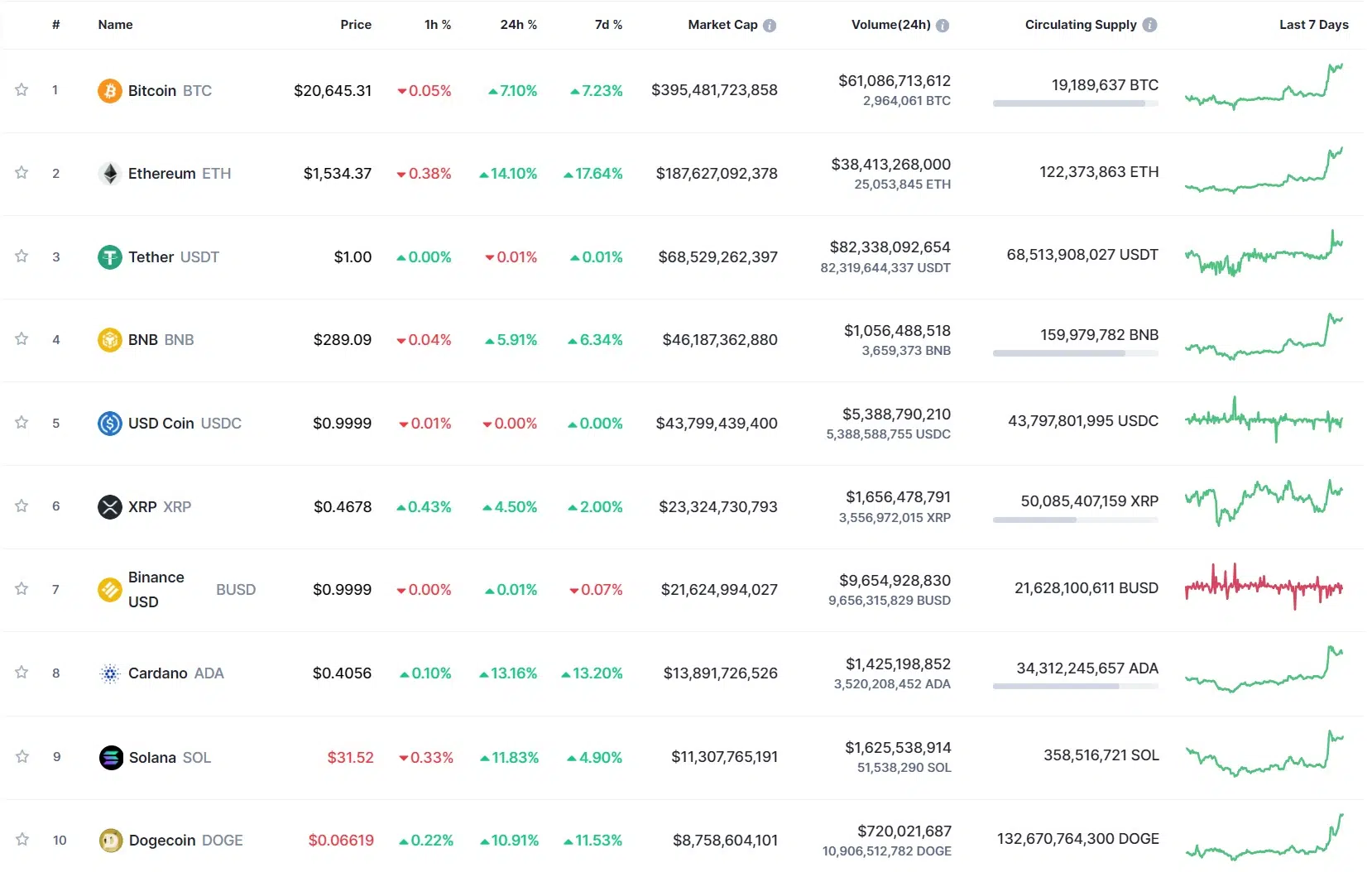

According to data gathered from CoinMarketCap, the value of cryptocurrencies has risen significantly over the past 24 hours in terms of total capitalization. The leaders of the leap were Bitcoin and Ethereum. The coins are trading at $20.64K and $1.53K at the time of writing, showing a growth of 7.14% and 14.19%, respectively.

It is also remarkable that Ethereum exceeded the mark of $1500: this is the first time the token has risen above the designated amount after The Merge. Such leaps upward have not been seen for a long time. Therefore, according to some experts, now, the most important thing for the bulls is to try to keep the market, which “contains a lot of technical and fundamental resistances,” in its current state.

Who pumps cryptocurrency and why?

BitMEX CEO Arthur Hayes tried to answer this question. According to him, the U.S. government is involved in the dramatic growth of cryptocurrencies.

The brand new newsletter with insights, market analysis and daily opportunities.

Let’s grow together!

1/

Guess who is pumping $BTC and $ETH pic.twitter.com/MIXh60PiIh— Arthur Hayes (@CryptoHayes) October 25, 2022

In particular, the businessman explained that the U.S. Treasury plans to put more Treasury bills on the market in order to reduce their deficit.

“Money Market Funds like short-term T-bills, but there aren’t enough so they park their money in the Fed’s reverse repo (RRP) facility [purchase of securities with the obligation to sell them back]. It earns a similar yield,” he said.

Globally, the mechanism of repo transactions involves the transfer of ownership of securities, which reduces the credit risk of this type of transaction compared with a deposit or secured loan and simplifies the resolution of situations in the event of default by one of the parties. But in the current cryptocurrency market environment, credit risk remains, Hayes says.

3/

Money Market Funds like short term T-bills, but there ain’t enough so they park their money in the Fed’s reverse repo facility. It earns a similar yield. Credit risk is also a factor, but let’s keep this simple for twitter.— Arthur Hayes (@CryptoHayes) October 25, 2022

Hayes is also convinced that money in RRPs is “dead money” that cannot be used by the banking system. By contrast, the money in treasury bills is “alive” and can be used to add to the financial assets exposed to the aforementioned risk. According to the businessman, there is about $2.2T in the Fed’s RRP program, and if that amount is reduced, the market will continue to rise, but it is not that simple.

“RRP balances are slightly down over the last month, but the market is clearly anticipating this buy back operation to push RRP balances much lower. And this is why everything that depends on dollar liquidity is ripping hard to the upside,” Arthur Hayes explains.

However, he also added that there have never been any such repurchases and reissuances of new Treasury bills in circulation. And if the authorities’ plan collapses, we won’t be laughing.

8/

These buy backs and re-issues of new on-the-run T-bills have not actually happened yet. If this is just a trial balloon and it pops, make sure to put on your adult diaper for the reversal.— Arthur Hayes (@CryptoHayes) October 25, 2022

You can also read buidlbee’s article on Arthur Hayes and his “theory of everything”, in which he explains why crypto winter began and how it will end.