Contents

The crypto market collapsed, we hear bankruptcy stories from every news item, and everything is terrible. But it turns out that there is one industry in the current crypto winter where things are not so bad at all. You might have heard of it or even experienced some of its projects first-hand if you’re a gamer. It is NFT/GameFi.

Today we’ve put together three analytical reports that show, with a lot of numbers and facts, that fun and profit still rule in this segment of the market.

DappRadar: General Conclusions

Summarizing Q2 2022, which came during the crypto winter, DappRadar released several reports for different sectors of the crypto industry. One of the most striking conclusions is that NFT and GameFi are the most resistant to the crypto crisis — despite the decline in related sectors, there is still growth in this area.

The brand new newsletter with insights, market analysis and daily opportunities.

Let’s grow together!

This latest DappRadar report says that the number of blockchain games grew by 9.51% in six months. Investors invested $2.5 billion in GameFi in the first and second quarters of 2022.

DappRadar’s CEO Skirmantas Januskas said June would go down in history as the worst month for the crypto industry. Even the blockchain gaming space felt the pain, registering the lowest monthly investment of $500 million; nevertheless, there is a rapid recovery.

Skirmantas Januskas commented on the current situation:

“We think that blockchain gaming is going to be key in the next two or three years and is going to bring at least 100 million new users into crypto, for one simple reason, they connect NFTs and DeFi. With all three combined, blockchain gaming, NFTs and DeFi you will see something genuinely new and exciting.”

The report notes a 7% decline in user wallet activity (UAW) since the first quarter. Users continue interacting with decentralized blockchain applications at about the same rate as before the Terra default. At the same time, the total number of transactions sent to smart contracts in the gaming sector is much higher than in other categories, such as DeFi, exchanges and marketplaces.

Blockchain/Dapps Leaders In Bear Market

In July, gaming transaction volume remained at over $24 million daily. DappRadar notes that Solana has attracted many NFT game developers as well. This trend can be attributed to low-cost transactions and efficient processing speeds. Despite numerous network outages and annoyance with its users, total blockchain activity has increased by 311% this year.

Another leader in its group is WAX, around which a “vibrant gaming community” has gathered. Its blockchain activity has been up 6% since May. The next leader, Decentraland, has reported qualitative growth in its demographic — the biggest player increase is in highly developed countries such as the U.S., Austria, Germany, Iceland and Liechtenstein.

Axie Infinity has managed to attract new users in Central and South America, rounding out the list of leaders.

Axie Infinity, the developer of the popular blockchain game, is working on expanding the Ronin network, as well as improving its security, according to the news. This second-tier Ethereum blockchain solution avoids high commissions when exchanging NFT earned in the game, for which new network nodes will be launched.

DappRadar also noted the Sandbox multiverse is rapidly gaining popularity in China.

DappRadar: Key Takeaways

We have compiled some interesting insights from recent DappRadar reports:

- While NFT Trading Volume and Transaction Count have receded by a third from Q1, interest in regions like North America, Oceania, and some parts of Europe remains high.

- Axie Infinity is the top searched NFT collection in 112 countries.

- Blockchain games transactions defied the bear market and grew by 9.51% since Q1.

- Investments into games and metaverse projects remain constant at $2.5 billion invested in Q1 and Q2.

- Game decentralized applications (dApps) currently account for 52% of the blockchain industry.

- Early players such as YGG have earned remarkable profits due to their early access to seed funding.

- VC investments remain strong, with $2.5 billion committed in Q2. Total 2022 investment is already outpacing the 2021 total by 33%.

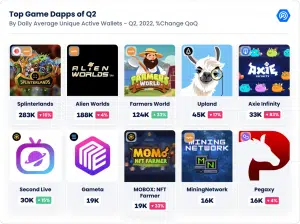

- Splinterlands remains the most played blockchain game with a daily average of 283,729 Unique Active Wallets (UAW) during Q2. Due to a revamp of the reward structure, the game saw 61% fewer UAWs in June.

- Despite a reduction of 29% in organic sales of NFTs since Q1, gaming NFTs saw a 19% increase in sales count year-over-year.

- Virtual Worlds’ NFT trading volume is up by 97%, and sales have increased by 27% since last quarter.

- NFT blue-chip collections appreciated in June, proving their status as assets capable of storing value.

Forecast For The Future Of GameFi

At the end of July, two other remarkable reports were also released, the data overlapping and confirming the report from DappRadar.

Blockchain-based games are going to be one of the best ways to attract new users to crypto because of the severe recession in the cryptocurrency market, according to experts from analytics company Absolute Reports.

Absolute Reports published its forecast for the rapid growth of the GameFi industry over the next six years. The NFT-based industry (Play-to-Earn NFT Games Market) will grow to $2.8 billion from 2022 to 2028. Moreover, the industry’s annual market capitalization growth rate will be 20.4% over the same six-year period.

According to Absolute Reports’ forecast report, the recession has left a few dozen projects in the cryptocurrency market that can continue driving the GameFi industry. Analysts singled out companies like Decentraland, Dapper Labs, Sky Mavis, The Sandbox and Immutable in the first place.

The Rich Get Richer, The Poor Get Poorer

Another interesting study was published by Civic Science, which states that low-income investors have sold the most cryptocurrency assets lately. However, 54% of cryptocurrency owners have weathered the storm by not cashing out their crypto assets. So who are these lucky people?

Through a survey of 1,000 investors, Civic Science concluded that most cryptocurrency holders with incomes over $150,000 a year kept their crypto assets during the market crash. Whereas, people with less income showed nervousness and lack of safety margin, they were forced to sell their crypto at a loss.

Thus, the lack of a good current income blocks the opportunity to implement an investor’s long-term strategy, leading to an even greater loss of money when investing than if such a person had not invested. Experts state the truth of life: during the crypto winter, money is gradually distributed from small ruined investors into the hands of large cryptocurrency holders.