Contents

Consider paying a reasonable price for a piece of digital artwork on the Internet and receiving a unique digital token that validates your ownership of the artwork. Wouldn’t that be amazing? That chance is now available, thanks to NFTs. They are currently sweeping the digital art and collectibles industry.

Just as everyone thought, While Bitcoin was the digital currency version, NFTs are now being pushed as the digital equivalent of collectibles. As a result of the large sales to a new crypto audience, digital artists’ livelihoods are altering. In this post, we will look at all of the information available about NFTs. Let’s get started and see what all the fuss is about!

What are NFTs?

Non-fungible tokens (NFTs) are frequently created using the same programming type as cryptocurrencies. These cryptographic assets are built on blockchain technology. They cannot be swapped or traded in the same way that other cryptographic assets may.

The brand new newsletter with insights, market analysis and daily opportunities.

Let’s grow together!

NFT proponents assert that NFTs give a public certificate of authenticity or proof of ownership, although the legal rights conveyed by an NFT are only sometimes clear. The blockchain defines ownership of an NFT as having no inherent legal meaning. It does not grant copyright, intellectual property rights, and other legal rights to the digital file with which it is connected. An NFT does not prevent its linked digital file from being shared or copied, nor does it prevent the production of NFTs that reference the same file.

What are the Characteristics of Non-Fungible Tokens?

As previously noted, each NFT is unique. Four main elements describe this uniqueness:

- The sole creator

When an NFT is generated, it is “signed” by the inventor. By interacting with a “smart contract” (a blockchain contract), the author will initiate a blockchain event, allowing time stamping and the creation of the NFT in an unalterable manner.

To provide a more meaningful image of this signature via blockchain, consider it the equivalent of a painter’s signature on a painting. This signature distinguishes the original from the reproductions.

- The content

The NFT’s identifier and content are two different pieces. The identification is defined at creation and is unchangeable, ensuring the NFT’s “identity.” The content is also defined during creation. However, it can be changed whole or partially. On the content side, the formats vary: it might be an image, a video, a document, or something else. In most circumstances, the NFT’s content will not be changeable.

However, in rare situations, the content may be altered. The owner can qualify it and enter information “on the NFT” within the blockchain. For example, I can hold an NFT that corresponds to a physical thing and qualify its content with its present state based on its wear.

Thus, the value of an NFT is determined by its unique and immutable identification rather than its content.

- The current ownership

The last feature of the NFT that will be used to characterize it is its present owner. Indeed, the transfer between two blockchain wallets will reveal the last owner of the NFT. Employing time-stamped blockchain transactions makes it feasible to identify all of the owners in chronological order. Certain rights, but also certain liabilities, flow from this transfer of ownership.

- The unalterable identifier

Its identification is the equivalent of the NFT’s identity card number. This unmodifiable and unalterable sequence of numbers or letters will be used to identify an NFT on a blockchain. To use a physical analogy, this equates to a unique serial number.

How do Non-Fungible Tokens work?

NFTs are created by a process known as minting, in which the NFT’s information is broadcast on a blockchain. At a high level, the minting process involves the creation of a new block, validating the NFT’s information by a validator, and recording the information. This minting procedure frequently includes incorporating smart contracts that assign ownership and control the NFT’s transferability.

Tokens are issued with a unique identification directly connected to a blockchain address. Each token has an owner, and the owner’s information (i.e., the address where the minted token is kept) is public. Even if 5,000 NFTs of the same object (for example, general admission tickets to a music festival) are minted, each ticket has a unique identity and can be differentiated from the others.

Most NFTs are part of the Ethereum blockchain at a high level, while other blockchains have developed their form of NFTs. Ethereum, like bitcoin or dogecoin, is a cryptocurrency, but its blockchain also keeps an account of who owns and trades NFTs.

Types of NFT

Non-fungible tokens have a plethora of potential applications (NFTs). However, because we are still in the early phases of the non-fungible period, it may be some time before we see large-scale projects that are tied to something other than art in some manner. NFT projects now often fall into one of seven categories. Everything you need to know about them is right here.

- Avatars and PFPs

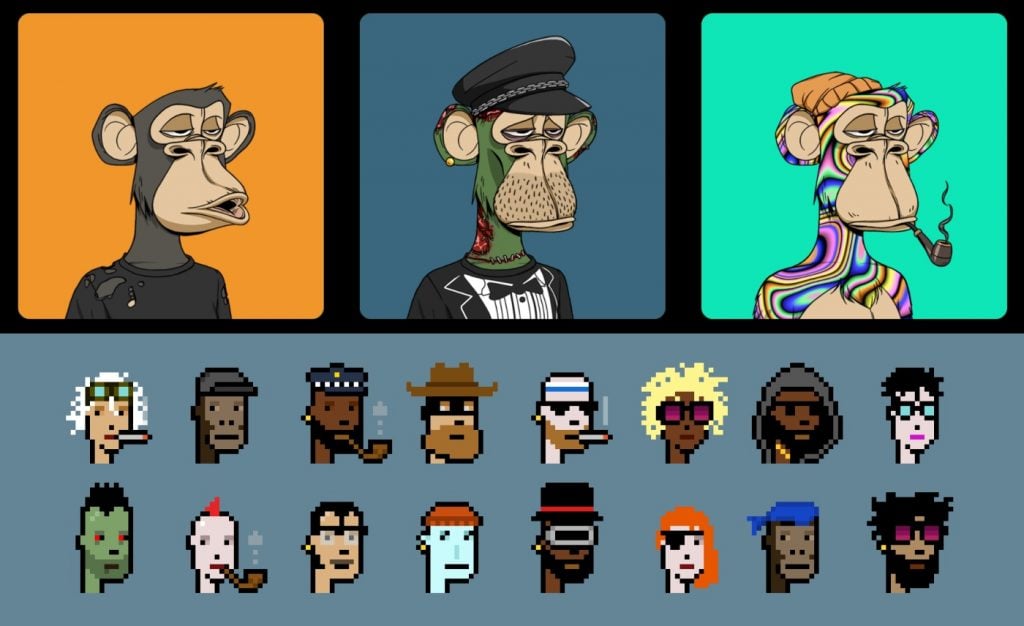

Most internet users outside of the NFT world think of this format when they think about NFTs. That’s on purpose: a quick Twitter search for ‘NFTs’ reveals a flood of replies from users with avatars like Bored Apes, CryptoPunks, Cool Cats, Doodles, and all its offshoots and spinoffs.

PFP and avatar NFT owners can use them on their social media pages, most commonly as a digital flex. Online flexing has one massive benefit for the greater NFT community: free advertising for NFTs. Several celebrities have added PFP NFTs to their social media profiles since the NFT boom of 2021.

- One-of-one (1/1) artwork

During the minting step of NFTs, authors can divide their work into various editions that differ exclusively on the blockchain. This means several editions of the same item may be aesthetically identical yet have different edition numbers or token IDs.

While this is a great way to increase an artist’s availability, some artists mint their work as a one-of-one NFT. Going this route means that only one person can own the object at any time, increasing its value on the open market.

- Generative art

Generative art is precisely what it sounds like: art created by a computer in some way. While most works are generated by a generative algorithm or artificial intelligence (AI), some are created by robots.

Because of NFTs, generative art has enjoyed a revival and market boom, with initiatives such as Art Blocks, Autoglyphs, and Braindrops pushing the art form’s boundaries. Some projects use generative art to make NFT products for writers, providing them with a strong entry point into the realm.

- Collectibles

The recent surge in the sports trading card and memorabilia market did not happen overnight. It’s also happening online, as efforts like NBA Top Shot demonstrate. Despite that project’s well-documented ups and downs, collectibles remain a viable format for NFT projects, especially when tied to already-popular IP.

NFT collectibles, like their real-world equivalents, can vary in rarity and value. This makes them appealing to enthusiasts and collectors, who are ready to spend a lot of money to complete their collections.

- Utility tokens

Tokens in this category are used as an internal mechanism to perform actions in a specific system. For example, you can use tokens to buy X or Y in a game or elsewhere. They are not meant to be an investment. So if you want to profit by short-selling or something like that, it probably could be a better idea because they do not have value outside the ecosystem where they were created.

Reasons for NFTs Selling for money

NFTs are not a new phenomenon. They have been around for the last two years, and there has been a lot of interest in them, which is why they continue to grow in popularity. This post will explain why people opt to sell their NFTs for money.

More and more people are opting to sell their NFTs because they believe that blockchain technology is a good investment opportunity, so they’re jumping on it as soon as possible before it becomes too mainstream and people stop investing in it. Some might also be concerned about being late adopters, which means being reluctant to learn new skill sets or technological advances to do something new. But, only some people are a good fit for the blockchain, and even if they were to sell their NFTs, they might need to gain the skill set necessary to handle blockchain technology.

Some wish to sell their NFTs because they don’t want any more responsibility than they already have. Other reasons include the following:

- They don’t want to be limited to what NFTs they can own and, therefore, would rather sell their NFTs and accept a buyout price.

- They don’t want to be limited by owning less than a certain number of specific NFTs.

- They are worried about the competition from other people who have NFTs and, therefore, would rather sell their NFTs for money.

- They need more time to learn new technology and are therefore selling their NFTs for money instead of trying to learn how to use blockchain technology.

- They think owning NFTs can be intensive work, and they’d rather work fewer hours than they currently do. So, they’d rather sell their NFTs for money and make a living doing something else instead of working hard to build up their digital assets.

History of NFTs

The early NFTs were not PFP collections like today’s popular ones. Instead, they were Colored Coins, which were little pieces of Bitcoins intended to symbolize ownership of various types of real-world properties. Here’s a sampling of what individuals bought with Colored Coins:

- Metals of value

- Government holdings

- Cars

- Digital artifacts

- Digital channel access

- Other digital currencies

Colored Coins had (and still have!) a variety of purposes, and while they were a novel aspect of the Bitcoin blockchain and the beginning of NFTs, they were not without problems. Despite these shortcomings, Colored Coins paved the way for what was to come in the NFT realm.

In 2014, engineers Robert Dermody, Adam Krellenstein, and Evan Wagner initiated a new stage in advancing the crypto and NFT lifecycles.

Spells of Genesis was released in 2015 and quickly became very famous.

Force of Will began selling trading cards in 2016.

Rare Pepes, a meme, gained enormous traction on the blockchain in 2016.

The CryptoKitties mania began in 2017 when Axiom Zen debuted them during the largest Ethereum ecosystem hackathon. This announcement was an instant hit with guests, and the popularity grew as the market heated up, driving the current state of crypto hype.

What are NFTs used for?

Non-fungible tokens (NFTs) saw a significant increase in demand in mid-2021. The sheer adaptability of NFTs, which allows the technology to be deployed in various use cases across industries, is driving this demand. Among the essential applications of NFTs are:

- Play-to-Earn (P2E) gaming model support.

Because they enable non-duplicable in-game assets, digital collectibles are the most widespread use of non-fungible tokens. Players can gain items with intrinsic worth as they go through the levels and then trade or sell them afterward.

- Creating genuine digital art ownership.

Artists worldwide can convert their graphical designs, digital artwork, or photographs into an NFT that can be purchased and sold.

- Getting rid of music industry fraud.

Non-fungible tokens enable musicians to sell digital music files directly to their audience. NFTs can be set to limit revenue sharing to a certain amount and no more, guaranteeing that the artist’s rights are not infringed upon.

NFT Benefits

NFTs are unique assets that any other type cannot replace. In video games, digital things are relatively frequent. The problem is that they aren’t limited to a single title. These are typically linked to the platform they were built on, so anyone interested in purchasing them must use a broker to connect them with the vendor. This problem is handled by NFTs, allowing users to easily trade their favorite products across multiple games and purchase and sell them.

Another benefit of NFTs is that they allow users to customize existing and new assets. Everything is dependent on the smart contracts used to build NFTs. This technology feature gives users complete control over each token, letting them change everything from the color scheme to the logo.

Also, NFTs are primarily intended for online trading, although they can also be used in the same way as actual currency. The issue with cryptocurrencies is that their value fluctuates and is not steady. Meanwhile, NFTs are linked to real-world items with some monetary worth.

Conclusion

With the NFT craze showing no sign of slowing down, investors should expect significant gains, making it a viable alternative to traditional asset classes. Along with the benefits come the disadvantages of consumers being cheated out of their money through problems such as wash trading, phishing, and others. Users must exercise caution and conduct thorough research before investing in such brands.