3 Arrows Capital (3AC) cryptocurrency hedge fund co-founder Zhu Su claims DCG a venture capital company focusing on the digital currency market and the FTX exchange conspired to attack LUNA

Terra Lab’s native token. Before the crash in May 2022, it was the network’s staking and governance asset and stETH

an ERC-20 token that provides a stake in ETH 2.0 stacking and can be used in Lido liquid staking protocol. If this is true, you can say that FTX has already been penalized: the company has filed for bankruptcy, and its head has appeared in court. According to Zhu, the same thing is about to happen to DCG.

What we know

In his thread, the co-founder of the bankrupt hedge fund explained that FTX head Sam Bankman-Fried (SBF) and DCG CEO Barry Silbert were very close. For example, SBF was one of the board members at Genesis, which is a subsidiary of DCG. Guess who later approved FTX’s first FTTFTX’s native coin-backed loan? That’s right. It was Genesis. It was also them that received billions of FTTs from Alameda Research and FTX in 2022.

Now, according to Zhu, DCG is worthless. In addition, FTX creditors have information about a fraudulent transfer to return the capital of Alameda to Genesis. Because of this, creditors will soon drive DCG into bankruptcy and take its remaining assets. However, there is a possibility that Barry Silbert will be asked to return the money to the creditors on his own to end the case without going to court. Whether he will take such a step remains unclear.

Here’s rough summary of dcg situation

1) they conspired w FTX to attack Luna and steth and made a fair bit doing so

2) they took substantial losses in the summer from our bankruptcy as well as Babel, and other firms involved in gbtc

3) they could’ve calmly restructured then

— Zhu Su (@zhusu) January 3, 2023

The brand new newsletter with insights, market analysis and daily opportunities.

Let’s grow together!

Zhu pointed out that DCG incurred losses after companies that participated in its bitcoin trust Grayscale collapsed. But instead of restructuring its business, the company, having decided that the crisis in the market would soon pass, continued to operate despite insolvency.

“Instead, they [DCG] fabricated a left pocket right pocket callable promissory note that magically filled the hole. This is like a kid losing at poker and saying, ‘I am fine, my dad will pay you, let me keep playing,’ but if your dad is yourself.”

3AC themselves filed for bankruptcy in July 2022 after a notice of default for failure to pay a loan to Voyager Digital. In total, the cryptocurrency broker loaned the hedge fund 15,250 BTC (~$255M at the time of writing) and $350M USDC.

DCG’s trail

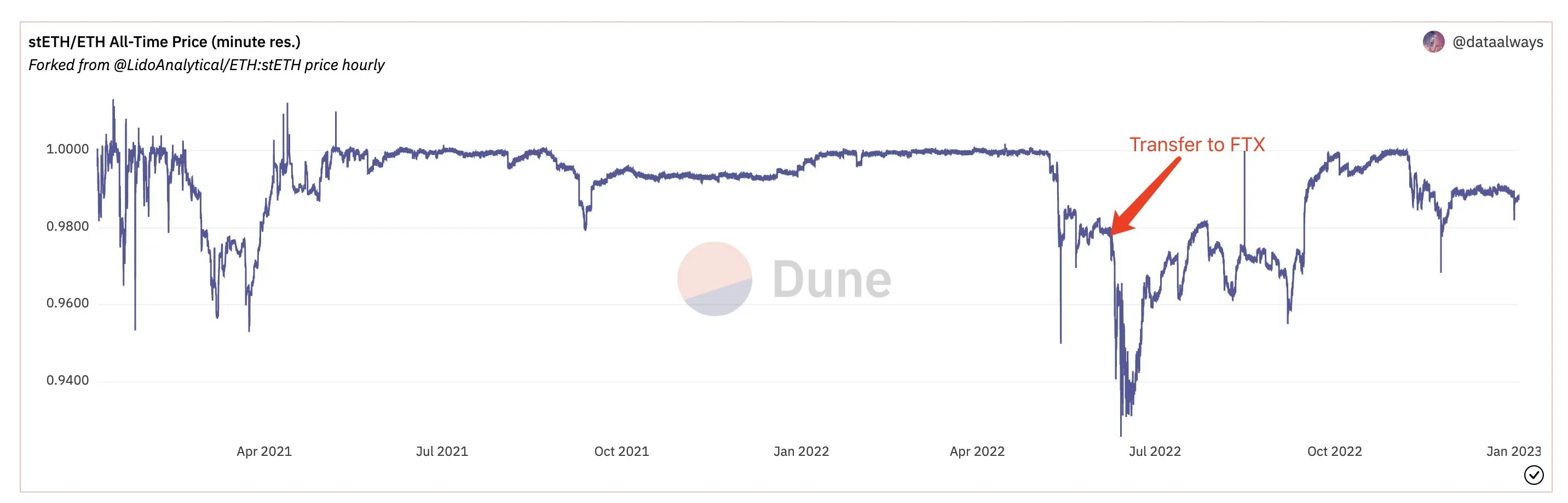

The possible involvement of DCG and FTX in the collapse of LUNA and stETH was also noticed by Lookonchain analysts. Specialists noticed that the cancellation of stETH/ETH binding could be related to the actions of SFB.

According to Lookonchain, after the collapse of UST/LUNA, an unknown person withdrew 110,286 stETH (~$131M) from Anchor Protocol and transferred all funds to an FTX account. After that stETH/ETH began to depeg [the phenomenon in which a stablecoin deviates from its intended peg].

“The address ‘0xd5c6’ is a new address and received 12 ETH from FTX as a gas fee. After transferring all stETH to FTX, someone transferred the remaining 10,5 ETH back to FTX,” researchers noted.

In addition, they said that they cannot be sure that the address belongs to SBF, but “it is very likely.”

Su Zhu, the founder of 3AC, tweeted that #DCG and #FTX conspired to attack #LUNA and $stETH.

Is the depegging of stETH/ETH in June related to #FTX?

1.🧵

Let’s try to find some evidence on chain. pic.twitter.com/ocBUCLjqtW— Lookonchain (@lookonchain) January 3, 2023

How can I make money on this?

We have previously reported about SBF’s possible involvement in the collapse of LUNA. Now the market manipulation is being investigated by the New York prosecutor’s office. Terraform Labs CEO Do Kwon reacted to the news of the investigation. Specifically, he said that Genesis Trading should come clean about whether it provided $1B UST to FTX or Alameda before Terra collapsed.

If SBF’s involvement in the Terra collapse is confirmed, it could restore confidence in LUNA, which would increase its value. However, so far, it is imperceptible. Over the last 24 hours, the coin has fallen in value by 100%.

As we reported above, the stETH token is issued by decentralized finance and staking protocol Lido. Therefore it makes sense to pay attention to the Lido token, which increased by 7.5% during the last 24 hours, and at the moment of writing, is trading at $1.24. During the week, its price went up by 17.09%.