Contents

Some researchers think Ethereum’s upcoming transaction to a Proof-of-Stake network will enable it to take over Bitcoin’s position as the most prominent crypto asset. It sounds incredibly ambitious, given that Bitcoin has been considered the primary market cryptocurrency for over a decade. It has the most significant capitalization, trading volumes, number of investors, and market share size.

Does Ethereum have a chance against such trumps? Let’s figure it out.

Ethereum’s flip

Ethereum researcher Vivek Raman is convinced that Ethereum would “flip” Bitcoin, and this would become possible thanks to switching the network from the Proof-of-Work mechanism to Proof-of-Stake (PoS). As part of the transition, Ethereum will transform into an economically (and environmentally) sustainable asset.

“After the merge, Ethereum will have lower inflation than Bitcoin. Especially with free burns, the token will be deflationary, while Bitcoin will always be inflationary. Although, with every halving, the inflation rate goes down,” he said.

The brand new newsletter with insights, market analysis and daily opportunities.

Let’s grow together!

The researcher added that the next key date for the merge watchers is Aug 8–10 range for the final test net (Goerli an Ethereum test network that allows for blockchain development testing before deployment on Mainnet, the leading Ethereum network) to merge. If that goes well, we could target a late September mainnet merge.

Moore’s law

The opinion that Ethereum may soon overtake Bitcoin is also held by J. Todd Morley, a famous entrepreneur, co-founder, and former CEO of investment giant Guggenheim Partners.

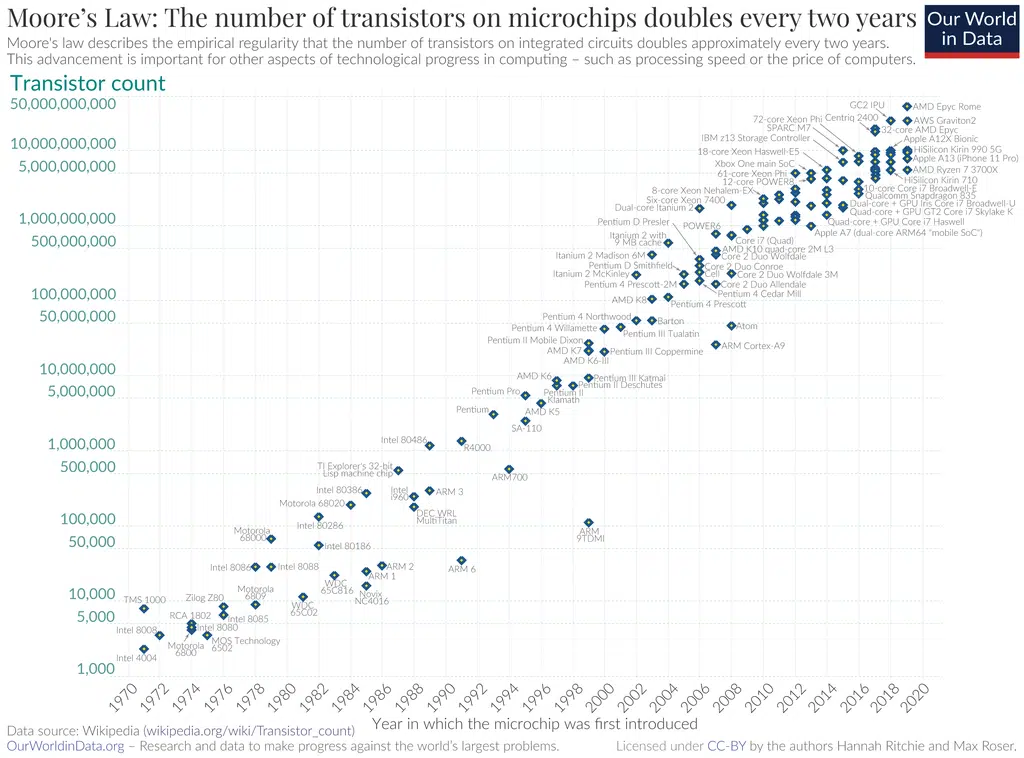

Ethereum’s growing popularity, according to Morley, is evidenced by Moore’s Law. According to this rule of thumb, computing speed and computer performance double every two years. Ethereum developers have increased 20-fold every year for six consecutive years, much higher than the numbers in Moore’s Law.

Also, the expert noticed that in the past 12 months, decentralized finance — the use of Ethereum-based technology to recreate traditional financial instruments, such as bank loans — has risen sharply in popularity. Blockchain protocols could replace the banks we are used to.

Billionaire investor Mark Cuban is convinced of this as well. According to him, the long-awaited Ethereum 2.0 update will lead to developing applications that will “eclipse” Bitcoin.

The advantages of Ethereum over Bitcoin

Bitcoin is not perfect and has a bunch of problems. According to experts, most of them are related to the fact that it runs on the outdated Proof-of-Work (PoW) consensus algorithm, which has a lot of disadvantages:

- low speed and poor scalability — the maximum transaction speed in the Bitcoin network is 3–7 transactions per second;

- high fees for miners;

- high energy costs, mainly derived from the burning of fossil fuels.

Ethereum is already technically superior to Bitcoin. The speed of this network is 12–25 transactions per second, and thanks to PoS, the throughput can reach 2,000–4,000 transactions per second. Block verification takes 12 seconds versus 10 minutes for BTC.

Ethereum 1.0 also runs on PoW. But the network is already undergoing an active transition to state 2.0, where the web will be PoS-based, there will be no mining, validators will achieve consensus, and new coins will be mined by stacking.

Also, Bitcoin is primarily a cryptocurrency. However, Ethereum is much more than a cryptocurrency. It is a vast decentralized computing network in which smart contracts a computer protocol that allows users to perform transactions and control their execution with the help of mathematical algorithms, decentralized applications, DeFi-protocols, tokens, and NFTs can be run.

It is also worth to be mentioned that compared to Bitcoin, Ethereum has many more options for use. Dozens of large and popular ecosystems have been built on it, including:

- financial and credit protocols;

- gaming;

- social networks;

- accounting systems, and so on.

When will Ethereum overtake Bitcoin

Ethereum’s universality attracts the attention of famous financiers and investors, who consider the coin an investment opportunity and the most likely competitor to Bitcoin.

Several experts believe that Ethereum will overtake BTC in capitalization and use cases one day, or maybe even within the next few years. For example, John Woo, president of Avalanche developer Ava Labs, Dan Morehead, founder of significant cryptocurrency investment fund Pantera Capital, Mike Novogratz, founder and CEO of crypto investment company Galaxy Digital, Nathan Cox, a chief investment officer of crypto fund Two Prime, Mark Cuban, billionaire investor, Charles Hoskinson, founder of Cardano and co-founder of Ethereum think so. That’s quite an impressive list of opinion leaders, isn’t it?

They say, for ETH to catch up to BTC in capitalization, its price would have to rise to $8k. But with such a bear market, Bitcoin is unlikely to stand still, so ether needs to consolidate at between $10k and $20k to overtake Bitcoin confidently.

However, Ethereum is trading at $1,549 per coin at the time of writing, so there’s a long wait. Unless, of course, Ethereum makes a colossal leap to the Moon after the switch to PoS.