Ethereum has great potential and probably will peak at $2,500 per token in 2023, predicts a survey of cryptocurrency and fintech experts from analytics platform Finder. Our article summarizes the opinions, which will help a crypto enthusiast determine his attitude toward the future of Ethereum.

The overall results of the forecast

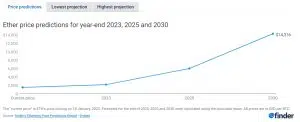

Finder published another large survey, “Ethereum price predictions,” based on the opinions of a lot of experts, this time focused on Ethereum. Most experts polled by Finder believe that Ethereum will peak at about $2500 this year and end the year at $2200. At the same time, 25% of the participants in the discussion believe that Ethereum will even surpass Bitcoin by 2025 in terms of growth rate.

A total of 56 fintech and cryptocurrency experts from around the world were interviewed in the report. Although some experts cite chronic problems associated with Ethereum (we discuss them in detail in this article), most see the future of this cryptocurrency as successful, calling it the leading smart contracts platform.

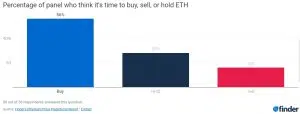

Currently, 60% of fintech and crypto experts believe that ETH is undervalued, and about 28% believe it is fairly priced. About 12% of the participants in the discussion think ETH is overvalued, and 16% currently recommend selling. 56% believe that now is a good time to buy for a long-term investment, while 28% advise refraining.

The brand new newsletter with insights, market analysis and daily opportunities.

Let’s grow together!

Flipenning probability

A separate hot topic of discussion among experts was the possibility of flipenning.

Flipenning is a situation hoped for by Ethereum fans, where the total market cap of Ether surpasses the total market cap of Bitcoin. The term was invented during the 2017 bull run when Ethereum set its historical all-time high against Bitcoin.

- 22% are unsure that the flippening will ever occur.

- 10% see the market cap of ETH flipping over that of BTC in 2024, while an additional 14% see it happening in 2025.

- A further 18% see it happening by 2030.

Comments from experts

Among the many comments in the Finder report, we have selected the most typical ones that express the opinion of the majority.

Sathvik Vishwanath, CEO and co-founder of Unocoin Technologies Private Limited, is positive about Ethereum’s future:

“More decentralized apps are being built on the Ethereum platform,” states Vishwanath, who believes that said apps, or Dapps, will be used by more and more businesses, which should benefit the price of ETH.

But Dapps are governed by smart contracts. So Ben Ritchie, managing director of Digital Capital Management, noted that, “Ethereum continues to dominate the market as the leading smart contract platform.” Because of this, Ritchie thinks the value of ETH will continue to increase even in the current complex market conditions.

“Ethereum is the base layer of innovation for the majority of DeFi and NFTs,” states Josh Fraser, co-founder of Origin Protocol.

“As scaling solutions gain mass adoption, Ethereum will be used for less-financially driven data, such as identity and social coordination. It’s at this point we could see Ether become a 6-figure asset.”

Damian Chmiel, senior analyst and editor at Finance Magnates, sees the relationship between the price of BTC and ETH in a more simple way:

“Ethereum’s price is still dependent on Bitcoin, I expect ETH to rebound only when BTC starts to rise.”