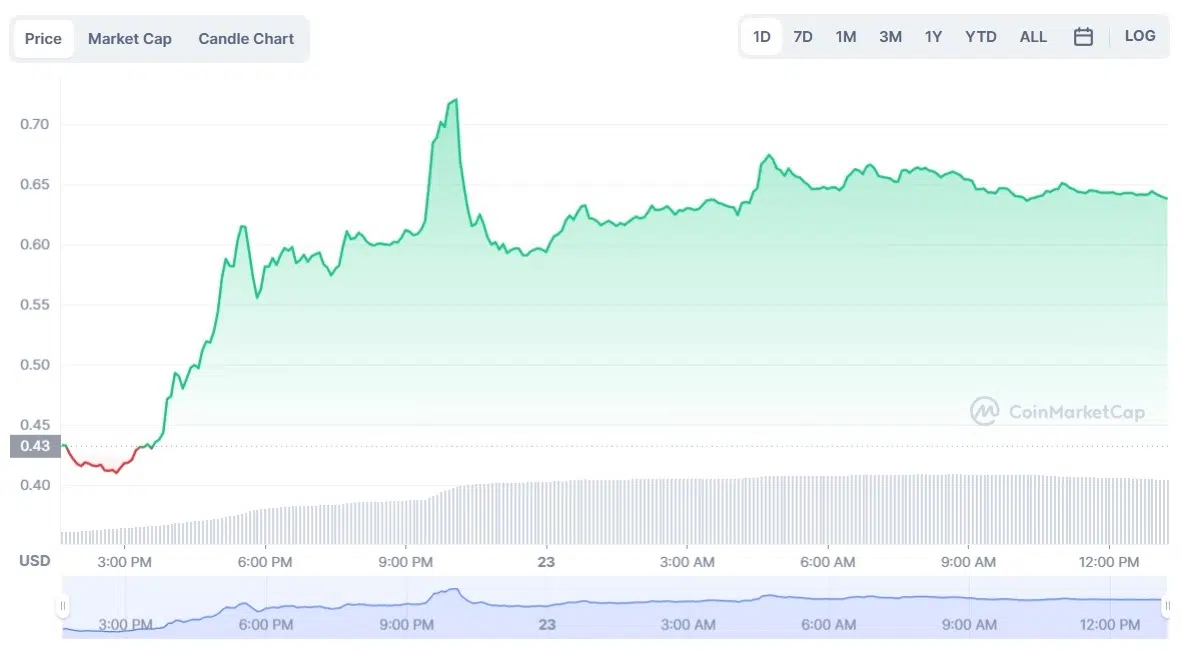

Curve, the second largest decentralized exchange on Ethereum, released a whitepaper on its crvUSD stablecoin. Due to this, the value of its other coin, CRV, has skyrocketed by more than 50%. This jump is especially impressive because the token had previously fallen by 30%. Experts say there are other reasons for stablecoin’s rapid growth, but let’s go over the details one by one.

Reasons for the sudden CRV growth

In addition to the release of a document detailing how the stablecoin works, there is another reason that may have influenced the sudden rise of the token. According to The Block, Curve jumped as one trader squeezed a large short position.

Researchers say that on the morning of 11/23, the value of the token plummeted from $0.53 to $0.4, roughly below the coin’s lowest level in two years. After that, however, there was a sharp rebound and CRV rose more than 50%.

At the time of writing, CRV is trading at $0.6247 per coin, with a market capitalization of $322B. In the last 24 hours, the token has risen in value by more than 50%, and the trading volume is $825.2M. However, the coin was down 30% before the whitepaper was released.

The brand new newsletter with insights, market analysis and daily opportunities.

Let’s grow together!

The report says the trader had to borrow a total of $92M CRV from the DeFi lending platform Aave, using $52M as collateral to make the large transaction. There is also information that the trader was selling CRV tokens, which may have been the reason for the initial token price drop earlier. However, the short seller is now at risk of liquidation for such actions.

What is CRV stablecoin?

The work on the Curve stablecoin became public back in July 2022. According to the idea, the coin is supposed to complement Curve DAO tokens, which are issued as rewards for liquidity providers on Curve Finance.

According to the whitepaper, CRV:

- will be able to be mined as a crvUSD stablecoin;

- will be available to users who deposit other digital assets as collateral;

- will run on an algorithm called Lending-Liquidating AMM (LLAMMA).

Decentralized finance specialist Ignas.lens tweeted more about how the algorithm works. According to him, current CDP (collateral-debt position) stablecoins have a problem, which is that they have to liquidate insufficiently collateralized positions in order to keep their fiat binding. Partial liquidation helps, but there are two nuances:

- Expose CDPs to bad debt.

- Users get penalized for liquidations.

The core idea of CRV is an AMM for continuous liquidation or deliquidation. This Lending-Liquidating AMM converts between collateral (ETH) and a stablecoin. That’s why when the collateral price is high, the user deposits all in ETH, but when prices go down, ETH is converted to USD.

“This model prevents positions from being liquidated (it just closed down) and no risk of bad debt,” explains Ignas.lens.

It is also remarkable that LLAMMA uses ETH/USD pair as a price source, so $crvUSD can freely trade above and below the peg. However, if the price is above the peg, crvUSD will use Automatic Stabilizer (similar to Frax’s AMOs).

At that time, the automatic stabilizer (PegKeeper) will simply mint crvUSD and deposit directly into Curve pools. This, the specialist says, increases liquidity for crvUSD and creates trading commissions. If the price is below the peg, crvUSD is withdrawn from the pool and burned, thereby reducing the supply of crvUSD.

How can I make money on this?

Despite the popularity of the most famous cryptocurrencies, such as Bitcoin, Ethereum, BNB, and others, sometimes it is easier to make money on some new project. Although Curve appeared back in 2020, interest in the token is only now showing up, so this could be a good time to invest in it. But first, we suggest researching the market and reading the whitepaper.