Bitcoin’s price has surged almost 6% to reach $29k, and Santiment analysts suggest that there are three reasons behind this active growth. The Altseason index currently shows a value of 8, indicating a lower probability of altseason coming. Meanwhile, Ethereum’s network nodes’ localization has an anomaly, adding to the discussion of deflation and high transaction costs. Curious to learn more? Check out the full article.

The logic behind the Bitcoin price rise today

The first cryptocurrency started today with a spurt to $29k, a rise of almost 6% in 24 hours. Let’s try to reconstruct the logic of the market.

Santiment analysts believe there are three reasons for such active growth:

- The crypto market has long correlated with the S&P 500, but this year, as Santiment confirmed, the digital asset market is in the early stages of divergence.

For example, this time Bitcoin went up after yesterday’s drop in the U.S. stock market. Such protective behavior in the crypto market promotes the inflow of new money.

The brand new newsletter with insights, market analysis and daily opportunities.

Let’s grow together!

- In addition, the growth of BTC could be contributed by fears of the bankruptcy of First Republic Bank — its shares fell by more than 50% — as well as rumors that the organization would be transferred to the government. As we have said many times before, the banking crisis in the U.S. is not over and will continue as interest rates go up.

Because of the rapid rate hikes, there has been an extreme reduction in the U.S. money supply. The nominal money supply fell by 4% and the real money supply collapsed by 8.6%, which is the most intense contraction since the post-war decline of 1946-1947, when it was minus 12%. An earlier analog is the Great Depression years of 1930-1933. There is no other historical analog to the pace of the current compression of the money supply in the U.S.

- Traditionally, strong price action causes many liquidations and temporarily stimulates price growth. During the last 24 hours, a total of 27,094 traders were liquidated for a total of $76.60 million. The largest liquidation order occurred on Bybit and was worth almost $1.83M.

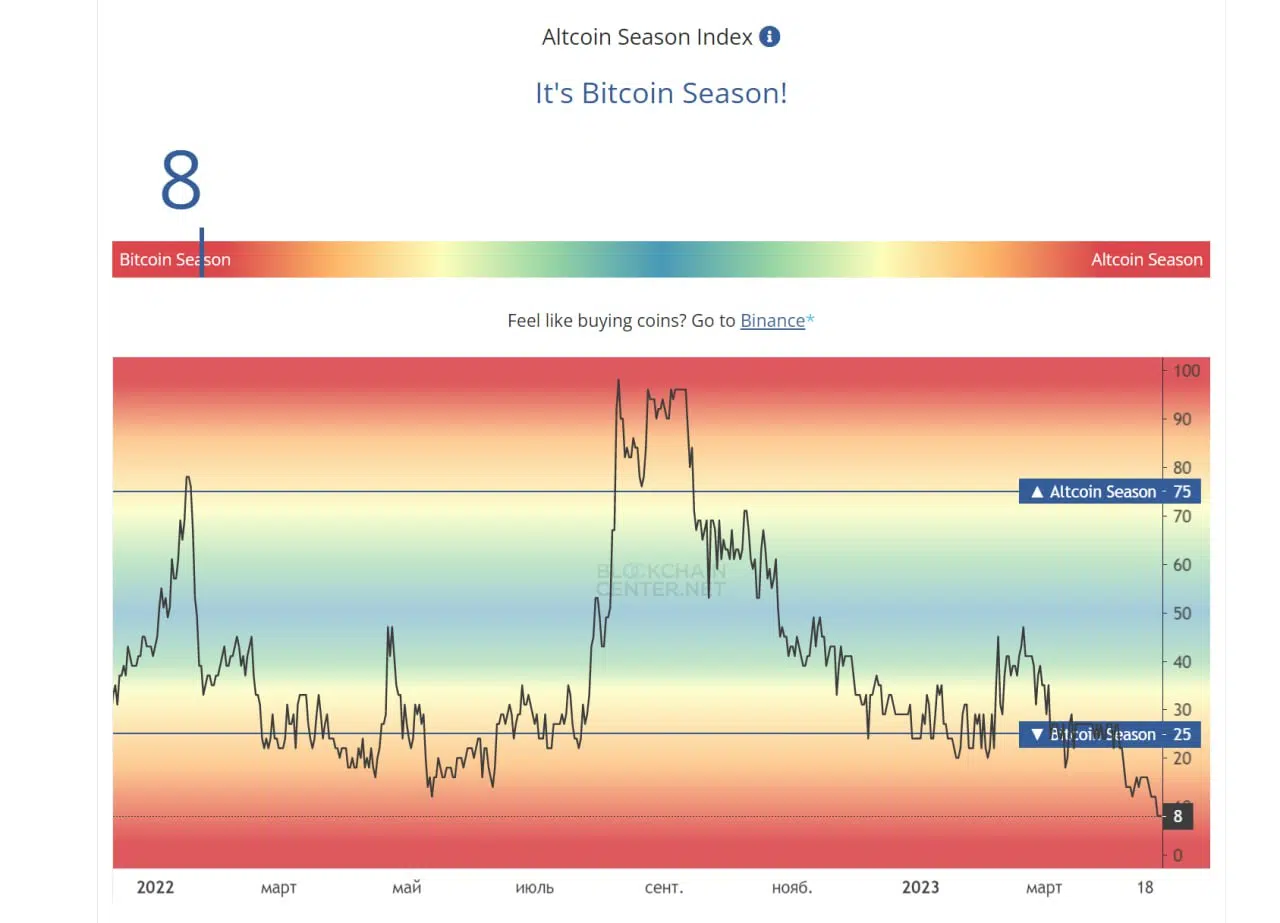

Altseason never came?

Right now, the Altseason index shows a value of 8 (the lower the value, the lower the probability of an altseason coming). Recall that the record high of the Bitcoin season was 6, which was recorded in 2021.

Government Ethereum

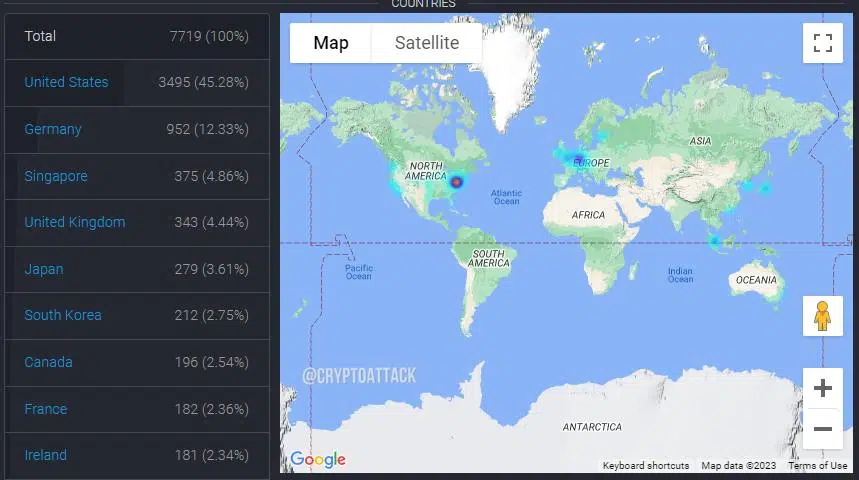

We continue to publish more and more facts about Ethereum. In the past, we talked about the beginning of deflation within the network after the migration to PoS, and we also discussed the high cost of transactions (remaining contrary to promises). This time we will discuss the localization of the network nodes because there is an anomaly here as well.

Right now, Ethereum is running on about 7,700 nodes, half of which are based in the US. Of these U.S. nodes, half are in a single data center in Virginia, which is 20 minutes from the White House and the CIA headquarters. Such a strange concentration of almost 30% of Ethereum nodes in one such strange place is still difficult to explain in any reasonable way.