Don’t miss out on the latest developments in the finance and crypto worlds! Learn about the Fed’s interest rate hike and the potential collapse of PacWest, Matrixport’s predictions for a Bitcoin rally, and the surprising role Bitcoin plays in a hypothetical investment portfolio. Dive deeper into these topics for a better understanding of how they could impact your investments.

Tension in the U.S. financial system is growing

Yesterday, despite volatility in the banking market, the Fed governor raised the interest rate to 5.25%. Jerome Powell also hinted that the rate hike cycle may soon begin to pause.

Immediately after that, another U.S. bank was scrambling to go out of business. PacWest shares fell -54% yesterday. According to Bloomberg, the bank is looking for a way out of the current difficult situation, but so far there are not many people willing to buy it. According to many analysts, the collapse of this bank will happen soon.

The brand new newsletter with insights, market analysis and daily opportunities.

Let’s grow together!

- If you are already tired of watching this series about the “stable banking system” (according to the head of the Fed), here is a brief announcement: the following American banks are also on the verge of collapse: $FHN, $WAL, and $MCB.

- According to a recent CNBC poll, 48% of American adults are now seriously worried about having their money in the bank.

- In addition to the interest rate hike and the ongoing contagion of the banking system, another important piece of news is that the SEC was required to formulate a formal position on the regulation of cryptocurrencies no later than 10 days later. This decision was made by the Court of Appeals in response to Coinbase’s lawsuit against the agency.

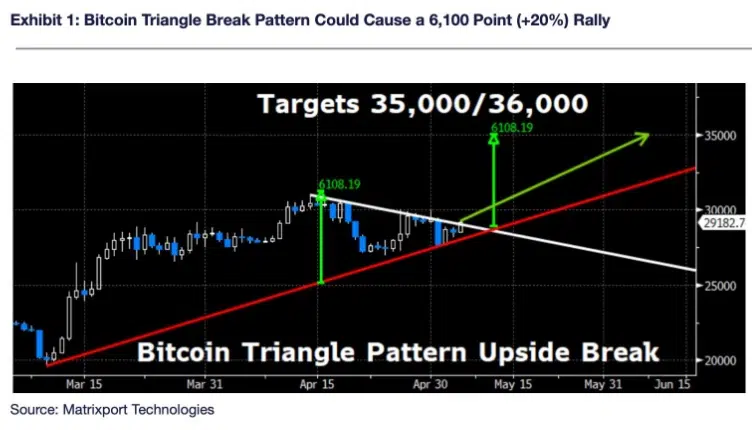

Matrixport predicts a 20% rise in BTC

According to analysts at Matrixport, signs of the end of the Fed’s key rate hike cycle could be a catalyst for a strong Bitcoin rally. In addition to the Fed, Matrixport named turbulence in the U.S. banking sector and corporate buybacks of their own shares from the market as drivers of growth. All of these factors combined could push the BTC price to $36k this summer, according to Matrixport’s modeling.

Can Bitcoin be used as a hedge?

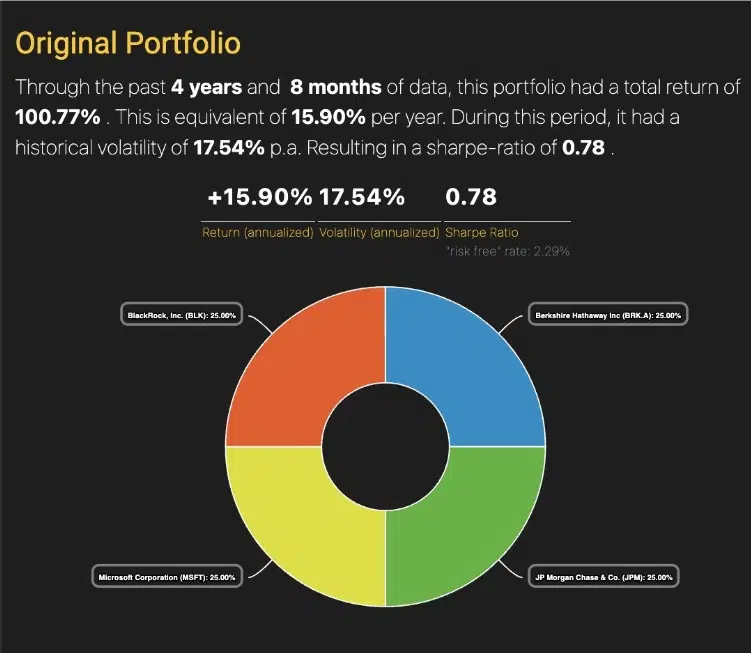

An anonymous analyst created a hypothetical portfolio as a mental experiment consisting of shares of four large companies with equal weighting : Berkshire Hathaway, Microsoft, JPMorgan, and BlackRock.

Simulations show that such a hypothetical portfolio would have yielded an annual return of 16% since 2014. However, if at least 2.5% of the portfolio were allocated to Bitcoin, the total return would increase immediately by 20%. In addition, when portfolio assets fall in value, Bitcoin tends to rise, which nicely offsets losses. This simulation proves Bitcoin’s unusual role as a hedge asset using historical trading data.