Ethereum completes the Shapella hardfork, a major milestone for the world’s largest altcoin, while Bitcoin’s resurgence against gold continues. Don’t miss out on the details; read on for more about this news and how it will affect the world of crypto below.

Another Ethereum hardfork is completed

Today, Ethereum developers activated the Shapella update on the main network. This is an important event for the largest altcoin in the world; this is the first time the unstaking of ETH will happen. The hard fork took place at epoch 194,048; the developers noted that there were a couple of missing blocks in the network, but overall the update was successful and the network is working as normal.

What’s the withdrawal rate?

What the public has been waiting for the most is the effect on the price of the beginning of mass ETH withdrawals from staking. Let’s look at the long-awaited numbers. At the moment, the withdrawal is not extreme.

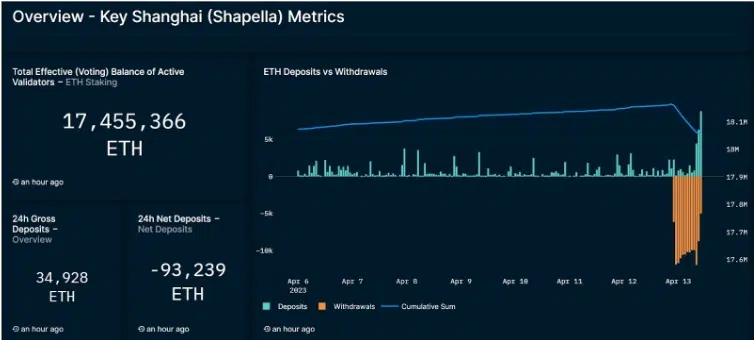

Since the upgrade 15 hours ago, 34,688 ETH have been deposited, with a net flow of -93,167 ETH. And the total balance of active validators ETH staking is 17,455,638 ETH.

The brand new newsletter with insights, market analysis and daily opportunities.

Let’s grow together!

You can see the most actual statistics on this dashboard, which is updated in real time.

What’s up with the price of Ethereum?

Ethereum broke through the $2000 price level at the moment! Here are the additional details on this topic from Kaiko’s research:

- At the moment, the price of Ethereum has grown a bit: in relation to BTC, it increased by 4%; in absolute terms, by more than 6%. In other words, the pessimistic forecasts and the price dump after the unstaking have not been confirmed.

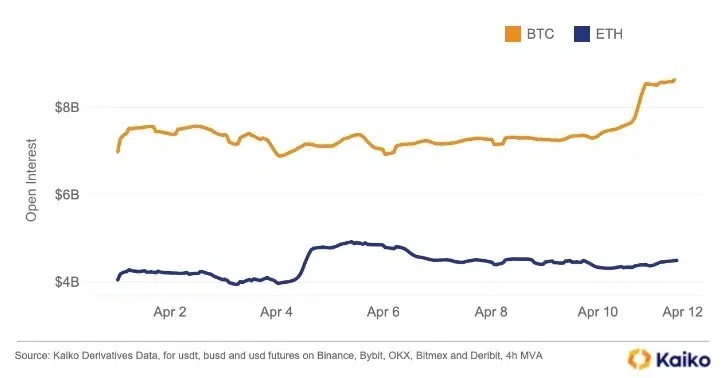

- But despite this, the volume of trading in ETH on futures is falling relative to the BTC market; on spot markets, the picture is similar.

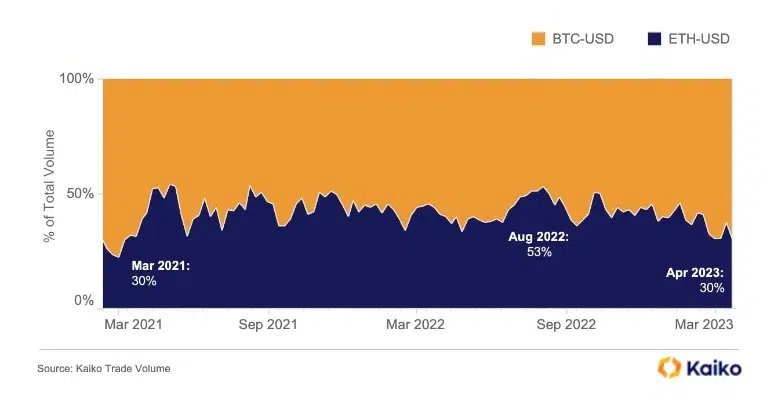

- As of last week, the spot volume of ETH relative to BTC was only 30%. The last time the Ethereum spot market share was this low was in March 2021. Most likely, after the unstaking, many investors make a secondary conversion into BTC.

Bitcoin vs. gold

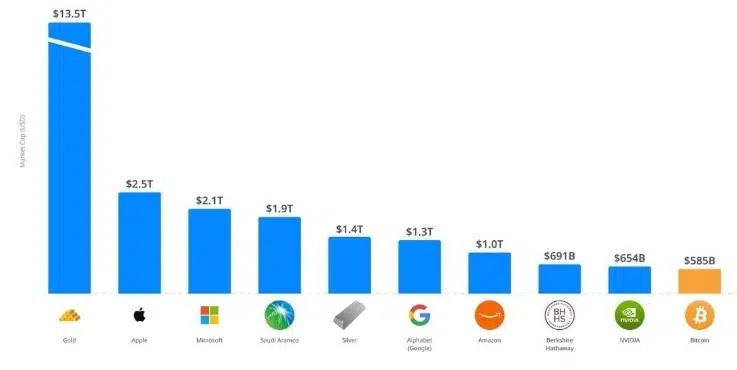

After breaking the $30k bar, Bitcoin is back in the top 10 publicly traded assets by market capitalization.

The absolute leader is gold, with a capitalization of ~$13.5 trillion, followed by Apple and Microsoft.

Analysts at Bernstein Research argue that investors in gold should take a closer look at Bitcoin, which is likely to offer better returns in the foreseeable future. In a new report, Bernstein Research wrote that the market for gold is exciting, but interest in Bitcoin is relatively low. And this despite the fact that the first cryptocurrency was the most profitable asset of 2023.

They believe that it is the so-called “hate syndrome for the fastest horse” — investors do not believe in long-term profits from the newcomer, explaining the current victories by accident. Despite emotions, according to statistics, Bitcoin has repeatedly shown more significant profits than gold, experts conclude.