As the banking crisis and state defaults loom over the U.S. economy, the surge of meme-crazy mania in the world of cryptocurrency is raising concerns about its potential impact on the leading BTC and Ethereum blockchains. In this article, we delve into the consequences of this frenzy and explore the possible outcomes for investors and the wider economy. Read on to find out more.

The best analysis of the U.S. economy

Crypto prophet Arthur Hayes has published a new article about the banking crisis and the advantages of Bitcoin. Apparently, a detailed analysis of the doom of the US banking system didn’t please Medium, and the service banned the article. Censorship of economic views is something completely new. A copy of the deleted article can be found at this link.

“Binance review” summarizes Arthur’s analysis this way:

The brand new newsletter with insights, market analysis and daily opportunities.

Let’s grow together!

“In the essay, Hayes compares the current situation in the US banking sector to friends splitting the bill at a nightclub and tries to answer the question: Who will pay for the banking crisis ignited by the Federal Reserve’s deflationary policies?

Hayes suggests that the crisis will be solved “at the cost of the lives” of medium and small banks, which he refers to as “not big enough to fail.” According to Hayes, their assets will be absorbed by the big systemic banks, which have guarantees from the US government to cover customers’ deposit losses.

However, Hayes also notes that the real value of $ in the pockets of citizens will certainly decrease as the Fed turns its policy around. Hayes ultimately sees salvation in Bitcoin and gold as means of preserving value outside the banking system. He urges readers to “get your Bitcoin, and get out!” if American politicians do not let the banking system collapse.”

BTC and Ethereum networks captured by meme-mania

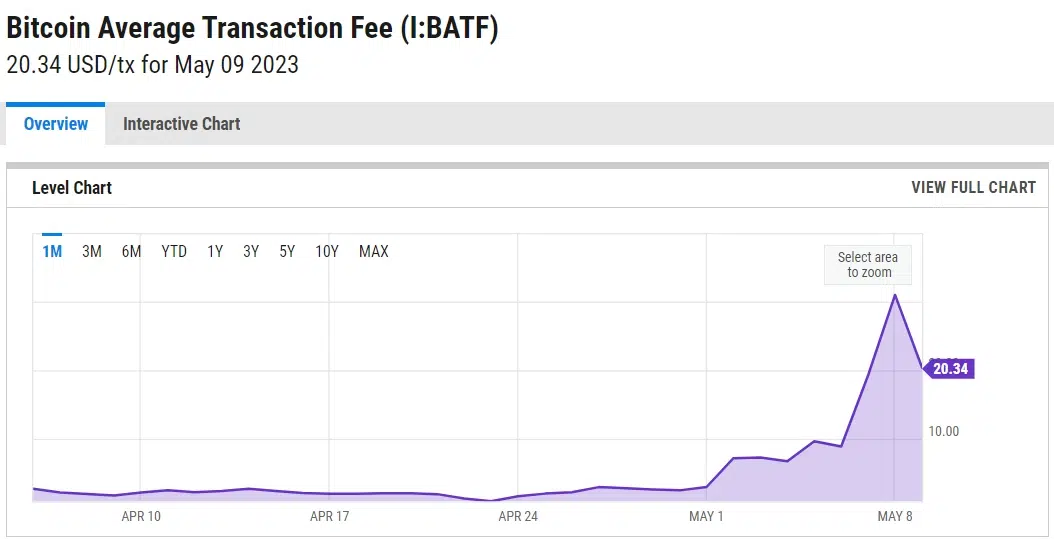

Meanwhile, Bitcoin has its own problems: the phenomenon of super-high fees within the network continues. Yesterday, the fees at their peak were as high as $30 per transaction; today they’re down to about $20. And even that seems unbelievable because earlier the fees were less than a dollar.

Ethereum has a very similar situation: transaction gas has gone up a lot. Memecoin mania seems to have the effect of “pushing out” the traditional Ethereum market: the number of ERC-721 tokens is dropping while the daily transfers of ERC-20 tokens are increasing significantly. This is a rather unusual situation!

The meme economy displaces traditional activity in BTC and Ethereum networks. It’s hard to know yet whether this is good or bad for the future of these networks (but definitely bad for networks like Solana, which traditionally specialized in NFT). Each of the opposing sides sees a different ideal implementation of BTC, but we urge each situation to be viewed from a different perspective: