The U.S. Federal Reserve System (Fed) consists of 12 independent banks. One of those independent banks, the Federal Reserve Bank of New York, recently released an unusual scientific study on the nature of Bitcoin. Its conclusion is surprising: this federal bank recognizes Bitcoin as a kind of savings vehicle, similar to gold.

What the report is about

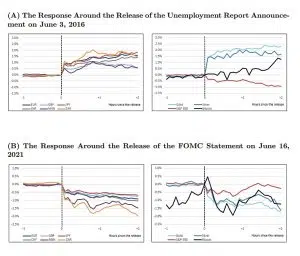

A new report, number 1052, from the Federal Reserve Bank of New York titled “The Bitcoin-Macro Disconnect” was released in February, in which the federal agency tries to understand the nature of Bitcoin. It is a serious academic paper using statistical analysis. Interestingly, the report is published with the tag “monetary surprises” because it contains unexpected conclusions:

“The key result is that, unlike other U.S. asset classes, Bitcoin is orthogonal to monetary and macroeconomic news. This disconnect is puzzling as unexpected changes in discount rates should, in principle, affect the price of Bitcoin even when interpreting Bitcoin as a purely speculative asset.”

The brand new newsletter with insights, market analysis and daily opportunities.

Let’s grow together!

Simply put, based on strict statistical analysis, it has been established that, contrary to popular opinion, Bitcoin’s price is mostly independent of both monetary and macroeconomic news. And even if Bitcoin does react to news, it reacts significantly weaker than other assets.

This conclusion contradicts the populist view that Bitcoin is a speculative asset only. This unusual feature makes Bitcoin a defensive asset. Financiers commonly classify assets as defensive if they behave contrary to some factor; for example, Bitcoin usually goes up in price when dollar inflation increases, which makes BTC a defensive asset against the dollar.

The big players often hedge their reserve portfolios against devaluation. This means they use defensive assets to balance the value of the portfolio. For example, if one part of the portfolio loses value, the other part becomes more expensive as a defensive asset to the first part, and in total it maintains the initial value of the portfolio. Such a balanced portfolio composition is called “hedging.”

Bitcoin’s “orthogonal properties,” which the Fed writes about in its academic study, are ideal for hedging traditional financial assets. The Fed also recognizes Bitcoin for a number of reasons as a savings vehicle (just like gold).

Is macroeconomic news driving Bitcoin? In today’s blog post, the authors analyze the impact of macroeconomic and monetary policy news on Bitcoin’s price. https://t.co/JazwOGzUEB

— New York Fed (@NewYorkFed) February 8, 2023

Bitcoin as a hedge

This conclusion is fully supported by the data of the American bank BNY Mellon. Bank clients have already realized that Bitcoin can be used to hedge risks. According to Reuters, Michael Demissie, head of advanced solutions at BNY Mellon Bank, said during the Afore Consulting fintech and regulatory conference that cryptocurrencies are firmly entrenched in the financial sector, with customers eagerly using them in their portfolios.

“We see that clients are absolutely interested in digital assets,” he said.

Demissie added that more than 90 percent of that bank’s customers plan to invest in crypto assets in the near future.

![ndua91elonmz[1] - buidlbee](https://buidlbee.com/wp-content/uploads/2023/02/ndua91elonmz1-222x300.jpg.webp)