A former developer from Latvia became an NFT artist and made more than €8 million (~$8.15 million), but now is suspected of money laundering. He faces up to 12 years in prison.

Ilia Borisov, mostly known in the NFT’s crowd as Shvembldr, is one of the world’s most financially successful NFT artists in 2021. In February 2022, all of his property was arrested by Latvian police without notice. He lost the ability to pay bills, legalize income, pay taxes, and make purchases. Now he is the subject of criminal proceedings for alleged money laundering through “an elaborate illegal scheme.” His situation has yet to be dealt with by the court, but there are cases where actions with NFT have been confirmed as criminal.

Due to the rapidly growing number of NFTs and their enormous value, they have long been on the radar of the experienced, as evidenced by British scientists’ research. This is becoming a BIG problem. In 2021 alone, scammers laundered $8.6 billion with the help of tokens.

Why is it a problem?

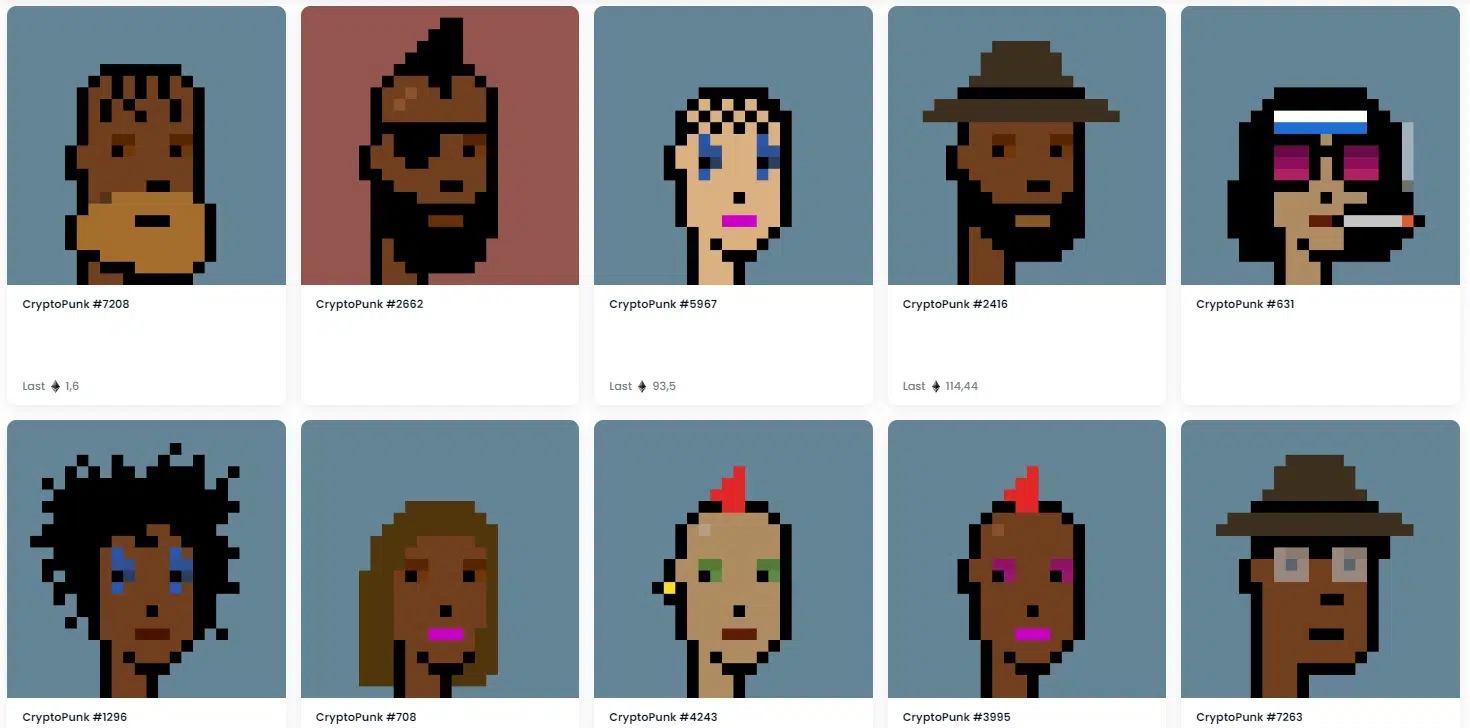

Some collections, such as the Bored Ape Yacht Club, are valued at more than $100k per token, making them an attractive vehicle for attackers, according to a study by three scientists from Coventry University in the UK. The main problem is that NFTs have no strict regulations.

The brand new newsletter with insights, market analysis and daily opportunities.

Let’s grow together!

“And we literally don’t know what an NFT is. Is it a digital asset? Is it art? Is it a collector’s item? Is it a security? It exists along with cryptocurrencies and all the digital assets that have not yet been approved for regulation. Still, NFTs is really a gray legal area,” said associate professor Dimitrios Kafteranis in an interview with Cybernews.

The anonymity of blockchain gives a lot of freedom. Therefore, protecting users and the industry from criminals’ actions is vital. To solve the problem, the EU is discussing the implementation of the Crypto Asset Market Regulation, which will introduce a legal definition of digital assets. However, the regulation has not yet passed the preliminary stage, and it is not sure that it will be approved.

How do criminals launder money?

Chainalysis experts distinguish two main ways of illegal activities that have been noticed in the digital assets market:

- artificial increase in the value of tokens through trading scams;

- money laundering through the acquisition of NFTs.

The analysts also determined that some sellers of digital assets make money from fictitious trading operations to increase the value of non-fungible tokens artificially. Here’s how they do it:

- the same person (individual or legal entities) buys and sells the same security (token);

- the company can engage a middle man to sell/buy the assets itself while setting a fixed price;

- NFT successfully sold from one Ethereum address to another.

At first sight, the transaction does not look suspicious, but a closer look reveals a fictitious (circular) trade. The selling token address sends an ETN one of the first cryptocurrencies to introduce an instant payment system to the buyer’s address just before the sale. The seller funds the address used to purchase the asset before the sale.

In essence, the scheme is similar to regular online sales, where the seller of, for example, a phone sends you money to buy it, thus creating the appearance of a sale. The difference is that blockchain technology allows the same person to fund any number of their crypto wallets to buy NFTs, and blockchain is beneficial in “covering their tracks.”

There are good news, however. Blockchain transparency could make it easier to trace the token back to the buyer. Currently, there is an increase in the number of NFTs used for money laundering. In 2021, cybercriminals laundered $8.6 billion using cryptocurrency, so regulators and law enforcement must keep a closer eye on NFT and cryptocurrency transactions.

“NFT can be transferred without an intermediary in minutes. The downside is that you can see where the token has gone. For example, if I take $10k from the bank and transfer it to you, the bank won’t know about it, and cryptocurrency can be traced. There are risks, but there are mitigating measures, and it will be interesting to see the results,” says the research.

Also, the experts think that it is a question of time until NFTs are put under the anti-money laundering legislation. Still, the risks that NFTs pose are alarming.