Contents

Reddit user Joe-M-4 performed a crazy experiment. Every January 1, he invests $100 in the top 10 cryptocurrencies by market capitalization, then monitors the market and writes reports about what’s happening. Here’s what he gets out of it.

The author started the experiment in 2018; according to him, 2022 was one of the most challenging years. In particular, the current crypto winter, which made many investors nervous and is still not finally over, played its role.

You can read about his last year’s experiments by following the link, but first, let’s see what results the author got this year.

The rules

During the experiment, Joe-M-4 follow the next rules:

The brand new newsletter with insights, market analysis and daily opportunities.

Let’s grow together!

- buy $100 of each of the top 10 cryptocurrencies on January 1st;

- hodl only;

- no selling;

- no trading;

- report monthly.

The author urges readers to think of this experiment as a lazy man’s Index Fund (no weighting or rebalancing) and less technical.

“I am trying to keep this project simple and accessible for beginners and those looking to get into crypto but may not be ready to jump in yet. I try not to take sides or analyze, but rather attempt to report in a detached manner letting the numbers speak for themselves,” he said.

And remember, this is not investing advice.

Experiment 2022

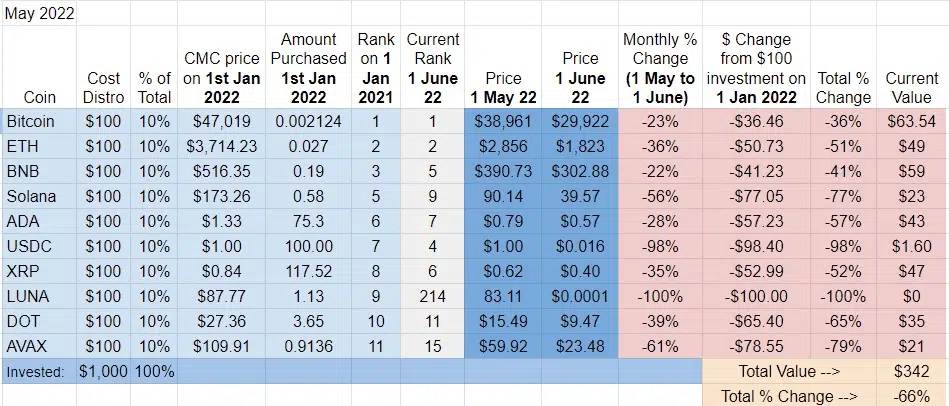

In 2022 the author traditionally purchased crypto-assets, which were in the top ten coins as of the 1st of January. They were BTC, ETH, BNB, SOL, ADA, USDC, XRP, LUNA, DOT, and AVAX. Again, the blockchain enthusiast invested $100 in each of the cryptocurrencies, meaning that the total investment amount was $1000.

The author noted that May 2022 was one of the most challenging months. In particular, the $1,000 invested on January 1st has now turned into $342. Thus, the total drawdown was 66%.

The chart shows data on the coins purchased, their value for the current period, the change in the amount compared to the beginning of the year, the percentage change, and the present dollar amount for each coin.

Such figures in May, in particular, can be explained by the collapse of the notorious LUNA, due to which one of the invested hundreds immediately fell to zero. According to the author, in 4.5 years of the experiment, this happened for the first time.

In June, things did not get any better. Thus, this month $1,000 invested on January 1st has turned into $246. Therefore, the total drawdown was 75%.

For clarity, he provides a chart with the place of each cryptocurrency by market capitalization as of the first of January, June, and July. LUNA’s position has changed most noticeably, moving from 9th place to 210th against the backdrop of its collapse.

It is worth mentioning that AVAX, LUNA, and DOT have dropped out of the top 10, replaced by BUSD, DOGE, and DAI.

As for the top three coins, Bitcoin has fallen 60% since the beginning of the year, Ethereum is in second place with a 72% collapse, while the third position belongs to BNB. It is down 56%.

A new feature this year

The experiment in 2022 is running with some changes. According to the author, he has not included stablecoin gains in the past experiment years in the monthly reports. Still, there is an opportunity to earn ROI a mathematical formula that investors can use to evaluate their investments and judge how well a particular asset has performed compared to others using stables alone.

“I figured this would be especially interesting to track this year, depending on how the crypto market performs. My goal of this little side quest was to beat the ROI of as many of the non-stablecoin cryptos in the Experiment as possible,” he said.

He started the year using the most straightforward strategies, moving the $100 USDC around to get bonuses from different platforms.

Report for all years of the experiment

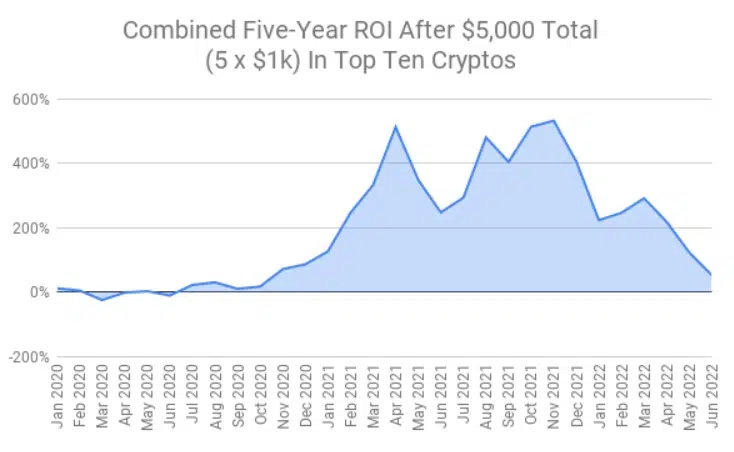

Joe also compared the interim results for 2022 with previous years this time. The experimental situation looks like this:

- 2018 Top Ten Experiment: down -55% (total value $449);

- 2019 Top Ten Experiment: up +126% (total value $2,256);

- 2020 Top Ten Experiment: up +227% (total value $3,269);

- 2021 Top Ten Experiment: up +45% (total value $1,451);

- 2022 Top Ten Experiment: down -75% (total value $246).

Thus, after five annual $1k investments ($5k total) in 2018, 2019, 2020, 2021, and 2022 Top Ten Cryptocurrencies, the combined portfolios are worth $7,671.

Here’s how his portfolio has changed over four and a half years.

That’s it. What do you think of this strategy? What do you think are the main pros and cons? Would you try it as well?