Two crypto entrepreneurs, CryptoJoe and Simeon.eth are considering a plan to buy FTX intellectual property (IP) and launch a new exchange. They have already thought out a name for it, listed the key features, and even described the possible risks of such a project. Read more about their idea below.

FTX’s rebranding: rationality

Based on a hypothetical plan, the initiators decided to call the new exchange Maven, which means “one who is experienced or knowledgeable.” To put it simply, an expert. Probably, hinting that the new company, contrary to FTX, which went bankrupt, will know what to do and not repeat the same mistakes.

There’s a strong case to acquire FTX’s intellectual property (IP) and spin out a new exchange with decentralised custody, ‘Maven’

Below @711_Joseph & I make our case. pic.twitter.com/66MyoKmXnz

— CryptoJoe (@Crypto_Joe10) January 3, 2023

The brand new newsletter with insights, market analysis and daily opportunities.

Let’s grow together!

The track says FTX’s popularity was primarily due to its user-friendly interface, UX, and optionality (the platform had low commissions on all trades, a wide range of asset classes and cryptocurrencies, and what seemed at the time to be high liquidity), rather than the approval of celebrities who began removing the evidence of a connection to FTX after the collapse.

“FTX had more than 1M users with billions worth of daily volume. The exchange was loved for its usability, [its] tooling and optionality in products and market,” the experts said.

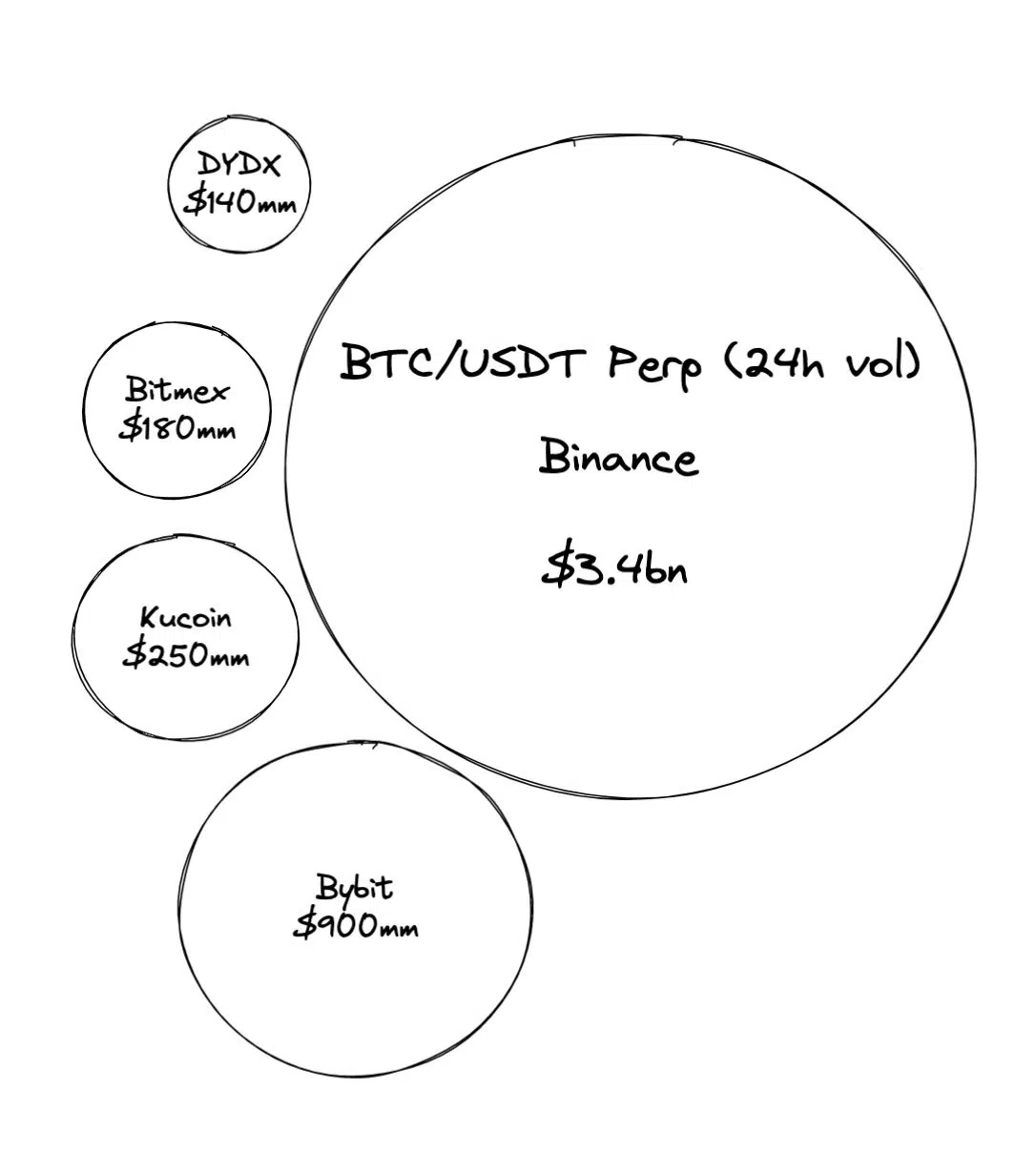

Now Coinbase, Kraken, and Binance dominate the market. The latter, according to CryptoJoe and Simeon.eth, has 30 times more volume on the spot market than Coinbase. Binance also trades more on the futures market, accounting for a significant share of the market.

An important indicator is the number of liquid assets. This metric is very important because, amid the massive outflow of funds due to the FTT token crash, FTX began having a liquidity crisis a financial situation characterized by a lack of cash or assets easily convertible into cash, which can lead to widespread defaults and bankruptcy.

According to the Nansen report, this is what the most popular exchanges have:

- Binance — $64.3B;

- Bitfinex — $8.23B;

- OKX — $5.84B;

- Huobi — $3.3B;

- KuCoin — $2.56B;

- Crypto.com — $2.36B;

- Deribit — $1.46B.

According to experts, if someone put forward a tender offer for FTX’s intellectual property, it would most likely be CryptoJoe and Simeon.eth, with a few added improvements, in particular, the operational changes stated include custody and governance, meaning that the new exchange could compete with existing ones.

“We explore this [by] estimating how much it would cost,” they said.

Maven’s revenue estimates and other features

As sources of income for the new exchange, CryptoJoe and Simeon.eth see several options:

- Maven Trading. This will be made up of a Spot & Derivative platform, as well as a live Margin Lending and Borrowing market.

- Maven Staking. Users can commit stablecoins to the exchange, which can be converted to fiat and held with regulated third-party banks to buy US Treasuries.

- Maven Prime. It will be an execution and custody business. It would generate a comparatively low amount of revenue because of the costs and extra risk controls.

According to the thread, there is also a serious emphasis on attracting customers. The report says that the new business plan plans to build an audience in two ways:

- Trading discounts for FTT holders for a limited period.

- Media coverage due to the fact that many people already know about FTX and are likely to be interested in rebranding it.

The estimated trading income of such a company, according to experts, could be about $140M based on trading fees. As for staking, on the basis of this method of earning, the platform can earn more than $10M. Using Ethereum staking in this estimate puts the figure at $2M. In total, the estimated revenue is $152M.

Possible risks and plans to avoid them

What could mainly prevent the intended goals are, according to CryptoJoe and Simeon.eth, negative macroeconomic conditions, volatility, difficulties in getting a license, regulation, and cyberattacks.

The experts think the lack of rigorous compliance and controls led to uninformed and unethical behavior previously, that’s why they would implement an independent compliance division to manage KYC standards designed to protect financial institutions against fraud, corruption, money laundering, and terrorist financing and listing.

To give users confidence in Maven, a new insight into the company’s liabilities and balance sheet by a reputable accounting firm is planned.

5) Big 4 Auditors

The development of independentcompliance divisions can be supplemented by the introduction of an established audit firm.

The introduction of audits by an established auditor will provide renewed insight into the company’s liabilities and balance sheet. pic.twitter.com/WsOEiF2jFf

— CryptoJoe (@Crypto_Joe10) January 3, 2023

What exactly is trust, given the constant bankruptcies and customer losses, will be the hardest to get. You can read the detailed plan of CryptoJoe and Simeon.eth here.

Do you think it’s a good idea to create something new on the ruins of FTX? Or is it easier to start from the bottom? Share your thoughts in the comments.