Contents

- 1 What are smart contracts on a blockchain?

- 2 What is a smart contract?

- 3 How smart contracts work

- 4 Historical background of smart contracts

- 5 Benefits of smart contracts

- 6 Applications of smart contracts

- 7 What are the main challenges faced by smart contracts?

- 8 Future of smart contracts

- 9 Top 5 smart contract platforms

Smart contracts are powerful tools because they cannot be monitored and are not vulnerable to cyberattacks. In multilateral digital agreements, smart contract applications reduce counterparty riskThe risk that another agent in a transaction will default., increase efficiency, reduce costs and make the entire process available for all parties to track.

What are smart contracts on a blockchain?

To make the description very simple, smart contracts are computer programs or protocols designed to automate blockchain transactions. They launch themselves as soon as they are required to meet certain predetermined conditions. Smart contracts execute agreements so that both the seller and the buyer learn about it very quickly and do not need to involve an intermediary.

What is a smart contract?

Smart contracts are contracts that execute on their own, without anyone involved. They work by having the terms of the agreement between buyer and seller initially spelled out in the code. In essence, they are automated computer transaction protocols whose job is to fulfill all contract terms. This makes all transactions traceable, transparent, and irreversible.

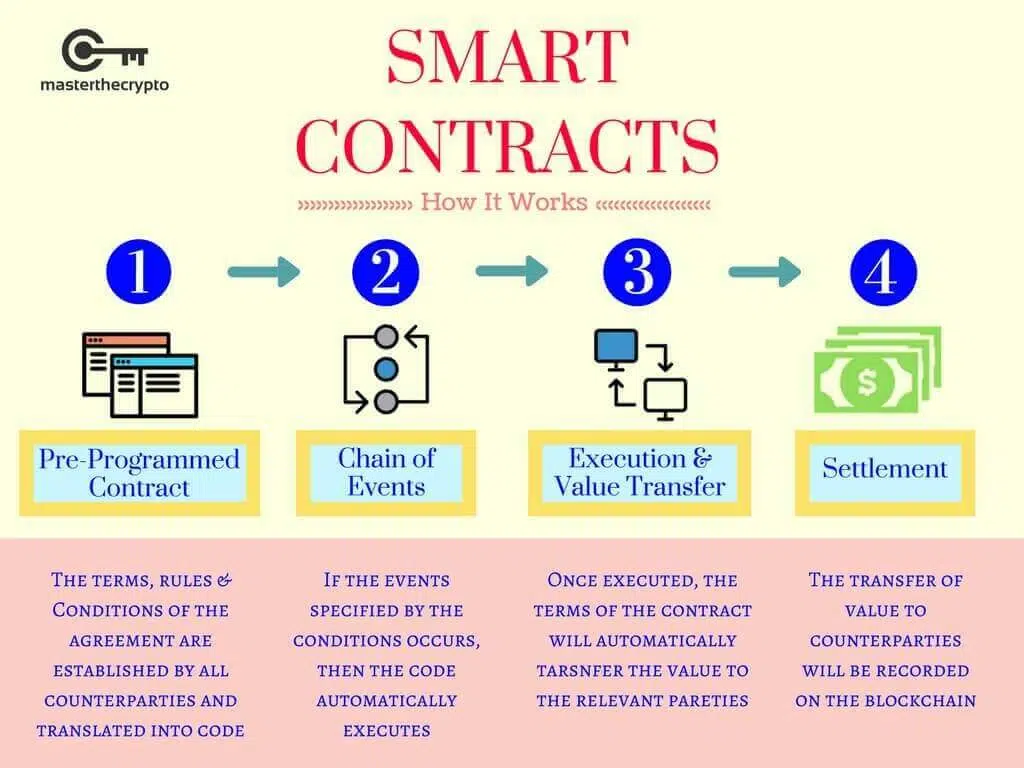

How smart contracts work

As we described before, smart contracts are simple programs that run on a blockchain network and are tamper-proof or tamper-evident. They are programmed to do a specific action when certain events occur. One smart contract can have multiple conditions, and one application can contain various smart contracts. Smart contracts are being programmed in different languages, but the most popular among them are Ethereum’s Solidity and Vyper.

The brand new newsletter with insights, market analysis and daily opportunities.

Let’s grow together!

Any developer can write their smart contract and put it on a public blockchain. For example, to have it transfer funds to the most profitable application.

It can even be an automatic sending of an email or issuing of a ticket. Once the transaction is completed, the blockchain is updated so that no changes can be made. And only parties with permission see the final result. The developer can begin programming the smart contract when the parties have agreed upon all the terms, exceptions, and opportunities to open disputes. Recently, though, organizations using blockchain for business have been offering presets and various online tools to simplify the structuring of smart contracts.

Historical background of smart contracts

The first person to think of such a helpful thing as smart contracts was computer scientist Nick Szabo from the United States. It was a relatively long time ago — in 1994. In his extensive work, he described a smart contract as “a computerized transaction protocol that fulfills the terms of the contract,” the goal of which is to meet the general conditions of the contract while minimizing all sorts of risks and the need for intermediaries.

The simplest example of a smart contract working is a vending machine. The code in it allows paying a certain amount to get the food or drink the customer has chosen. And also give the change, for example. And in 2009, with the advent of the Bitcoin blockchainBlockchain technology is a newly evolved database that stores information in blocks linked together in a chain. The data is repeated thousands of times on different computers connected to the same network., the first protocol smart contract appeared. The transfer of tokens between network users was performed only when certain conditions were met. For example, participants in the transaction had to enter the correct key (which must match the public address) and have the right amount of money in their account to complete the transaction.

In 2012, the Bitcoin network introduced the possibility of multi-signature transactions. The need for multiple private signatures helped reduce the risks of error, theft of funds, or loss of access. However, using smart contracts on Bitcoin requires knowledge of opcode programming.

Then came Ethereum. This blockchain platform brought programmable smart contracts to light. The Ethereum blockchain could run numerous smart contracts at once.

Full support for smart contracts in the Bitcoin network has been developed by a tool called Rootstock (or RSK). It also uses the Solidity language but can handle up to 100 transactions per second and adds news blocks in time slots of 10 seconds (which is lower than the 16-second time slot in the Ethereum blockchain).

Benefits of smart contracts

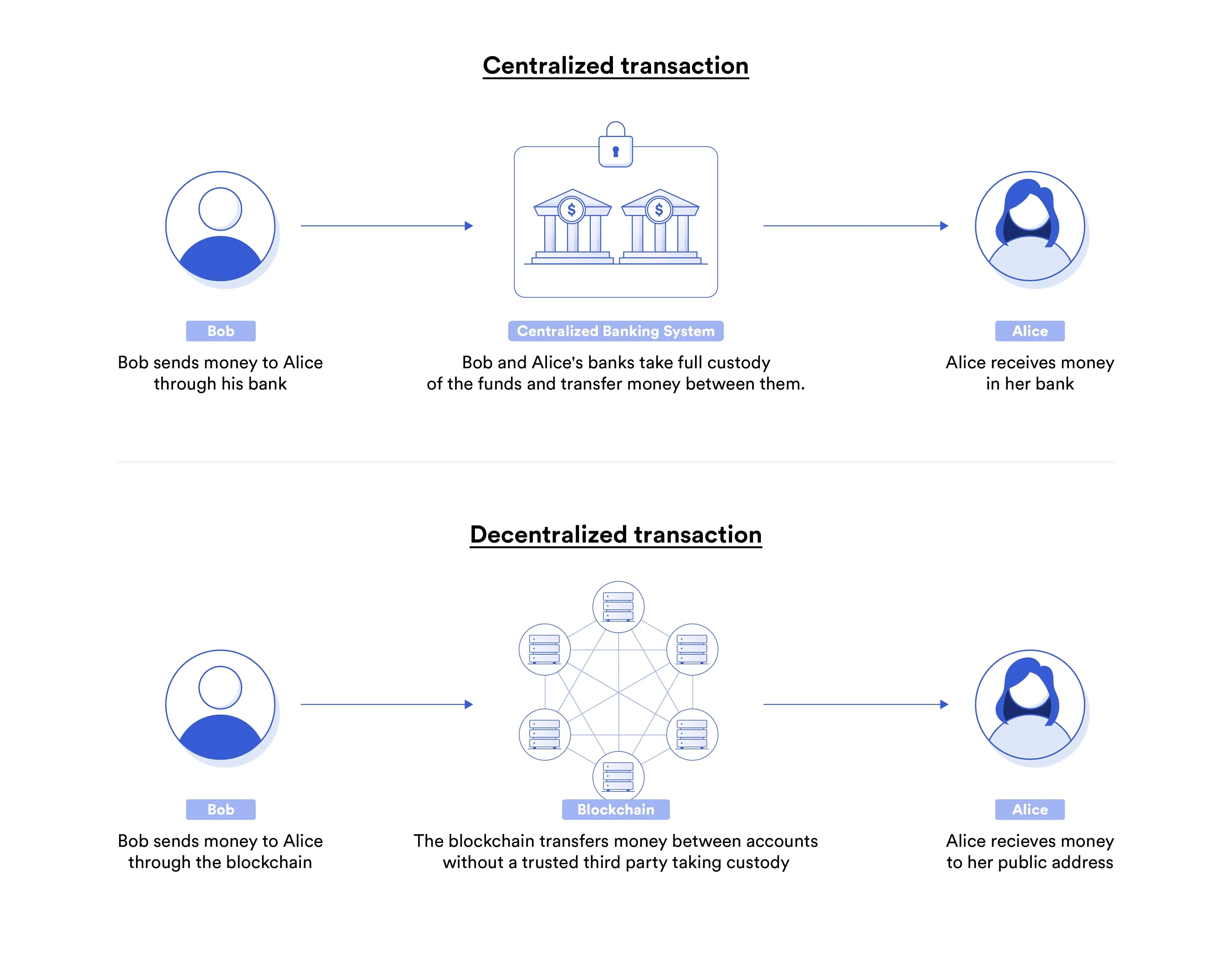

The essential difference between blockchain and the banking system lies in how the user’s funds are processed when a payment is made. That said, smart contracts have several superiorities.

- Due to the decentralized structure of the blockchain, contract execution ensures that there is no central point that can be attacked to spoof information or change terms.

- Secure processing and verification of contract logic by a network of nodes ensures robust tamper protection and seamlessness. The contract is completed according to all terms and just in time.

- Using decentralized platforms reduces the risk of the commercial intermediary using its privileges to extract rents and pump out value.

- All internal agreement processes are automated, so parties do not have to wait and waste time entering data manually until the counterparty finishes its part or the intermediary completes processing.

Applications of smart contracts

Thanks to smart contracts, it is possible to create, track and grant ownership of specific digital tokens. The token contract programs the functionality of the tokens it issues. For example, holders can receive insurance in a dApp (utility token), vote weight in a protocol (governance token), equity in a company (security token), and ownership of a unique real or digital asset (non-fungible token or NFT).

Decentralized finance (or DeFi) consists of applications that use smart contracts to provide everyone with the usual financial products and services (exchanges, asset management, etc.) and, at the same time, can contain several services and create new financial primitivesAn instrument such as a stock or bond for which payments depend only on the financial status of the issuer..

Blockchain-based games use smart contracts to protect against cheating and fair distribution models (eliminating the problem of unpredictable loot drops). This applies to limited edition NFTs as well. So NFT players and collectors get a chance to get their hands on the rare digital assets they want.

Smart contracts are also suitable for parametric insurance. It is insurance in which the payout is related only to a specific event. They provide a tamper-proof infrastructure for creating insurance contracts triggered by pre-entered data.

What are the main challenges faced by smart contracts?

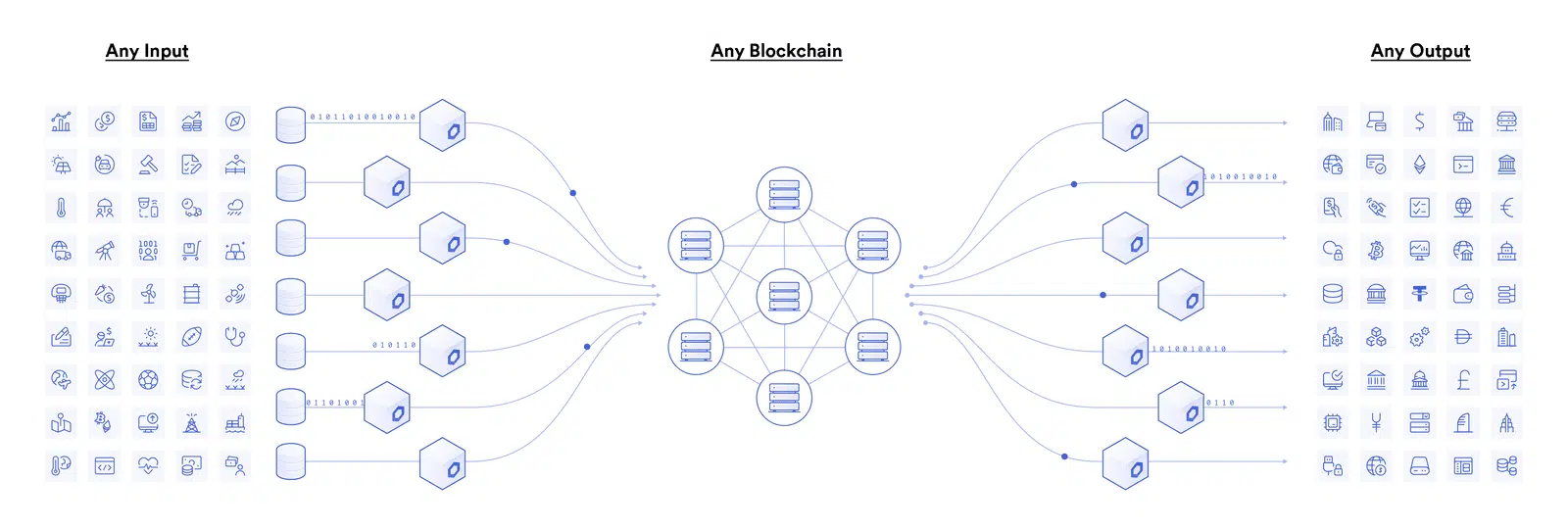

Smart contracts (like everything in this world, unfortunately) have their disadvantages. The blockchain networks in which they operate are isolated. That means they have no connection to the outside world and cannot interact with external systems to confirm the occurrence of real events. For the same reason, they have no access to cost-effective computing resources. The asset’s price may not be known before the transaction takes place.

Therefore, programmable smart contracts with access to real-world data and traditional systems are becoming increasingly popular. They are called hybrid smart contracts. They use secure middleware (oracle) to, for example, trigger a smart contract using outside data or to settle an out-of-chain contract using a traditional payment system.

Oracles connect the inputs and outputs in blockchain to create hybrid smart contracts. They allow blockchain platforms to be linked to familiar systems to create more productive, secure, and confidential smart contracts. By providing hybrid smart contracts, oracles greatly extend and amplify the pros of blockchain, enabling the creation of better digital agreements based on cryptography.

Future of smart contracts

Blockchain looks promising (though not all consider it good for all fields to use). Many areas can be changed by smart contracts: voting, governance, supply chains, healthcare, and real estate. The ability for multiple parties to cooperate without the ability to manipulate or use the system to their advantage, its security, and transparency not only open the way to innovations and cooperation between bodies that were not possible before but also make these procedures much more efficient. But, as already mentioned, smart contracts also have drawbacks and vulnerabilities.

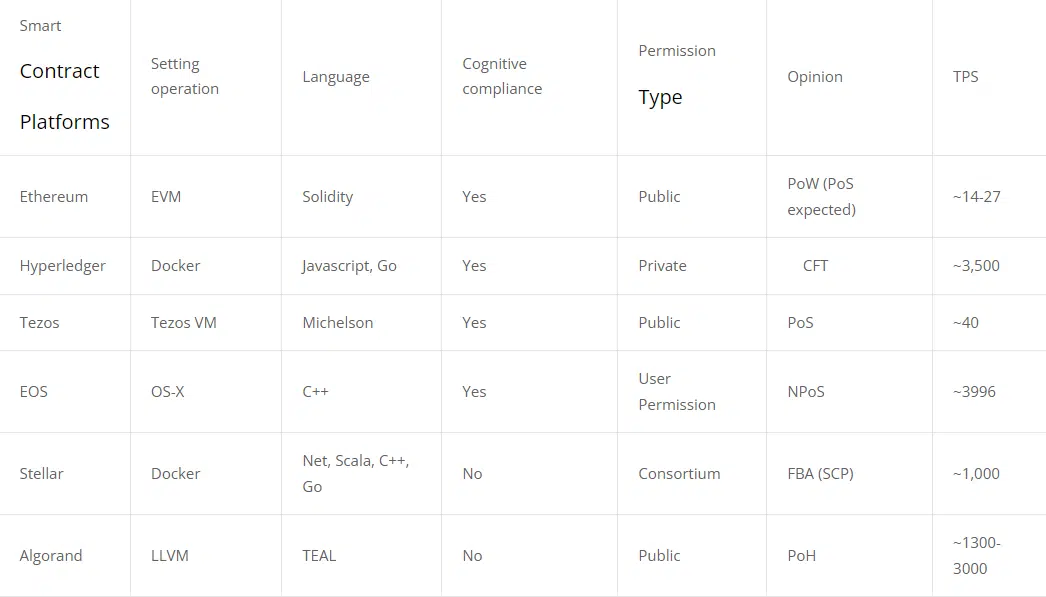

Top 5 smart contract platforms

Blockchain and smart contract application development are relatively recent, and there are many nuances associated with them. This is why many look at platforms based on their reputation and their developer status. However, the choice of the blockchain platform is also closely related to how it will be used. And that’s something to consider.

- Ethereum is undoubtedly one of the best platforms for smart contracts. This platform was launched in 2015 and can be used to implement various applications, from initial coin offerings (ICOs) to insurance based on smart contracts. Ethereum is in demand from famous giants such as Intel and Samsung. On the plus side, it has a large developer base. On the downside, there are scalability issues. Therefore, transaction speeds remain pretty low, and processing costs are high.

- The Linux Foundation created Hyperledger in 2015. It was co-founded by 30 corporate members, including IBM, Intel, J.P. Morgan, and Cisco. It is an authorized blockchain, so member identities must be disclosed. This is important for companies dealing with sensitive data and complying with data protection requirements. Users of the platform can create private channels for targeted network members, allowing select participants to see transaction data. The platform has an additional hardware security model for identity management, giving top cybersecurity. However, Hyperledger has a complex architecture, an insufficient number of highly skilled programmers, and a minimal API and SDK set.

- Tezos appeared in 2017 and combines chain management with self-modification. Thus, rapid changes to protocols are possible if stakeholders approve a developer’s proposed change. The platform also uses Proof of Stake (A method of protecting cryptocurrency by asking users to show ownership of a certain amount of currency.) rather than Proof of Work (A decentralized consensus mechanism that requires users of a network to expend effort solving an arbitrary mathematical puzzle to prevent anybody from gaming the system.). And so, it doesn’t consume the same amount of power to add a new block to the chain. This platform boasts high security, formal verification, and easy programming, thanks to Michelson’s smart contract language. However, Tezos also has many vulnerabilities.

- The EOS platform was launched in 2017 and immediately attracted attention due to its penny transaction fees and ability to process multiple transactions per second. And this is crucial for the operation of smart contracts. EOS was created for large-scale applications and does not incur the cost of sending or receiving EOS tokens. Instead, the protocol additional tokens to the companies running the network. EOS is designed in C++, scalable, inexpensive, and fast. It uses Proof-of-Stake. Smart contracts are executed in the blockchain using the WebAssembly Language (WASM). However, the disadvantages include concerns about the possible centralization of the platform and the introduction of censorship.

- Stellar appeared in 2014. It is only suitable for basic smart contract scenarios, such as ICOs (Initial Coin Offering – the issuance of tokens by a project intended to pay for the site’s services in the future.) or simple escrow contracts. But that makes Stellar one of the finest money exchange platforms on the list of smart contract platforms. It outperforms other platforms in terms of transaction speed, cost-effectiveness, and security. A giant like IBM chose Stellar to develop World Wire, a worldwide payment system designed to facilitate cross-border money transactions. Stellar doesn’t have its smart contract language or virtual machine. They can be created in any of the most popular programming languages.