More than ten months have passed since Bitcoin was worth a record $69K. Since then, the value of the cryptocurrency has dropped noticeably, and it is still unclear where the minimum bar is. In June, the price per coin fell below $17.8K, and many still think that was the bottom, but some believe it is still in the future.

Reddit users are still wondering if that was the bottom when Bitcoin broke through the $17K mark or if it is still to come. There are more arguments both for and against on both sides. Let’s break down both positions.

What if 17K is the bottom?

Reddit user fan_of_hakiksexydays made five arguments why $17K was the bottom. Moreover, according to him, unless we have a prominent black swan event (A market collapse that exceeds six standard deviations. An extremely rare event in terms of probability) in the next two months, the chance of seeing a lower price becomes increasingly slim.

Five reasons why Bitcoin won’t fall below 17K.

The brand new newsletter with insights, market analysis and daily opportunities.

Let’s grow together!

#1 The macroeconomic environment

- Technical analysis shows that events like June are still unlikely.

- Inflation is not falling as fast as Wall Street would like it to, but it is still falling, from 9.1% to 8.3% in three months.

- Unemployment is at a low level. The year 2022 saw the highest wage growth in a decade.

- Home prices and rents are falling.

- Food prices (oil, lumber, food, and others) are falling and replenishing more quickly in quantity as the supply chain recovers.

- Oil prices continue to fall.

- The value of Bitcoin has been above 17K for a long time and is getting further and further away from that figure.

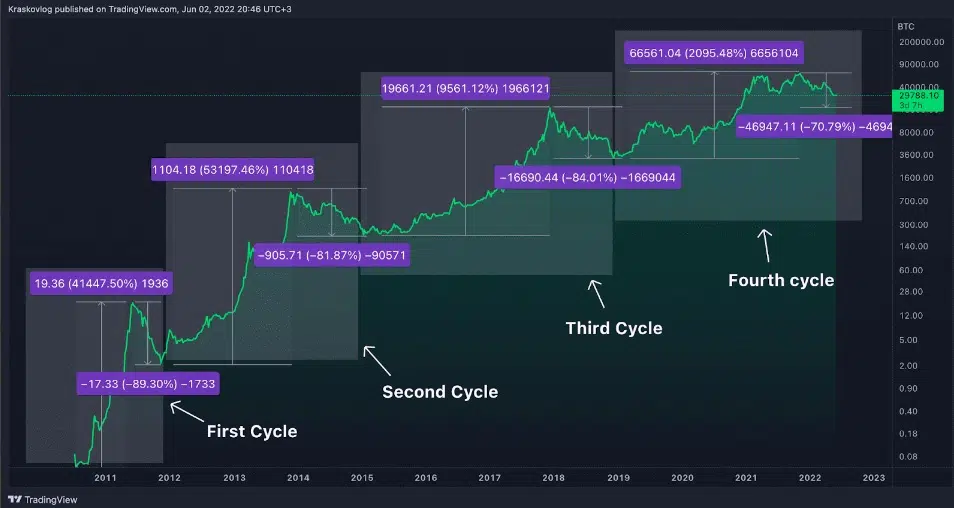

#2 Every bull market becomes less intense, and as a result bear market becomes shorter and less intense

According to analysts’ observations, past bull markets have been less intense. The same can be said of bear markets. Each cycle of decline to the bottom gets smaller and smaller.

- in 2014, BTC fell 86%.

- in 2018, 83%, or 74% to 76% if you don’t count hash wars (something that can occur when two forks of a chain compete to have the higher hash rate to try to prove themselves as the dominant chain).

Also, the timeline from ATH to the bottom is getting shorter: it took 405 days in the bear market in 2014 and 364 days in 2018. The current collapse has taken 308 days so far. If there is another bottom, it will happen in the next few weeks, or, according to fan_of_hakiksexydays, it has already happened.

#3 History often rhymes

The chart below shows the 2018 bottom (top diagram) and a possible 2022 bottom.

If history repeats itself, the global price collapse has already happened, the bottom has also passed, and the bull market has started.

#4 The fuel for the correlation with stock markets is no longer there

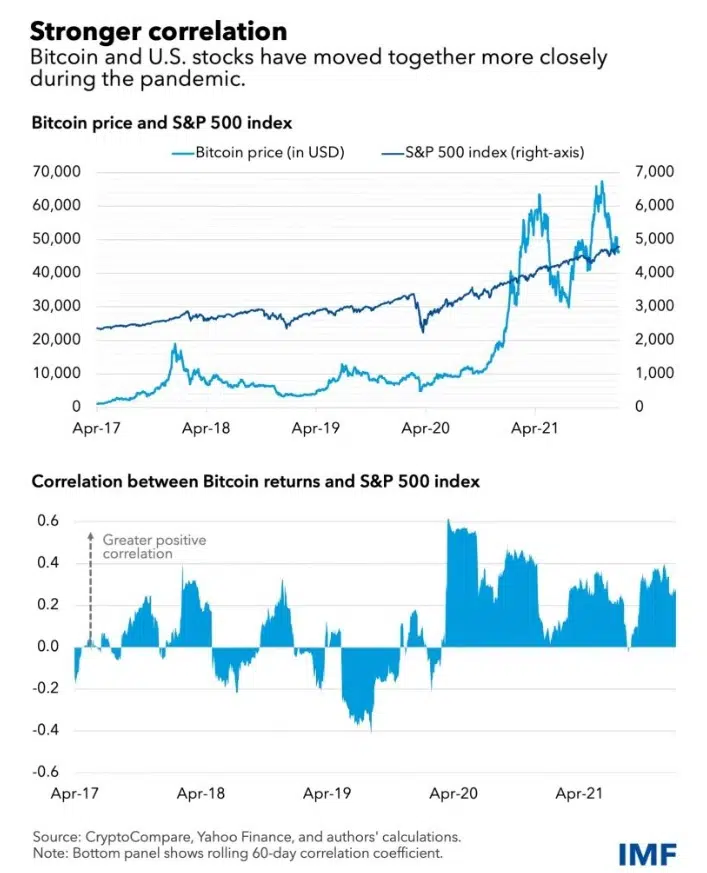

Analysts have noticed that Bitcoin is increasingly doing the opposite of what the stock market is doing. In their view, the correlation with stocks hasn’t grown since May 2022. The coin has become less consistent.

Typically, Bitcoin has a weak correlation with stocks. The cryptocurrency’s value only began to rise after the pandemic, as we see in the chart below.

Covid-2019 caused the bull market to reset and synchronize it with stocks. There is a chance that Bitcoin will no longer be tied to stocks, as it was in May and June 2022.

#5 BTC hasn’t strayed from its cycles

This happened despite the exceptional conditions (including a pandemic and a war). That says a lot.

What if 17K isn’t the bottom

If the fan_of_hakiksexydays data is accurate, then we have already entered a bull market, and all that remains is to wait for Bitcoin prices (and probably other cryptocurrencies with it) to start rising. However, some don’t believe the collapse is over. They think they can expect anything, as the market for digital assets is as unpredictable as possible. That’s why they think no one can tell where the price will go next.

- Nobody can predict the market any better than a monkey throwing darts.

- If anybody could, with even a slight degree of accuracy, they would leverage up and become very rich (and they probably wouldn’t post here to let you degenerate in on it).

- Anything that is even vaguely predictable is already priced in.

- Cryptocurrency world is like casinos.

- All markets are subject to rife corruption.

According to Reddit user Low_Acanthisitta4445, the likelihood of any possible future event happening or not happening is already priced in. Merge already priced in. Inflation already priced in etc.

The fact is that the big industry players (companies, whale bulls and bears, CEX, regulators, and so on) will constantly influence the market, and no one can stop them. So no one but them can say for sure what will happen next.

What do you think about that? And what is your prediction for the future of Bitcoin, or are you adjusting to the market depending on the current situation and not making any forecasts? Please let us know in the comments.