In 2021, venture capital funds financed $25.2B worth of crypto startups. However, not all projects become successful, which affects their overall value and native cryptocurrency, if it exists. Therefore, the question arises if an investment by a large and famous fund means that a token of the project will be a 100% success. Let’s examine it.

What is a16z?

We have looked at the investment portfolio of a16z, Andreessen Horowitz’s subsidiary venture capital fund in Silicon Valley, which invests in various digital technology startups, including those related to the Web3 industry.

a16z started investing in blockchain in 2013, and one of its most successful investments can be considered the crypto exchange Coinbase, which has a net profit of ~$590M in 2022 despite the prolonged crypto winter.

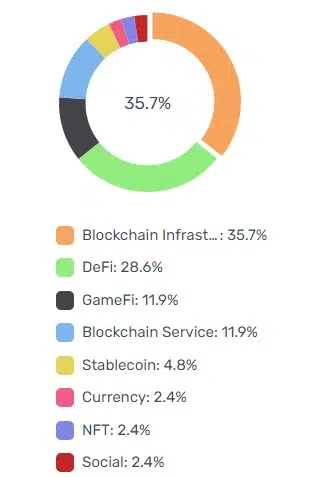

According to the analytics platform Cryptorank, a16z’s main investment categories are:

The brand new newsletter with insights, market analysis and daily opportunities.

Let’s grow together!

Using Cryptorank, we found out that a16z invested in 45 crypto projects in 2021. The total amount of investment was $6.2B. The fund put the most money into the following projects with native tokens:

- Solana (SOL) — $314M.

- Axie Infinity (AXS) — $152M.

- dYdX (DYDX) — $65M.

- ECO (ECO) — $86M.

- Optimism (OP) — $25M.

Let’s take a look at how these projects are doing more than a year after investing in them.

Solana

Solana is a blockchain platform designed to host decentralized, scalable applications. Solana builds the architecture of their blockchain based on the Proof-of-History a sequence of computation that can provide a way to cryptographically verify the passage of time between two eventsa sequence of computation that can provide a way to cryptographically verify the passage of time between two events consensus mechanism.

The first block was created on March 16, 2020. In September 2020, Tether announced the availability of USDT on Solana. The cryptocurrency is known in the crypto space because of the short processing times (400 milliseconds compared to 5 minutes in Ethereum) that the blockchain offers.

a16z invested in Solana on June 9, 2021. The total amount of funds raised was $314M. Judging by the chart on CoinMarketCap, the news had no immediate effect on the value of the asset, but SOL grew over the next year. In November 2021, the token peaked in value at $258.78. Before funding, the cryptocurrency was worth $41.28, so the growth was 526,89%.

After the start of the crypto winter, the asset, like all others, fell in value, but Solana continues to grow as a project. Solana ranks second in terms of NFT trading volume and is among the top 5 chains that continue to attract the most daily active users in cryptocurrency. More details about the blockchain successes are here. The cryptocurrency is in the top 11 by market capitalization ($12.5B) and is trading at $23.08 as of this writing.

You have not selected any currency to displayIf you had invested in SOL after hearing the news of the investment, at its peak you would have earned six times the amount invested. And if you had held on until today, you would have lost about 50%.

Axie Infinity

The project was launched in October 2018 by Sky Mavis. Axie Infinity is a blockchain-based trading and battling game. It allows users to collect, breed, raise, battle, and trade token-based creatures known as Axie.

The Axie Infinity ecosystem has its unique governance token, AXS, which is used to participate in key governance votes and will give holders a say in how funds in the Axie community are spent.

On October 4, 2021, Axie Infinity raised an investment of $152M. Since then, the number of players began to grow, and it peaked at 2.27M in February 2022, down 646K before the fundraising.

Axie Infinity’s native cryptocurrency also peaked shortly after funding. On November 8, 2021, the token soared to $160.62. Before the funding, the asset was worth $107.96. The difference is 32,79%.

At the time of writing, AXS is available for purchase at $11.79. On January 23, the token went up 50% in 24 hours on the eve of the token unlock. In the latest version, the creators added new modes, such as idle battles, trading, and a leaderboard, as well as released a roadmap, which probably indicates that the project will continue to grow.

You have not selected any currency to displayIf you had invested in AXS after the news of the investment, at the top price, you would have earned 1,16 times the amount invested. And if you had held on until today, you would have lost about 90%.

dYdX

dYdx is the governance token for the Layer-2 protocol of the decentralized cryptocurrency exchange. Token holders are granted the right to propose changes on the dYdX’s Layer 2 and are presented with an opportunity to profit through token staking and trading fee discounts.

The exchange was launched in 2017 with over $10M in seed venture capital. The initial coin offering (ICO) took place on September 9, 2021, and earlier, on June 15, the platform was funded by $65M. Based on CoinMarketCap data, the token peaked the same year on September 30. DYDX could then be bought at $26.76 per coin.

You have not selected any currency to displayNow the token is trading at $2.87. The difference with the maximum recorded value is 89,28%.

At the end of January, the creators set a limit on the number of tokens. Their quantity is now equal to 1 billion, while there are only 155M in circulation. According to Token.Unlocks, the project team plans to unlock another 6.5M DYDX on February 14, which will likely affect token value.

If you had invested in DYDX after the report of the funds, at the peak value, you would have earned 2,06 times the amount invested. And if you had held on until today, you would have lost 77,2%.

ECO

This is a digital cryptocurrency platform that can be used as a payment tool for daily-use transactions. Before rebranding, the startup was called Beam and was launched in October 2015. To make money, ECO holds users’ funds in the form of USD or USDC and lends them to trading desks a department or investment bank where securities are sold and purchased to provide market liquidity and lending platforms, as liquidity to earn high yields.

ECO regulates itself through its own monetary policy, much like the fiat currencies. But instead of a central bank setting the policy, a selected group of ECO users, called Trustees, does so.

In 2021, ECO was funded twice, in early March and late July. The investments were $26M and $60M, respectively.

“As investors, we’re in the business of finding and backing ideas, and ECO has no shortage of those. The challenge is often finding teams who have the skills to back up that vision and bring it to life,” said the a16z representatives.

The asset peaked more than a year after financing in November 2022. At that time, you could buy ECO for $0.02611. Now it costs $0.02044. The difference is -21.72%.

You have not selected any currency to displayJudging by the page on Twitter, the project continues to evolve and offers its customers:

- No hidden fees.

- No ATM fees.

- No overdraft fees.

- No transfer fees.

- No wire fees.

- No monthly maintenance fees.

- No insufficient funds fees.

- No minimum account balance fees.

However, the token is in 5,507th place by market capitalization, and the number of circulating coins is not shown at all.

If you had invested in ECO after the report of the funds, you would have lost more than 20%. After entering the market at $0.02611, the token has not exceeded that value so far.

Optimism

The coin was created by the Optimism Foundation and launched in 2019, but the Layer-2 Ethereum-based ERC-20 token was introduced in May 2022. Optimism benefits from the security of the Ethereum mainnet and helps scale the Ethereum ecosystem by using optimistic rollups — transactions are trustlessly recorded on Optimism but ultimately secured on Ethereum.

Of the entire list, Optimism was the least funded in 2021. On Feb. 24, the asset raised $25M. One year later, however, on March 17, 2022, the company was funded for another $150M. A few months after that, OP reached $3,0002, but the asset is now down to $2.68 (-10,67%).

You have not selected any currency to displayRecently, the Optimism token hit a record price $3.0935 after the Optimism Foundation proposed the first protocol updated to Bedrock. This protocol will help reduce fees and deposit time. You can read about it in detail here.

Currently, the asset:

- Ranked 13th in the number of active data users (21K).

- Ranked 4th by the number of contracts (367).

- Is the second Ethereum Layer-2 chain in smart contracts.

- Ranked 7th in total blocked value. 73% (1.14B of 3.15B) of tokens are blocked. The next unlock is scheduled for May 31. Developers plan to unlock ~155M more coins as part of the event.

- 74th by market capitalization — $626M.

Conclusion

Coincidence or not, none of the above projects went bankrupt after raising funds. And most of them showed significant growth in the value of native tokens after funding.

And probably, if not for the beginning of the crypto winter, they would have continued to grow. But despite the fall in token price, all of the above projects continue to grow, and there is a chance they will increase in market cap during the next bull run.

In editor’s opinion (which is in no way a financial advice; please do your own research:)), it is worth following news of a16z’s new investments. This kind of project and its tokens have a good chance to grow.